Weekly Energy Update (March 5, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

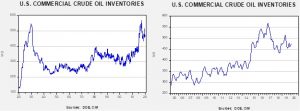

Crude oil inventories rose 0.8 mb compared to the forecast rise of 3.0 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to a new record of 13.1 mbpd. Exports rose 0.5 mbpd, while imports were unchanged. The inventory build was less than forecast due to rising exports and steady imports.

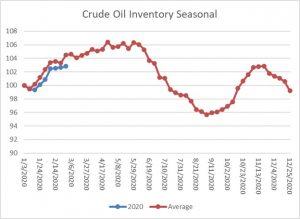

This chart shows the annual seasonal pattern for crude oil inventories. This week’s report was less than the usual seasonal patterns, and the gap between the normal pace of inventory accumulation and the actual widened modestly.

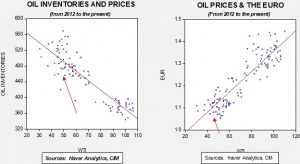

Based on our oil inventory/price model, fair value is $59.19; using the euro/price model, fair value is $46.44. The combined model, a broader analysis of the oil price, generates a fair value of $50.08. Oil prices have stabilized this week. OPEC has reportedly agreed to a 1.5 mbpd production cut; it is unclear if Russia is participating. This decision comes not a moment too soon as we are hearing reports that tankers are being used for floating storage, a clear sign of oversupply.