Asset Allocation Weekly (October 18, 2019)

by Asset Allocation Committee

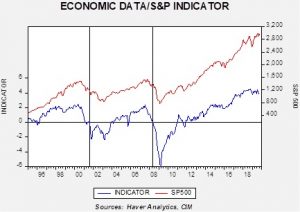

In 2017, we introduced an indicator of the basic health of the economy and added it to the many charts we monitor to gauge market conditions. The indicator is constructed using commodity prices, initial claims and consumer confidence. The thesis behind this indicator is that these three components should offer a simple and clear picture of the economy; in other words, rising initial claims coupled with falling commodity prices and consumer confidence is a warning that a downturn may be imminent. The opposite condition should support further economic recovery. In this report, we will update the indicator with September data.

This chart shows the results of the indicator and the S&P 500 since 1995. The updated chart shows that the upward momentum in the economy slowed last year but it does remain well above zero. We have placed vertical lines at certain points when the indicator fell below zero. It works fairly well as a signal that equities are turning lower, but there is a lag. In other words, by the time this indicator suggests the economy is in trouble, the recession is very near and the equity markets have already begun their decline.

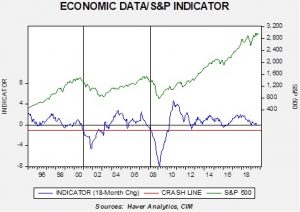

To make the indicator more sensitive, we took the 18-month change and put the signal threshold at minus 1.0. This provides an earlier bearish signal and also eliminates the false positives that the zero threshold generates. Nevertheless, the fact that this variation of the indicator is just below zero raises caution.

What does the indicator say now? The economy has decelerated but is not yet at a point where investors should become overly defensive. At the same time, the 18-month change in the indicator has fallen below zero; in 2016, this situation led to several months of sideways market activity. If we continue to see the lower chart hover around zero, the greater the likelihood that equities will flatten. Thus, reducing equity risk by rebalancing for a more defensive equity sector exposure would be prudent.