Asset Allocation Weekly (December 20, 2019)

by Asset Allocation Committee

(N.B. This is our last Asset Allocation Weekly for 2019. The next edition will be published January 10, 2020.)

Did the Fed engineer a soft landing? That is the critical question for 2020. If the Fed, through its rate cuts last year,[1] has rescued the economy, it would be one of the most remarkable episodes of deft central bank practice.

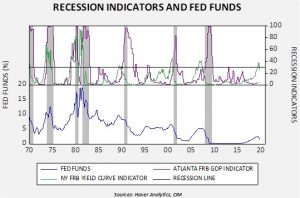

This chart shows fed funds along with recession indicators from the New York and Atlanta Federal Reserve Banks. The former uses the yield curve in its forecast and the latter uses GDP. The New York indicator gives a 12-month forward read on the economy. Since 1970, any reading over 30 for the New York indicator has led to an eventual recession. Nevertheless, even though its track record is impressive, we like to wait for confirmation from the Atlanta indicator before declaring a downturn. The chart shows that risks of recession are elevated.

What if recession is avoided? Because retail money market levels are elevated, we could see a strong rally in equities.

This chart looks at retail money market funds (RMMK) compared to the S&P 500. When RMMK fell from 2008 into 2011, the equity index more than doubled. The high level of RMMK may not necessarily all flow to equities, but avoiding recession (and a reduction in trade conflicts) could lead to this liquidity finding its way into asset markets.

In conclusion, the odds of recession are elevated but we don’t see a downturn as imminent. The FOMC has moved aggressively to cut the policy rate and is at a level we would consider neutral. If a recession is avoided, risk assets could appreciate significantly in 2020. However, the risks of a downturn are probably high enough to keep asset prices contained at least for the first few months of the new year.

[1] And the expansion of the balance sheet as well.