Daily Comment (January 16, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Good morning! Equity markets continue to grind steadily higher; in fact, it’s the third longest streak since 1995 of the major indices not moving more than 1% in either direction. Why? Our quick take is that we are seeing the combination of monetary accommodation coupled with uncommon caution by retail investors. We look at the aftermath of the China/U.S. trade deal. Putin moves to extend his rule. Here is what we are watching this morning:

U.S./China deal: Although the press has focused simply on the signing of the U.S.-China Phase One trade deal yesterday and the big import commitments China made in the agreement, our read of the text itself suggests the bigger story may be that the U.S. got the Chinese to make significant concessions in a number of important areas. The draft deal that China walked away from last May was apparently quite intrusive, with detailed changes to multiple areas of Chinese law. The text of the deal signed yesterday also includes many requirements that China change its legal and regulatory system to match U.S. standards, but without specifically enumerating each article, chapter and clause of Chinese law that has to be changed. Most of those changes relate to the protection of intellectual property, so there are many more issues in the U.S.-China relationship that still need to be addressed.

The agreement is being widely panned in the media. Although we always take the position of political neutrality, the tone is probably more negative than justified. There are two primary criticisms of the agreement. First, China’s practice of subsidizing firms that supports their export efforts wasn’t addressed. This charge is accurate. However, as we noted yesterday, USTR Lighthizer is working to use the WTO and team up with Japan and the EU to address this issue. In our view, Lighthizer is a grandmaster of trade negotiations; he appears to have decided that the subsidy issue is better dealt with in a broader context. Second, there is legitimate concern that China will not live up to its promises as it has in previous agreements. What is different this time is that the U.S. has shown it will implement tariffs if China doesn’t do what it says it will. We find it notable that the U.S. has kept the vast majority of tariffs in place even after this deal. That suggests the U.S. feels it won’t get compliance from Beijing without the persistent threat of a “stick.”

At least in our initial look, we have some worries too. There doesn’t appear to be a well-designed dispute mechanism; thus, the ultimate enforcement may come down to “I quit.” We are also concerned that China may not be able to fully meet the import targets; we note soybean prices fell yesterday on these worries.

However, overall, the trade war with China has clearly caught the attention of Chairman Xi. We suspect the USTR’s primary goal is to change the way the Chinese economy works, similar to what he helped engineer against Japan in the late 1980s. Simply put, he wants to change China’s economy from being investment and export driven, to consumption and import driven. Japan was never able to make the transition and thus has suffered 30+ years of economic stagnation. If China wants to avoid the same fate, it will need to make changes. Of course, history never repeats exactly the same way; China is big enough that it may try to create its own sphere of influence, something that Japan, who was dependent on the U.S. for its security, could never execute.

So, where do we go from here? There are two trends we are following. The Trump administration will likely conclude that, given what they were able to accomplish with China, tariffs are effective. Thus, tariffs can be used to force trade concessions and to change behavior. We suspect the EU is the next area that will come under scrutiny. We also note reports that the U.S. threatened the EU with tariffs on autos if they didn’t warn Iran about violating the nuclear deal.

Putin: We once worked with a strategist who pretty much always had the same forecast, but the “show” was seeing how he would manage to create a path to that outcome. Vladimir Putin is similar in that respect. We know the outcome is always that Putin will remain in power. However, how he does it is interesting to watch. In his annual State of the Union address yesterday, President Putin launched a surprise constitutional revamp that could keep him in power past the end of his term in 2024. Under the proposal, which Putin said would be put to a referendum, the power to name the prime minister and his or her cabinet would be transferred from the president to the lower house of parliament (although the president would still be able to dismiss the prime minister and cabinet ministers). Parliament would also get greater power over the judiciary and the security services. Eligibility to become president would be tightened up so that anyone taking the post would need to first live 25 years in Russia and have no foreign citizenship or residency. Future presidents would also be limited to two terms in total. Meanwhile, the State Council, which Putin already heads, would be given increased power. To put the changes in motion, Putin replaced incumbent Prime Minister Medvedev with Mikhail Mishustin, the head of Russia’s tax office who is relatively unknown and has no appreciable political base. The move reflects a number of important principles: 1) Putin takes great pain to prolong the illusion of constitutional legitimacy, just as he did a decade and a half ago when he temporarily took the role of prime minister after reaching the term limit on his first presidency; 2) By neutering the presidency and installing a weak figure as prime minister, Putin is ensuring that he will maintain overwhelming control over the government from his position at the top of the State Council; and 3) Although the timing of the change seems early compared with the 2024 end of Putin’s current term, moving now may make sense given that Russia will hold parliamentary elections in 2021, and Putin could package the move to the advantage of his party in that balloting.

Germany: The federal government has struck a deal with the country’s coal-producing regions to phase out the use of coal for power by 2038 in return for €40 billion worth of compensation and benefits. That suggests Germany will try to stop using both nuclear and coal power at the same time, replacing them with renewables and natural gas.

South Korea: The U.S. ambassador to South Korea said the Trump administration has softened its demand that Seoul quintuple its contribution to supporting the U.S. troops stationed on the Korean peninsula. The ambassador gave no details on the new demand, but if the softening is significant, it could help diffuse tensions between the U.S. and South Korean governments, and allow them to focus on issues like the renewed threats from North Korea.

Turkey: Despite a recent rebound in inflation, the Turkish central bank today cut its benchmark short-term interest rate more sharply than expected, to 11.25% from 12.00% previously. The recent rate cuts, which have been driven largely by President Erdogan, appear to be spurring better economic activity even if they are spurring stronger price hikes. That may explain why the lira actually strengthened slightly after the rate cut was announced.

Iraq: Caretaker Prime Minister Adel Abdul-Mahdi suggested in a cabinet meeting that he would leave the decision of whether to expel U.S. forces from the country to his successor. In spite of parliament’s recent call for such an expulsion and the Trump administration’s threat to impose sanctions if it does so, that means the issue may not come to a head in the near term. Any U.S. sanctions could very well be targeted against Iraqi oil exports, boosting oil prices, so pushing the issue off into the future could help keep the oil markets calmer than would otherwise be the case.

European news: The German media is reporting that an unnamed EU diplomat and two others are being investigated by German officials on suspicions of spying for China. British MEPs are preparing to leave the European Parliament after the Brexit. The U.S. has added Switzerland to its currency manipulator watch list (it’s about time!).

Odds and ends: Amid unrelenting drought, Australian mining firms are struggling to find enough water for their mining operations. The Wuhan coronavirus may be capable of human-to-human transmission; if so, this would make the disease much more dangerous. We also note that the Japanese health ministry has confirmed that the new coronavirus that has sickened dozens in China has now spread to Japan.

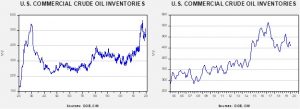

Energy update: Crude oil inventories fell 2.5 mb compared to expected no change in stockpiles.

In the details, U.S. crude oil production rose 0.1 mbpd to a new record of 13.0 mbpd. Exports fell 0.4 mbpd while imports fell 0.3 mbpd. The decline in stockpiles was unexpected but offset by large increases in product.

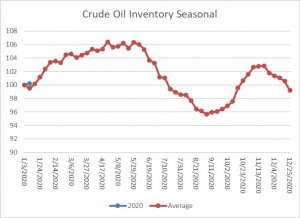

This chart shows the annual seasonal pattern for crude oil inventories. This week’s decline was a bit below normal. As the chart shows, oil inventories usually rise into late spring and then decline significantly into late summer. Last year, this pattern was disrupted to some extent because of exports.

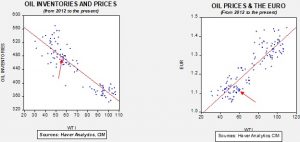

Based on our oil inventory/price model, fair value is $64.41; using the euro/price model, fair value is $51.35. The combined model, a broader analysis of the oil price, generates a fair value of $55.43. We are seeing the divergence between dollar and oil inventories narrow as dollar weakness persists. Given the level of geopolitical risk, prices have not moved significantly above the inventory fair value price, although the combined model would suggest a richly valued market. With inventories poised to rise seasonally and tensions seemingly easing, softer prices are more likely in the coming weeks.