Asset Allocation Weekly (February 28, 2020)

by Asset Allocation Committee

Since the end of the Financial Crisis, there has been a steady deterioration in investment-grade credit quality.

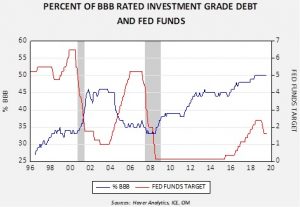

This chart shows the percentage of investment-grade bonds rated at BBB. Since late 2018, this portion has represented half of outstanding investment-grade credit. This rating is the lowest end of investment-grade credit, so the dominance of this segment raises questions about the stability of these corporate bonds under deteriorating financial conditions.

History tends to show that monetary policy has the most significant impact on the percentage of BBB debt.

A rising policy rate between 2004 into 2006 coincided with a sizeable decline in the percentage of BBB-rated debt in the investment-grade category. Low rates since 2008 led to a steady rise in the percentage of BBB-rated debt. Most notably, the policy tightening from 2016 into last year did not slow the rise, suggesting investors did not believe that monetary policy would lead to concerns about credit quality.

This data suggests a couple of issues. First, the current high level of low-rated debt in investment-grade is a concern if the economy weakens or policymakers overtighten. Second, investors appear confident that neither outcome is likely in the short run and, if anything, the FOMC will react quickly to protect the economy from trouble. The risk, of course, is that either this confidence is misplaced or a circumstance will develop to which no amount of policy stimulus can prevent credit deterioration.

In response to this deterioration of credit quality, we have reduced our overall exposure to investment-grade credit in our allocations to fixed income. However, we remain overweight to investment-grade, in part, due to expectations that a recession or a credit event isn’t imminent.