Daily Comment (May 23, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Good morning! U.S. equity futures are modestly lower this morning. There is a lot of news to digest this morning. Here is what we are watching:

Trade wars: There is little evidence that the trade situation in China is improving. If anything, conditions are worsening. Here is what we are seeing:

- The trade negotiations are turning from a mere discussion of tariffs and the trade deficit to a direct attack on China’s tech sector. As we have noted in the past, China’s economy is in the midst of transitioning from a high-growth/low-cost manufacturer to a moderate-growth, mature economy. Like virtually all nations that have developed since the industrial revolution, China has developed by expanding investment and has now reached the point in its development where it has excess capacity. It needs to address that excess capacity through a combination of methods: (a) finding new markets for this production, (b) writing down the value of this investment to make it profitable for a new buyer, and (c) transforming the old investment capital into new higher value-added capital. It is mostly trying to deploy options (a) and (c); the former is through the belt and road project, a modern form of 19th century imperialism, and the latter through the China 2025 project, where it wants to dominate the tech sector. The U.S. is trying to prevent either method; if China is forced to deploy option (b) then it can either take the American sub-option, which is also affectionately known as the “Great Depression,” or the Japan sub-option, which means 30+ years of stagnation. Needless to say, China is resisting. Preventing China from dominating tech seems to be rapidly evolving into the thrust of U.S. policy. If this is truly the goal of U.S. policy, relations between the U.S. and China will be forever changed. Consequently, the trade talks, though they still matter, may not give the financial markets the boost that a deal would have given us just a few weeks ago.

- We are starting to see other developed nations fall in line with U.S. tech policy regarding China. Initially, it looked like other nations were defying Washington; however, that defiance has waned. It is possible that continued bad behavior by Chinese tech firms has changed sentiment. This adds to the argument that we are seeing a fundamental shift. Essentially, since Deng, American policy has been to foster China’s economic development, assuming that increased development would eventually lead to democratization and acceptance of the U.S. global order. That idea was steadily fraying under Obama but it’s dead under Trump.

- We fear financial markets are misreading the situation with China. Faith in the “Trump put” remains high. The assumption is that Trump will cave to China if financial markets buckle and accept a trade agreement, lifting risk assets. However, financial markets may be missing the fact that there is strong bipartisan support for opposing China. It appears blue collar workers are very supportive of Trump’s China policy.

- China may be misreading the U.S. and President Trump’s situations as well. Yesterday, we saw scheduled infrastructure talks canceled in anger as the president ended them due to Speaker Pelosi’s comment that the White House was engaged in a “cover up.” Although we view this as normal political sniping, it could have wider implications if Beijing views the cycle of investigations and lawsuits as evidence that Trump is under pressure and needs a trade deal. In fact, that assumption may be completely wrong; given the support the president gets from his tough stance on China, he may need that support more than a deal…unless the economy tanks. And, that may have more to do with the FOMC (see below) than the China trade deal. In fact, Trump may hold even tighter to his hardening position on China with the leading Democratic Party candidate downplaying the Chinese threat.

- China appears to be dusting off a ploy it first unveiled in 2010—using its dominant position in rare earths as negotiation leverage. Rare earth minerals are critical components of modern technology, including not just smartphones but also green energy and missile guidance systems. To some extent, the term “rare” is a misnomer. The minerals are actually accessible in most of the world, but the production is extraordinarily “dirty,” causing serious environmental problems in mining. Because China doesn’t have strong environmental regulations or a tort bar, China became the leader in rare earth production because it was willing to bear the environmental costs internally. The U.S. and others could restart rare earths production but, given our environmental restrictions, the costs of these minerals would increase.

- Meanwhile, the U.S. is continuing to build pressure on China in other ways, such as sailing U.S. Navy vessels through the Taiwan Strait.

The bottom line is that the likelihood is falling for a trade deal at next month’s G-20 meeting. Although President Trump’s mercurial nature could lead to a surprise agreement, in reality, China and the U.S. are now strategic competitors. While it’s possible the two nations could eventually accommodate each other, that sentiment suggests a level of optimism we struggle to share. In the immediate situation, financial markets continue to cling to hope that this will all pass. That hope is becoming increasingly difficult to maintain.

Gaming trade: Trade restrictions have been around for centuries and producers and consumers have worked on ways to evade them. A prominent American protein producer has apparently figured out a way to evade Chinese trade sanctions.

Gaming tech: Drivers for the various ride-sharing companies have developed a new tactic to force up their pay. At large airports, all the contractors coordinate to shut off their apps, leading the algorithms to assume there is a shortage of drivers. This leads to surge pricing, allowing the drivers to increase their pay.

Fed minutes: Overall, the minutes were a bit hawkish, more reflecting Chair Powell’s press conference comments about transitory inflation than leaning toward a rate cut. There were comments expressing concern that continued low inflation might lead to lower inflation expectations, with the term “several” being used. But, the general tenor is that current low inflation is an aberration and won’t be maintained. One reason for this position is based on the Dallas FRB Trimmed Mean PCE. The “trimmed mean” process essentially throws out the most extreme component readings of the PCE that could be skewing the data. Their yearly reading does show stable prices.

At the same time, it does not suggest a decline in inflation that would strengthen the need to cut rates. In looking at the extreme distributions, 26.7% of the PCE components indicated monthly price changes in excess of 26.7% annualized. Price changes from zero to 2% were around 14%. Overall, this distribution would suggest caution on being overly worried about disinflation. The minutes suggest a Fed on hold, with a “few” members pressing for tightening, but the financial markets are leaning even more heavily toward a rate cut.

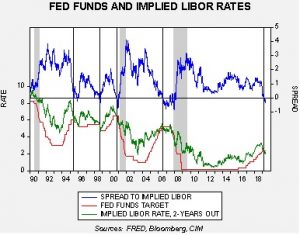

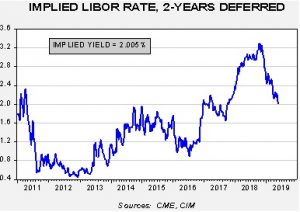

This chart shows the two-year deferred implied LIBOR rate from the Eurodollar futures market and fed funds. The upper line shows the spread. The relationship has been remarkably accurate in signaling when policymakers should end tightening cycles. We inverted these rates in late March; the implied LIBOR rate is now down to 2.01% (see chart below), suggesting monetary policy is too tight. That is not the message the FOMC is sending, which is increasing the risk of a policy error.

The end of May: It finally looks like the end for PM May is coming. Andrea Leadsom resigned from her cabinet position yesterday, indicating she could no longer support the PM’s Brexit plan. Tory MPs are furious with May’s flirtations with Labour by offering a customs union and hinting at supporting a second referendum. At the same time, the Brexit Party looks like it will win the majority of EU Parliament seats, a further blow to May. Internal Tory party leadership is expected to meet with May in the coming days and will likely press her to step down. All this political turmoil has been bearish for the GBP.

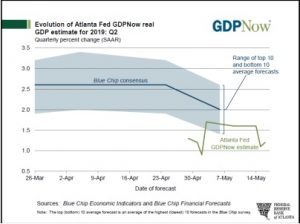

Weaker economy: The Atlanta FRB GDPNow forecast is signaling GDP for Q2 at 1.2%, a significant slowdown from Q1 3.2% growth. Here is the forecast chart.

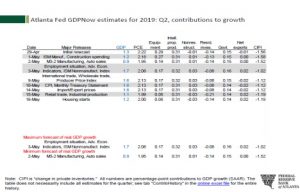

And the contributions.

The largest drag on growth is inventory liquidation, which accounted for 65 bps of growth in Q1.

Those pesky Russians: Russian warplanes were buzzing the coast of Alaska earlier this week; two incidents were reported that led the U.S. to intercept in both cases. The Russians sent two Tu-95 bombers and two Su-35 fighter escorts. The Tu-95 is a Cold War-era large turboprop bomber; it is essentially Russia’s answer to the B-52. The bomber is a lumbering aircraft; although it can act as a platform for cruise missiles, its ability as a bomber is minor due to its large size and low speed. But, it is a perfect aircraft to send a message as one can’t miss it in the air. However, it isn’t obvious what that message is except to signal that Russia isn’t afraid to make provocative acts.

Foreign political news: EU parliamentary elections begin today. We covered them in detail in yesterday’s report. Election disputes in Indonesia led to riots yesterday. It is hard to see how Joko Widodo could have won by fraud given the size of his win, but the loser, Prabowo Subianto, protested the outcome and apparently triggered the response. We continue to wait to see how the incumbent responds. In India, as expected, Narendra Modi has returned to power in a landslide.

Energy update: Crude oil inventories rose 4.7 mb last week compared to the forecast drop of 1.9 mb. There was a 1.1 mb draw of the SPR, meaning the actual build was closer to 3.6 mb.

In the details, refining activity unexpectedly fell 0.6% compared to the 0.5% increase forecast. Estimated U.S. production rose slightly by 0.1 mbpd to 12.2 mbpd. Crude oil imports fell 0.7 mbpd, while exports fell 0.4 mbpd.

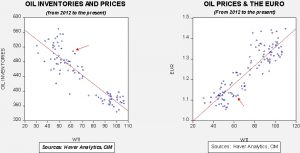

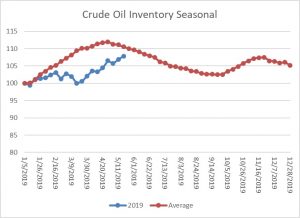

This is the seasonal pattern chart for commercial crude oil inventories. We are now well within the spring/summer withdrawal season so the continued build is bearish for prices. The seasonal pattern remains below normal but the gap is closing rapidly.

Based on oil inventories alone, fair value for crude oil is $49.10. Based on the EUR, fair value is $51.24. Using both independent variables, a more complete way of looking at the data, fair value is $49.45. Geopolitical risks are adding nearly $13 per barrel to crude oil prices. Although the geopolitical risks are formidable, this spread is unusually wide and raises the odds of a deeper price correction in the coming weeks, assuming that inventories remain elevated and the dollar remains strong. Of course, this rich price is due to geopolitical risks; Iran has been using covert actions in response to U.S. sanctions, and the U.S. is considering boosting its troop presence in the Persian Gulf.