Asset Allocation Weekly (November 1, 2019)

by Asset Allocation Committee

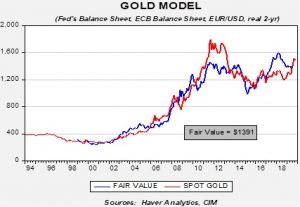

We continue to hold a favorable outlook toward gold despite evidence that current prices may be getting a bit ahead of themselves. Our gold model puts fair value at 1391.

In the coming months, we expect the fair value to rise; both the ECB and the Federal Reserve have resumed expanding their balance sheets. And, the Fed will likely continue to cut rates, which would be expected to reduce the real interest rate on two-year T-notes. The dollar remains overvalued but will likely need a catalyst to trigger depreciation. Still, over time, we do expect gold prices to find support from improving fundamentals.

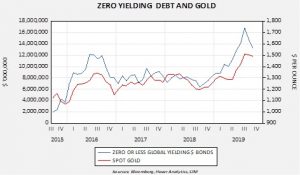

In addition, the high level of zero-yielding debt should be supportive.

We have seen a drop in zero-yielding debt recently, but with slowing global economic growth, a renewed expansion is likely.

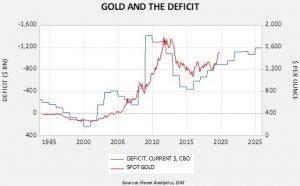

Finally, there is a long-term relationship between gold prices and the level of the fiscal deficit. Although the level of the current deficit does suggest, again, that gold prices might be a bit overvalued currently, the likelihood of expanding deficits should offer underlying support for gold prices.

In the immediate term, we may see steady to lower gold prices but there are ample fundamental factors that should support future prices.