Daily Comment (November 15, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] Episode #3 of our Confluence of Ideas podcast is now available.

U.S. equity futures are modestly higher this morning. Lots of data today (see below). Some optimism on trade. Hong Kong is still very tense. Debt is on the rise. Here are all the details and more:

Trade: There are a couple positive news themes this morning. First, Larry Kudlow told the Council on Foreign Relations that a deal was “close,” but President Trump was not ready to sign off quite yet. Kudlow is part of the establishment wing of the administration and has repeatedly offered optimistic viewpoints on numerous issues including trade. Earlier this week, the talk on trade was much less favorable. Although Kudlow may be offering a valuable insight into the path of negotiations, it is also likely he is merely showing his bias. Second, Speaker Pelosi was optimistic that USMCA may be close to passage. With a number of distractions on Capitol Hill (impeachment, spending bills[1]), passage of the North American trade pact seems unlikely but moderate Democrats facing tough elections next year are pushing the Democratic caucus to pass the measure.

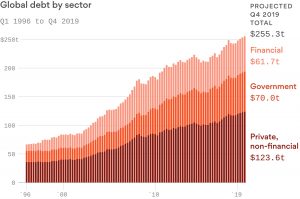

Debt: The Institute of International Finance (IIF), a bank-funded research group, reported yesterday that global debt rose $7.5 trillion to a new record of $250.9 trillion. The group forecasts a number of $255.0 trillion by year-end.

Financial debt is usually less of a concern because it includes some double-counting. Still the rise in private, non-financial (business and household) and government debt is significant. There are two issues to focus on. First, there is the sustainability problem. Debt by itself isn’t usually a problem; it’s the ability to service it that is the issue. High debt levels increase pressure on central banks to keep rates low because higher interest rates raise debt service costs. The implementation of negative interest rates is related, in part, to the issue of debt size. Second, there is the adjustment problem. If the debt does become unsustainable, the allocation of “pain” to debtors and creditors becomes the key part of the resolution process. The decision on the allocation of costs comes from the political system. It’s important to remember that one party’s debt is another’s asset. If debt values are going to fall, it’s either because asset values are going to decline, or borrowing is going to reverse (or both). Reducing debt values has led to historic events. The Great Depression was one such event. Japan over the last 30 years is another. Debt management may be the biggest issue the world faces now because a “sudden stop” in lending can lead to a cascade of defaults and in some nations, this debt may be denominated in some other nation’s currency, which makes resolution much more difficult. This is one of those “background” issues that always lurks, but occasionally pops up to cause problems.

Hong Kong: There were rumors that authorities were going to implement a curfew but those have been denied. Positions on both sides are hardening. Chairman Xi is pressing the Hong Kong government to bring the unrest under control. Hong Kong is now in recession as the violence escalates. In addition, the unrest appears to be spreading; South Korean students in Seoul put up posters supporting Hong Kong and faced a confrontation with students from the PRC. Adding to pressure for China, Senator Rubio’s (R-FL) Hong Kong pro-democracy bill has made “very significant progress.” A similar measure has already passed the House. If it passes, it would likely become a serious impediment to a trade deal with China. The U.S.-China Economic and Security Review Commission, a bipartisan panel of experts which offers advice to Congress on China, has recommended that if the PRC sends troops to Hong Kong, the U.S. should suspend the former colony’s special economic status. This same group issued a report yesterday that essentially signals to Congress that the U.S. should be prepared for a “prolonged strategic competition” with China. Former Secretary of State Kissinger, at an event sponsored by the National Committee on U.S.-China Relations, warned that the United States and China are now so equally powerful that neither can expect to dominate the other. Because of their equal strength, any significant conflict between them would result in a catastrophe “worse than the world wars.” Kissinger said the United States and China have to get used to that fact and learn to live together. If we can’t, globalization is under threat under these conditions.

North Korea: A day after North Korea threatened a “new path” if the United States and South Korea hold their planned joint military exercises next month, satellite images show dozens of military aircraft parked wing-to-wing at a North Korean civilian airport. The line-up could be in preparation for a visit by North Korean leader Kim Jong-un, but it could also signal some new kind of air power demonstration. In any case, it seems to confirm North Korea’s growing frustration with the denuclearization issue and the likelihood that it could soon revert to provocative military steps, which would likely unsettle the financial markets. Meanwhile, on a visit to South Korea, U.S. Defense Secretary Esper called on South Korea to cover more of the cost of stationing U.S. troops in the country. The Trump administration is pushing for the South Koreans to quintuple their contribution to $5 billion per year.

France: As an antidote to all the news about global trade tensions and slowing factory activity, it’s important to keep in mind the power of economic reform, and not just in the so-called emerging markets. For example, French new business registrations in October were up 15.7% year-over-year, continuing the double-digit increases over the last two years. The continuing surge is driven by business-friendly reforms under President Macron, including the scrapping of a wealth tax on all assets other than property, a flat tax on capital gains and a special visa to attract start-ups.

Odds and ends: Google (GOOGL, 1309.15) is facing a widening state-led anti-trust probe. The U.S. is threatening sanctions on Egypt as Cairo is considering the purchase of Russian arms.

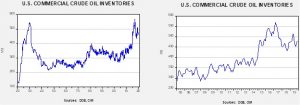

Energy update: Crude oil inventories rose 2.2 mb compared to an expected build of 1.5 mb.

In the details, U.S. crude oil production rose 0.2 mbpd to 12.8 mbpd, a new record. Exports rose 0.3 mbpd, while imports declined 0.3 mbpd. The rise in stockpiles was mostly in line with expectations.

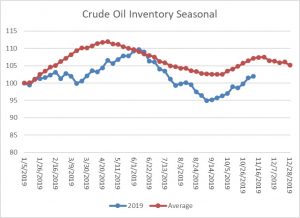

The above chart shows the annual seasonal pattern for crude oil inventories. We are approaching the end of the autumn build season, which implies we will see a modest drop during the month of December.

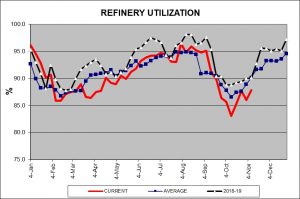

We continue to monitor the autumn refinery maintenance season.

This week’s rise is normal, but utilization remains below average. Run rates should continue to rise into the new year.

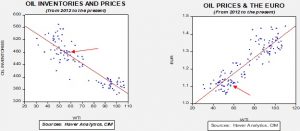

Based our oil inventory/price model, fair value is $57.82; using the euro/price model, fair value is $49.07. The combined model, a broader analysis of the oil price, generates a fair value of $51.25. We are seeing the divergence between dollar and oil inventories narrow as the dollar weakens and oil stocks rise. We expect the Saudi IPO process to support oil and any positive news on the trade front would be supportive for oil prices as well. At the same time, the IEA is warning of a potential supply glut next year due to rising non-OPEC output. Although we expect output discipline into the IPO, the Saudis may attempt to retake market share post-IPO. Historically, such events usually lead to much lower oil prices.