Daily Comment (June 18, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Good morning! It’s a risk-on morning following a speech by ECB President Draghi. The Fed meeting starts today. Here is what we are watching today:

Draghi: The Eurozone is holding meetings in Sintra, Portugal; these meetings are considered this region’s equivalent of the Jackson Hole meetings for the Fed. At this meeting, ECB President Draghi suggested additional stimulus if the economy fails to reach its inflation target or increase growth. His speech was dovish. What is interesting isn’t that Draghi gave a dovish talk; after all, he has made numerous stimulative moves in his tenure, which ends in October. What we find surprising is that the markets have taken the news as completely unexpected. Equities jumped on the news, gold rallied and sovereign yields tumbled. German 10-year Bunds dropped to -32 bps[1] and French 10-year sovereigns fell to 0% for the first time in history. Even President Trump weighed in, with a less than subtle nudge to Jay Powell.

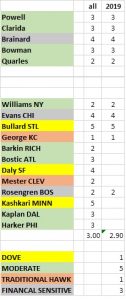

The Fed: The Fed meeting begins today. A rate cut isn’t expected today, but the markets will be looking for “tells” that signal future easing. The chances of disappointment are high. Take a look at our hawk/dove table.

To move the dots chart median lower, we would need to see a minimum of eight members vote for a rate cut. The March dot plot had 10 members vote for steady policy, with six looking for hikes. It would be a huge reversal for any of those calling for a rate increase in March to shift to a cut in June. To move the median dot lower, you would need a minimum of eight members to move from steady to cut, which is unlikely. We will see some move in this direction; Bullard, Kashkari and Daly will likely signal a cut. Bostic might change due to his earlier discussions of the yield curve. However, four members changing their vote to ease won’t be enough to lower the median dot to signal a cut. Among the rest, the moderates have mostly signaled steady policy. We doubt Powell will tip his hand toward a cut. The “financial sensitives” will worry that moving to cut rates will trigger a market bubble, so they will likely hold their fire as well. Thus, the median dot may signal steady policy but not a cut.

Now, let’s look at the actual voters. We would expect all the moderates to vote for no change. The financial-sensitive voters will also likely vote for no change, worried about the behavior of the asset markets. The traditional hawks won’t move either, so the only member to vote for a cut will likely be Bullard. We expect the Fed meeting to yield the removal of a rate hike from the dot plot, with no change in rates and one dissent for a rate cut. Powell’s press conference will be more dovish than the materials offered. Overall, the Fed will likely disappoint but the financial markets feel pretty confident that the economy is weakening, therefore we still expect risk-on assets to digest the bearish news without serious incident.

Iran: The U.S. announced that another 1,000 troops will be sent to the Middle East. Although this has raised worries, in reality, this move is not much more than posturing. If a real war was brewing, tens of thousands would be sent; invading Iran would likely need 300k to 400k to secure the country. As we noted in this week’s WGR, Iran is much larger than Iraq with a greater population and difficult terrain. Moving 1,000 troops is a signal for concern but not an indication of imminent military action of consequence. Meanwhile, Iran is moving to increase its uranium enrichment activities, which will turn Europe against Tehran. While the hawks in the administration continue to push for a conflict, we suspect the president really does want to negotiate. This sort of fits the pattern with North Korea, which was to bluster and threaten, then talk. The problem is that, from Iran’s perspective, it’s hard to see how the Americans can be trusted from administration to administration. After all, if Tehran concludes that Trump may not win in 2020, it will likely take its chances on the next administration.

It is also worth noting that a Navy analyst noted that Iran’s placement of limpet mines above the waterline of the tankers was designed not to sink but to damage. This suggests Iran isn’t going to war (sinking a vessel in the Strait of Hormuz would be a big deal) but is posturing. We are further from a hot war than the media would suggest.

Hong Kong: China is continuing to back Carrie Lam despite the protests. With the G-20 meeting coming this weekend, we doubt Beijing will move against the former British colony. However, given Xi’s history, he won’t accept this behavior much longer.

Facebook (FB, 187.01) into crypto: Facebook announced it is creating a new token to facilitate payments in the social media platform. The best analysis of this move we have seen comes from here and here. We note that regulators are watching this with interest.

Odds and ends: There is some speculation that Xi’s visit with Kim might be a play to restart nuclear talks. This could be a way to offer a win for President Trump that may help China on trade. On trade, China is trying to suggest the U.S. needs a deal more than it does, perhaps reacting to growing business sector criticism of the president’s trade policy. Egypt’s former president, Mohammed Morsi, died in court yesterday. The GBP is falling on fears that Boris Johnson will bring a hard Brexit. Russia is starting to back away from support for Venezuela’s President Maduro due to the continued downward spiral of the Venezuelan economy.

[1] Fahrenheit financial freezing?