Daily Comment (September 16, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

It’s Fed week, but the big news is that financial and oil markets are roiled by an attack on Saudi Arabia’s (KSA) oil infrastructure. Here is what we are watching this morning:

The attack of the Houthis? Houthis in Yemen have claimed a massive attack on Saudi Arabia’s oil infrastructure. Here are the key points:

- Initial reports indicated that 5.7 mbpd of crude production was lost, or about 58% of the KSA current output. Saudi officials have indicated that they expected to bring about a third of that production back early this week. However, recent reports suggest that outlook may have been overly optimistic.

- The attacks appear to be strategically sophisticated as 19 different points of impact were reported. First, the processing facility at Abqaiq was struck. This facility processes 7.2 mbpd of oil; therefore, even if Saudi fields continue to pump oil it can’t be exported until this facility is restored. Second, 1.2 mbpd of the Khurais oil field was also damaged. About 18% of the KSA’s natural gas production is offline, as is 50% of its NGLs that were affected.

- Although the Houthis have claimed responsibility for the attack, there is a great deal of skepticism about this claim. Secretary of State Pompeo blamed Iran shortly after the attack. Iran has categorically denied this claim. Regional media sources claim the attacks came from Iraqi soil, which the Iraqis have denied. The White House has released photos that suggest the attack came from the north or northwest, which are casting doubt on the Houthis’ claim. In fact, the attack appears to be sophisticated enough that it probably exceeds the Houthis’ capability. This factor alone increases the odds that this either came from Iran or from a close proxy.

- We now will watch closely to see how the administration responds. President Trump indicated he was “locked and loaded.” Iran may have misjudged the president, exhibiting a classic mistake that foreign nations have historically made about the U.S. The Jacksonian streak that runs through American foreign policy has befuddled foreign adversaries before. The Jacksonians appear to be isolationists and thus can be taken advantage of; the president’s decision to back away from an earlier missile attack may have emboldened Iran into thinking that it could get away with the escalation. However, Jacksonians will defend their honor, thus a military response is likely if the president concludes that this act besmirches America honor. As we note below, we still believe the president wants to avoid a military confrontation, but if he feels he is personally being challenged then all bets are off.

- At a minimum, this attack will end any chance of talks, at least in the near term.

- If Iran is implicated, it will be hard for Europe to continue to maintain the Iranian nuclear deal.

- Here is our “back of the envelope” analysis of the oil situation. OPEC has been producing around 29.9 mbpd; its total capacity is about 34.6 mbpd. Thus, at first glance, this problem appears manageable. The loss of Saudi production is 5.7 mbpd but excess capacity is 4.6 mbpd. Thus, the world only needs 1.1 mbpd, which could easily be filled from the OECD’s SPRs around the world. However, it isn’t that simple:

- Although the KSA’s capacity is thought to be 11.5 mbpd, it is still likely that much of that oil would still need to flow through Abqaiq. Thus, a conservative estimate would have to assume that the KSA’s current full production is probably closer to 4.1 mbpd, at least initially. We would expect some of that capacity to be restored in the near term, although full recovery may take months.

- If our back of the envelope analysis is correct, this action against the KSA cuts OPEC excess capacity by 7.4 mbpd.

- In addition, 1.6 mbpd of the cartel’s excess capacity resides in Iran. It is unlikely the U.S. will lift sanctions on Iran now as excess capacity is down 9.0 mbpd.

- Taking this all into account, a rough estimate is that OPEC can now produce around 26.6 mbpd. That means the world must find 4.4 mbpd of lost production.

- Essentially, the world oil market is now running without any buffer. For most of the history of the oil market, some producers have held production off the market to stabilize prices. This offline capacity has acted to dampen price spikes when events occur. The world mostly relies on the KSA for maintaining this buffer. For the time being, that buffer is missing which means price volatility will rise.

- The loss of a buffer turns our attention to the Strategic Reserves (SPR). The estimated operational drawdown capacity of the U.S. SPR is 4 mbpd. It takes about 13 days from the time a presidential order is made until oil begins to reach the market. The SPR has never had a sustained drawdown of this magnitude and thus, we don’t know for sure if it will work. At the same time, given high U.S. production and rather elevated levels of commercial inventory, the likelihood of an extended supply shock is rather small…if consumers act rationally. However, that is a heroic assumption. The reason the OECD, through the auspices of the IEA, created the SPR system was to prevent hoarding. In theory, in the case of a global supply shock, the IEA “coordinates” the SPR response. Since the SPR system has never been tested on a drop of this magnitude, it is unclear if the IEA members will actually allow the IEA to coordinate the national SPRs. In theory, the IEA could direct the U.S. to sell SPR oil to Paraguay to relieve a shortage there. The idea that U.S. taxpayers would not have access to the oil they paid for so that Paraguay could avoid a price spike is politically unlikely. The economic reasoning behind coordinating the SPRs is to discourage hoarding, but if the SPRs become mere national stockpiles, hoarding behavior is likely and the price spike could have legs.

- This attack is a potential test of the Carter Doctrine. The Carter Doctrine states that the U.S. is prepared to use military force to defend its interests in the Persian Gulf, originally a response to the Soviet Union’s invasion of Afghanistan in 1979. The U.S. response to Iraq’s invasion of Kuwait in 1990.[1] It has even been claimed that the Carter Doctrine was used to justify the 2003 Iraq War. If SoS Pompeo’s allegation that Iran was responsible for this attack, the Carter Doctrine would seem to argue that a military response against Iran is warranted. It is certainly possible that the Houthis did launch the attack, but even so they likely procured the drones from Iran. So, we could end up with one of two scenarios:

- The Carter Doctrine is enforced and we see military action against Iran—at least airstrikes against Iran’s defense industry, the part that makes drones, would be possible. A military strike would increase uncertainty surrounding oil supplies, at least in the short run, lifting the odds of escalation and pushing prices higher.

- The Carter Doctrine is not enforced—this would mean the doctrine is probably no longer operational and would signal a major change in U.S. policy. This decision would lower oil prices in the short run but increase the “normal” level of geopolitical risk in the market, putting a higher premium into oil prices.

- Our expectation is that the White House, notwithstanding Pompeo’s claim and the president’s comment about “locked and loaded,” would prefer to avoid military action against Iran. Once engaged, it may be hard to contain the escalation and a sustained spike in oil prices could tip a slowing U.S. economy into recession. Although the Trump administration is facing a decision on the Carter Doctrine, it has been on shaky ground for some time. The Obama administration’s “pivot to Asia” was a clear signal that the U.S. just wasn’t as concerned about the Middle East. The shale revolution reduced the need for the doctrine. Still, it is important when a superpower pulls back from a stated policy. Clear points of departure force other nations to change policy. At a minimum, if the Carter Doctrine is defunct, Middle East oil supply becomes less secure.

- The KSA is no longer a reliable swing producer. To some extent, this attack is “the big one.” Anyone who has analyzed oil markets has always acknowledged the possibility of an attack on the KSA oil facilities. Even after repairs and the return of production, forevermore, we will know that these facilities are not completely safe.

- The timing of this attack was inauspicious. There are two problems. First, CP Salman had just fired the leadership of the energy ministry and Saudi Aramco. That means this crisis will be handled by the new, untested leadership. This crisis would have challenged a seasoned staff, but the odds of a mistake are elevated with an untested group. Second, the IPO of Saudi Aramco is in doubt; a company that faces these sorts of threats will face a significant discount.

- Finally, a sustained spike in oil prices will further undermine global economic growth.

Overall, the attack is a new, significant risk factor for not just the oil markets but for the world economy. It will take a few weeks to determine the significance of this weekend’s activities.

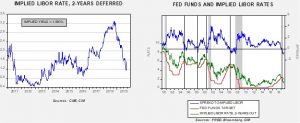

The problem of easing: As we noted last week, ECB President Draghi’s easing plans were not universally supported. It appears that at least nine members had some level of misgivings. This week, Chair Powell has his turn to try to convince the voting members that a rate cut is necessary. Although we have little doubt that a 25-bps cut is coming, we would not be surprised to see a hint of uncertainty surrounding future cuts. The financial markets have reduced their expectations of future rate reductions; we might see more if the statement is balanced and does not lean toward further easing.

The chart on the left shows the implied three-month LIBOR rate, two years into the future; the implied rate comes from the Eurodollar futures market. The chart on the left shows the implied rate and the fed funds target on the lower lines with the spread on the upper line. In general, the Fed tends to ease when the spread inverts. We have seen a deep inversion recently but the backup in the implied rate would suggest that up to two rate cuts of 25 bps have been withdrawn from the markets. Still, the implied LIBOR rate suggests that at least three more cuts are still coming.

Perhaps Powell’s biggest hurdle will be convincing the Phillip’s Curve adherents that they should cut rates. To visualize Powell’s problem, we use the Mankiw Rule, a derivation of the Taylor Rule. The Taylor Rule is designed to calculate the neutral policy rate given core inflation and the measure of slack in the economy. John Taylor measured slack using the difference between actual GDP and potential GDP. The Taylor Rule assumes that the Fed should have an inflation target in its policy and should try to generate enough economic activity to maintain an economy near full utilization. The rule will generate an estimate of the neutral policy rate; in theory, if the current fed funds target is below the calculated rate, the central bank should raise rates. Greg Mankiw, a former chairman of the Council of Economic Advisors in the Bush White House and current Harvard professor, developed a similar measure that substitutes the unemployment rate for the difficult-to-observe potential GDP measure.

We have taken the original Mankiw rule and created three other variations. Specifically, our model uses core CPI and either the unemployment rate, the employment/population ratio, involuntary part-time employment and yearly wage growth for non-supervisory workers. All four variations compare inflation and some measure of slack. Here is the most recent data:

This month, all the variations’ estimated target rates rose substantially, a product of rising inflation and tighter labor markets. All the models now suggest the Fed is too easy, although the employment/population variation is just above the current midpoint implied by the target. Essentially, even the most easy variation would argue for steady policy. Powell, likely on momentum alone, will be able to get a rate cut at the meeting but further cuts will likely require more persuasion.

The divergence of opinion about monetary policy is coming from two sides. The first is the idea that the economy isn’t in all that bad of shape and cutting rates is not justified. This is the usual problem with monetary policy and the business cycle. Financial markets give the longest lead but tend to trigger false positives; waiting for the economic data to show a downturn in place usually means policymakers cannot move quickly enough to avoid a recession. However, the fear is that easing when labor markets are tight might trigger inflation and thus the desire to hold steady will be notable. The second idea is that monetary policy is exhausted and further stimulation must come from fiscal policy. We are more sympathetic to this argument, but the problem is that the Western world’s legislatures are deeply polarized and (a) getting a fiscal package passed will be hard, and (b) getting a package passed that is actually effective may simply be impossible.

On a related note, the BOJ is considering further easing, which would require negative nominal interest rates.

On strike: The United Auto Workers (UAW) is calling a strike against General Motors (GM, 38.86). The union has instructed some 46k workers to walk off the job, the first action of this magnitude since 2007, when a UAW strike idled 73k workers. The union is striking over the usual things, benefits and pay, but is also wanted to force the automaker to follow earlier contracts that forbid closing the plants except in an emergency. Work stoppages have become increasingly rare since the 1980s. Last year, nearly 500k workers were involved in stoppages. Including this recent action against GM, the workers involved year to date is 372k.

The increase in labor actions is likely due to the long expansion. We suspect the UAW leadership wants to make a deal now when the economy is still expanding because it will be much more difficult to press for higher wages in a recession. In addition, UAW officials are facing investigations from the DOJ; a successful strike could keep the rank in file aligned with the current leadership.

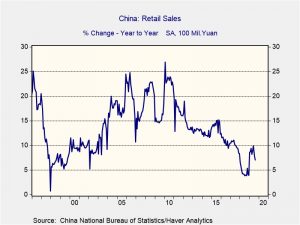

Chinese economy: The Chinese economy is slowing rapidly. Industrial production growth fell to the lowest level since the Great Financial Crisis.

Fixed asset investment rose 5.5%, which was weaker than forecast, and retail sales growth eased as well.

All this suggests that China needs further stimulus to avoid additional economic weakness. There is little doubt that the trade war is adversely affecting China’s economy more than the American economy; however, the issue isn’t so much the level of pain but rather the tolerance for it. It is our position that Chairman Xi believes China has a higher pain tolerance and that Washington will blink first.

An interesting side note is that Chinese firms are divesting foreign assets, including those in the U.S. It is unclear what is driving this divestment. Some of it is likely coming from government pressure to reduce exposure abroad. There is a desire from Beijing to curb capital flight. Restrictions on investment are increasing and the change in the investing climate might be encouraging divestment. But the bigger worry is that firms in China may be facing a cash crunch and they are divesting to build liquidity. If the latter is the reason, it bodes ill for global growth.

United States-Japan: In a joint statement that President Trump and Prime Minister Abe will release after their meeting in New York next week, the U.S. will promise not to hike tariffs on Japanese autos. The leaders will also sign a new bilateral trade agreement. Up until now, President Trump hasn’t definitively ruled out new tariffs against Japanese auto imports, so the move is a significant sign that the trade tensions weighing on so many other U.S. relationships probably won’t be a problem for Japan in the near future.

Hong Kong: For the 15th straight weekend, anti-Chinese protestors launched demonstrations and mass vandalism, underlining their view that Chief Executive Carrie Lam’s withdrawal of her controversial extradition bill was “too little, too late.” In what may be a new tack by Beijing to fight the protestors and split the pro-democracy movement, editorials in three Chinese state-owned media outlets accused Hong Kong’s property tycoons of hoarding land and driving up real estate prices. With tensions remaining, the risk of a crackdown by China is likely to continue weighing on Hong Kong’s economy and asset markets.

United States-European Union: In the longstanding dispute over EU aerospace industry subsidies, the World Trade Organization approved a U.S. request to impose punitive tariffs against some European goods. If implemented, the new U.S. tariffs could widen the trade war and further undermine confidence and investment in the EU.

Italy: The new governing coalition of the populist, left-wing Five Star Movement and the center-left Democratic Party has filled out its cabinet positions, putting the traditionalist Democrats in an unexpectedly strong position. For example, Roberto Gualtieri, a Democratic Party veteran and EU insider, has gotten the post of finance minister. The new government is widely expected to loosen fiscal policy in an effort to boost the economy, just as the previous coalition between Five Star and the right-wing League sought to do, but the new government is likely to get substantially more leeway from the EU, which should help calm some of the volatility in Italian assets that was common over the last couple of years. To illustrate how the new coalition might be more different in tone than in substance, the government allowed a charity ship with 82 rescued African migrants to dock in Italy over the weekend, but only after requiring it to first wait six days at sea while it negotiated with other EU countries to take some of the refugees.

United Kingdom: Prime Minister Johnson today holds his first face-to-face talks on Brexit with the outgoing European Commission president, Jean-Claude Juncker, and the EU’s chief Brexit negotiator, Michel Barnier. Johnson is not expected to present a detailed proposal for a new exit deal, but he may float some trial balloons, especially related to his thoughts on keeping Northern Ireland in a customs union with the EU. There also seems to be some disagreement within Johnson’s cabinet as to whether a Brexit delay might be countenanced.

Tunisia: Exit polls show outsiders won the first round of the country’s presidential election yesterday. The top vote gatherers were apparently Kais Saied, a constitutional law professor unaffiliated with any party, and Nabil Karoui, a television tycoon imprisoned for tax evasion shortly before the balloting. The current prime minister and other mainstream politicians were punished for their inability to improve economic growth and cut corruption since the country launched the “Arab Spring” reform movement in 2011. If the results are confirmed, Saied and Karoui will face off in the final round of the election on October 13.

[1] Klare, Michael. (2004). Blood and Oil: The Dangers and Consequences of America’s Growing Dependency on Imported Petroleum. New York, NY: Henry Holt and Company.