Asset Allocation Weekly (July 19, 2019)

by Asset Allocation Committee

In his last testimony to Congress, Chair Powell agreed with Representative Ocasio-Cortez (D-NY) that the relationship between unemployment and inflation appears to have been broken. This relationship, usually referred to as the Phillips Curve, suggests there is an inverse relationship between the two variables. If one desires low inflation, then the tradeoff is higher unemployment.

The Phillips Curve has a controversial history. There is nothing in economic theory that necessarily supports the tradeoff. In fact, in its original construction by the economist A.W.H. Phillips, the relationship was between wages and unemployment and was developed by observation. On the one hand, the relationship makes intuitive sense. The unemployment rate should offer some insight into the supply/demand balance for labor and it would be reasonable to expect that the relative scarcity of labor should increase wages. Economists then took the next step and assumed that rising wages would lead to higher price levels. There are periods when the relationship between prices and unemployment is stable. But, history shows the relationship is far from consistent.

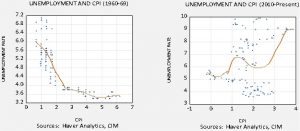

Both charts are scatterplots of the unemployment rate and the yearly change in CPI. The chart on the left shows the relationship from 1960 through 1969. It exhibits what the theory suggests—declines in unemployment are consistent with higher inflation. It also suggests a non-linear relationship, in that when the unemployment rate declines below a certain point then inflation tends to rise quickly with little improvement in the labor markets. This chart was part of the development of the theory of the “natural unemployment rate,” which suggested there was a long-term unemployment rate and falling below that rate would lead to sharply higher prices, thus limiting the impact of policy.

The chart on the right suggests something quite different. In the data since 2010, the relationship is positive, meaning that higher levels of prices are consistent with high unemployment. Although that relationship is due, in part, to the distortions caused by the Great Financial Crisis, the fact that the curve slopes upward does suggest the relationship between price levels and unemployment may be sensitive to other factors.

It is no great secret that the relationship between unemployment and price levels is inconsistent. So, in light of this problem, why has the Federal Reserve clung to the Phillips Curve in policymaking? As the linked article above notes, Chair Powell appears to have given up on the relationship but others on the FOMC have not. We suspect the Phillips Curve served an important narrative for the Federal Reserve tied to its dual mandate. The Fed is expected to execute monetary policy that yields stable prices and full employment. The Phillips Curve made it clear that this mandate had a tradeoff; if the Fed delivered low unemployment, there was an inherent risk of rising price levels. The belief in the Phillips Curve allowed the Fed to avoid policies that brought very low unemployment that might risk higher price levels.

For the Federal Reserve, the Phillips Curve was a useful theory even if it wasn’t always consistent. But, if there is a belief that the Phillips Curve doesn’t work anymore, then one could see Congress demanding ever lower levels of unemployment. If the theory really doesn’t hold, there is no risk of inflation coming from falling unemployment. However, there may be other issues. For example, very low interest rates could distort financial markets. It could lead to malinvestment in the economy. Perhaps the most potent problem is that terms such as “stable prices” and “full employment” are not fully defined. Former Fed Chair Allen Greenspan defined stable prices as inflation that is low enough to where consumers and firms do not take inflation into account when making investment and purchase decisions. Although workable, Greenspan’s definition is clearly ad hoc. It is arguable that any level of inflation is inappropriate. Defining full employment has been difficult as well. Part of the Phillips Curve theory is the concept of Non-Accelerating Inflation Rate of Unemployment (NAIRU), which suggests there is a minimum rate of unemployment consistent with steady prices. Policymakers have used NAIRU as a proxy for full employment, even though it changes over time. Most elected members of Congress would describe full employment as every likely voter in their district or state has a job if they want one.

The problem for the Fed is that if the Phillips Curve is jettisoned, there could be a focus on the unemployment rate of the mandate and the inflation mandate could become secondary. After all, if inflation isn’t affected by the unemployment rate, the political class would generally want a rate as close to zero as possible. Since inflation is affected by the degree of deregulation and globalization, it may be possible that inflation will remain low even at historically low levels of unemployment. Unfortunately, it is also possible that the Phillips Curve relationship has become dormant for a myriad of reasons, including the aforementioned globalization and deregulation policies, demographics, and custom. One observation we have noted is that the level of service seems to decline when the unemployment rate falls significantly. Businesses note that they don’t have much pricing power and, in the face of rising wages, firms may opt to simply deliver less in terms of normal service. In other words, hotel rooms may not be available at check-in time due to the lack of housekeeping staff or tables in restaurants may not be bussed as quickly due to the lack of entry level staff. Such deterioration is not technically “inflation” but can occur in response to factors that otherwise would trigger rising price levels.

In the end, the Fed may find itself without an adequate response to Congress when it demands ever lower levels of unemployment. The Phillips Curve was useful for the FOMC to avoid being forced into extreme policy positions. Without the Phillips Curve, there is the potential that the Fed will be forced to engage in persistently accommodative monetary policy, with outcomes that could either lead to inflation or significantly distorted financial markets.