Daily Comment (September 26, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Markets are rather quiet this morning. The IMF has a new leader. The head of the DNI testifies today before the House and Senate Intelligence Committees. The House testimony will be public, while the Senate will be closed. We expect the media to remain focused on the impeachment issue. Here is what we are watching this morning:

Impeachment update: Before we start, we want to correct something we said yesterday. We implied that we didn’t think the president would be impeached. That’s not exactly what we meant. We would not be surprised if the House impeaches the president but think the odds of a conviction in the Senate are near zero.

After another 24 hours, here are some additional thoughts on the impeachment issue:

- Although we suspect this event will look more like the Clinton impeachment rather than the Nixon one, history doesn’t necessarily tell us very much. The fact that there are only two events in recent history means we simply don’t have enough of these circumstances to draw clear conclusions. Our expectation is that these proceedings will probably help the president more than hurt him. However, our confidence in that expectation isn’t all that solid. To frame just how current conditions affect these events, imagine the Clinton impeachment in the #MeToo era. Democratic Party senators would have been torn between trying to protect their party’s president and allowing him to get away with what was clearly an inappropriate relationship. In other words, in the late 1990s, what President Clinton did was framed as an unfortunate dalliance. In the current world, such actions, especially by older, powerful men against younger women, are not tolerated. In today’s world, Clinton may have been removed from office. So, we will have to play this one by ear because each one of these is unique.

- Americans have little knowledge of the degree of corruption in Ukrainian politics. There have been chemical attacks on candidates. Former leaders have been jailed. The country elected a young comedian hoping he might be able to clean things up. If we see Ukrainian officials testify before Congress, it will be quite a show.

- Ukrainian President Zelenskiy will likely be making some apology calls to EU leaders over the coming week.

The German resigns: Sabine Lautenschläger, the German representative and only woman on the ECB’s executive board, has resigned over recent easing actions by the ECB. She was in her sixth year of an eight-year term. Germany, along with other northern European nations, has become increasingly unhappy with the easy money policies of the ECB. Draghi was able to force his will on the ECB, in part, because he has the intellectual “chops” to argue for his position. It will be interesting to see how Legarde handles this growing hawkish opposition to easy policy. It is possible that she will not be able to stand against it. We will also be closely watching to see who Germany appoints to replace Lautenschläger.

More repo: Like the cowbell, the financial system can’t get enough Fed repurchase operations. The NY FRB will increase the size of the repo operations to $100 bn from $75 bn. It appears that the Fed is focusing on the largest banks’ reserve hoarding as the reason for why there appears to be a scarcity of liquidity in the repo market. If the large banks are, in fact, hoarding reserves, the key question then becomes, “why?” We suspect it is regulation uncertainty causing this behavior, but will be watching to see if other reasons emerge.

United States-Japan: At the UN yesterday, President Trump and Japanese Prime Minister Abe signed a trade deal that will cut Japanese agriculture tariffs and U.S. industrial duties. However, the agreement is seen as limited. It doesn’t appear to open up major new markets, nor does it produce major new momentum for the U.S.-China trade negotiations.

North Korea-South Korea: Recent reporting suggests North Korea secretly annexed and occupied a small South Korean island near the countries’ maritime border, sparking a scandal for the South Korean government. The government denies the islets are really South Korean territory, but reporters have found evidence that they were considered so in the past.

China: Chinese buyers continue to lap up U.S. agricultural products. At the same time, U.S. hardwood lumber exports to China have fallen 40% this year, after China’s imposition of 25% retaliatory tariffs on the product. This helps explain why major timber REITs have fallen in price over the last year, while REITs as a whole have surged. On another topic, the PBOC auctioned 10 billion yuan of six-months bills in Hong Kong to shore up the yuan exchange rate. The trade war has also affected global trade. The Netherlands Bureau for Economic Policy Analysis has a World Trade monitor; for the first seven months of 2019, world trade contracted.

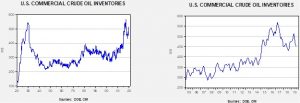

Energy update: Crude oil inventories rose 2.4 mb compared to an expected draw of 0.6 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.5 mbpd, a new record. Exports fell 0.2 mbpd, while imports fell 0.7 mbpd. The rise in stockpiles was mostly due to falling refinery demand (see below).

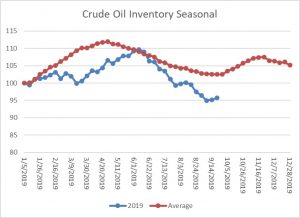

This chart shows the annual seasonal pattern for crude oil inventories. As we approach the end of the spring/summer inventory withdrawal, we are starting the autumn rebuild period at a sizeable deficit. For the past two weeks, we have seen small builds but, as the chart shows, the seasonal gap is still significant. Without aggressive increases in stockpiles, we will likely continue to lag seasonal patterns which, on its own, is bullish.

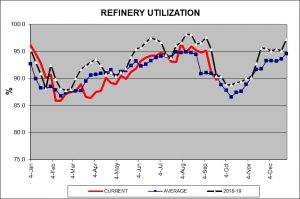

The most important information from this week’s data is that we appear to be well into the autumn refinery maintenance season.

The drop in refinery utilization will likely continue for the next three weeks; utilization should begin to rise by mid-October. During this period, inventories usually rise. However, the usual seasonal rise will depend on Saudi production.

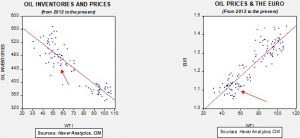

Based our oil inventory/price model, fair value is $67.53; using the euro/price model, fair value is $48.17. The combined model, a broader analysis of the oil price, generates a fair value of $54.23. We are seeing a clear divergence between the impact of the dollar and oil inventories. Given that we are in the maintenance season, we would normally expect inventories to rise. Prices will remain sensitive to Saudi output and tensions in the Middle East.

On the Middle East, conflicting trends are emerging. The Kingdom of Saudi Arabia (KSA) is arguing that it’s oil production is recovering quickly, claiming it is producing around 8.0 mbpd, mostly from other fields and facilities that were not affected by the recent attacks. However, it is not clear if the production has any use; if the oil can’t be processed to rid it of impurities and imbedded gasses, it can’t go anywhere. So far, the KSA has been fulfilling its export requirements by using storage, but it is unclear how much longer it can maintain exports by draining stockpiles. So far, markets are obviously giving the KSA the benefit of the doubt and pushing prices lower.

As the KSA supplies the oil market, calming supply fears, the U.S. continues to “turn the screws” on Iran. The White House has barred senior Iranian officials from entering the U.S. In addition, in the midst of trade talks with China, the U.S. has sanctioned Chinese firms that have conducted oil trade with Iran. Tightening conditions probably increases the likelihood of a lashing out by Iran; even if there is another attack on the KSA, U.S. support for the kingdom may be tepid at best. We view the geopolitics as bullish.