Daily Comment (January 23, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] After a hard drop yesterday, equities are rising modestly this morning. Here is what we are watching:

The importance of trade: Equity market action on Friday and Tuesday made it abundantly clear how focused financial markets are on trade.

This is a five-day chart of the S&P futures. On Friday, reports that China was prepared to bring the bilateral trade deficit to zero over six years led to a strong rally, shown by the blue line. The red line shows the drop on reports that the U.S. rebuffed a Chinese offer to send officials for preparatory talks before the already scheduled meeting at the end of January.[1] However, in the afternoon, National Economic Council Director Kudlow did an interview where he indicated that trade meetings were still on, leading to the rally shown by the green line.[2]

What we suspect is happening is that the Mnuchin/Kudlow wing of the administration is battling for the “heart and mind” of the president against the Navarro/Lighthizer wing and are making dueling press statements that are affecting equity markets.[3] On the one hand, 2019 is critical to the 2020 elections; if a recession begins this year it would doom Trump’s re-election chances, and even if recovery occurs in 2020 it will likely be too late to offset the weakness that would have already occurred. This fact would suggest the president will take a deal with China that boosts optimism. On the other hand, China is now a strategic competitor. China is becoming a serious military threat to the Far East and is working to move up the value chain by dominating technology, an area that the U.S. has ruled for years. Thus, there are longer term issues of resetting Chinese relations to a hostile stance. The actions against Huawei (002502, Shenzhen, CNY 4.15) are part of that policy direction.[4] Our position is that Trump will make a short-term trade agreement with China and delay additional tariffs. However, in the long run, U.S. policy toward China will take a more aggressive turn which will disrupt global supply chains. If the president decides the long-term goal outweighs the short-term goal, then the potential for a recession and further economic weakness rises significantly.

Pressure on Venezuela: The U.S. has mostly stayed out of the turmoil hammering Venezuela. The Bush administration did make positive comments about the 2002 coup attempt that failed against Hugo Chavez but there was no evidence of active support. Subsequent administrations have applied various sanctions but avoided any that would seriously disrupt the Venezuelan oil industry (Chavez and Maduro accomplished that all on their own). Although the government has systematically undermined a divided opposition through arrests and domestic intelligence, conditions have deteriorated to the point where forces opposing the government are rising under new leadership.[5] More ominously for the government, there are increasing reports of military unrest.[6] Chavez did a good job of keeping the military aligned with the regime, playing on his veteran status, but Maduro does not have the same ties. Now, it appears the Trump administration is taking a more active role to undermine Maduro.[7] The most likely outcome is a military coup which would overthrow the regime. In the short run, if the takeover is “messy” it is a bullish factor for oil; although Venezuela’s oil production has plummeted to just over a million barrels per day (it once produced over three million per day), chaos would likely reduce output to zero. However, if Maduro is ousted and the next government is supportive of foreign investment, then an eventual rise in output is very likely.

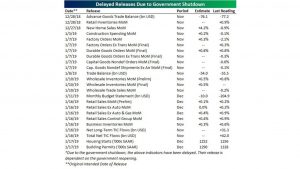

Shutdown: There is some movement on the government shutdown; the Senate is expected to vote on competing plans to temporarily fund operations.[8] We don’t expect either to pass the House or be signed into law but the fact that votes are taking place is some form of progress. There are widespread reports of government workers who are not being paid but are required to work who are not coming in. Especially critical are those working for the IRS; if they don’t go to work, tax refunds could be delayed.[9] Here are all the economic releases that have been delayed:

Brexit: There’s not too much new to report. We are seeing tensions rise between Ireland and the EU on the border issue. Ireland wants to avoid a hard border with Northern Ireland on fears that a return to a hard border will lead to sectarian conflict. Ireland suggested it would not enforce a strict border even with a hard Brexit, while the EU indicated Ireland would need to put hard border controls in place if a hard Brexit occurs.[10] Hard Brexit supporters have argued that technology could allow for trade to be monitored without a hard border control. However, a soft border could become a headache for the U.K. as well because it could become a conduit for people to cross into the U.K. without papers being checked. Still, divisions within the EU increase the odds that the union may be more willing to adjust than it has been indicating. We are also noting softening opposition to May’s plan. Although the vote failed spectacularly last week, Brexiteers are beginning to fear that their desire for a hard break with the EU is not a majority position; in fact, the majority support avoiding hard Brexit at all costs. If the choice is to remain in the EU or May’s proposal, the latter is starting to look much better.[11] Although we fear a hard Brexit could occur because neither the EU nor the U.K. will budge, there is some evidence of movement that is raising hope for a more orderly outcome. That factor is why the GBP is doing better. Meanwhile, we continue to hear reports of firms leaving the U.K. on fears of a hard Brexit.[12]

Davos: This picture says it all:

[1] https://www.ft.com/content/466cc9e2-1e4c-11e9-b126-46fc3ad87c65

[2] https://www.cnbc.com/video/2019/01/22/the-full-interview-with-national-economic-council-director-larry-kudlow.html

[3] https://www.reuters.com/article/us-usa-china-trade-analysis/trump-wont-soften-hardline-on-china-to-make-trade-deal-advisers-idUSKCN1PH02I

[4] https://www.reuters.com/article/us-usa-china-huawei-tech/u-s-will-seek-extradition-of-huawei-cfo-from-canada-idUSKCN1PG2HL

[5] https://www.nytimes.com/2019/01/22/world/americas/who-is-juan-guaido.html?emc=edit_mbe_20190123&nl=morning-briefing-europe&nlid=567726720190123&te=1

[6] https://www.nytimes.com/2019/01/21/world/americas/venezuela-maduro-national-guard.html?module=inline

[7] https://www.axios.com/trump-regime-change-venezuela-maduro-pence-video-b2a231d5-af89-4b49-bf68-dae2fc2a2f8e.html

[8] https://www.ft.com/content/06b2765c-1e98-11e9-b126-46fc3ad87c65?emailId=5c47f93d51f118000497abae&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[9] https://www.washingtonpost.com/business/economy/hundreds-of-irs-employees-are-skipping-work-that-could-delay-tax-refunds/2019/01/22/1885e74e-1e7d-11e9-8e21-59a09ff1e2a1_story.html?utm_term=.50d990d9fc2e

[10] https://www.ft.com/content/05114d7e-1e42-11e9-b126-46fc3ad87c65?emailId=5c47f93d51f118000497abae&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[11] https://www.ft.com/content/2848f57c-1e3c-11e9-b126-46fc3ad87c65?emailId=5c47f93d51f118000497abae&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[12] https://www.ey.com/uk/en/newsroom/news-releases/19-01-07-ey-financial-services-brexit-tracker-heightened-uncertainty-drives-financial-services-companies-to-move-almost-800-billion-pounds-of-assets-to-europe?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosmarkets&stream=business