Daily Comment (March 16, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

It has been a very busy three days. We update the COVID-19 news. Risk assets reacted favorably to Friday’s press conference at the White House. However, we are not seeing any follow-through today; global equities are lower and bond yields are down across the board. Gold continues to sell off. The Fed moved aggressively, cutting the policy rate and opening QE4. Other central banks are following along. Here are the details:

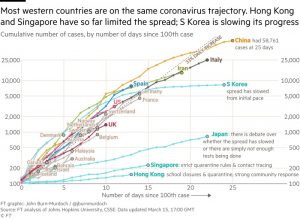

COVID-19: The world now has 169,387 reported cases of COVID-19, with 6,513 fatalities and 77,257 recoveries. The following is a chart of infections from FT.

Assuming the U.S. continues to track Italy, cases will be up to 25k in a week or so. Here are some bullet points for today:

- The U.K.’s natural experiment may be ending: The Johnson administration was bucking the trend of most Western nations by not ordering gathering places to close. The idea was that the virus can’t be contained anyway, so instead the government allowed movement to take place. As infections rose, a “herd immunity” would develop faster. For the population under the age of 50, this policy arguably makes sense. Most younger people are not threatened by the disease. However, for those over 60 it could be deadly. His government is rethinking the policy.

- Shutdowns increase: Schools, restaurants, theaters, churches and sporting events are all closing. Nearly 30 million school-aged children are now home. The administration is instructing Americans to “hunker down.” The same is true across Europe. Spain and Italy have been most aggressive as infection rates rise.

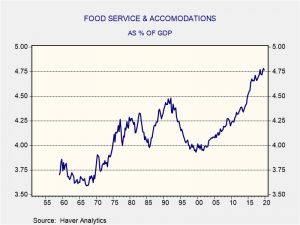

- All this is having an economic impact: The airline industry is reeling. In Europe, the automobile industry is starting to shut down. The restaurant industry is getting hit hard. In the U.S., this industry represents about 4.75% of GDP.

As economic data from China rolls out, the impact is stunning. Industrial output fell 13.5% for January and February compared to a year earlier. Retail sales plunged 20.5% for the same period and fixed asset investment dropped 24.5%.

- Nationalism is on the rise: Border closings are being announced across Europe, undermining the free movement of the past three decades. Travel bans are being extended. Germany is being rocked by reports that the U.S. tried to buy exclusive rights to a COVID-19 vaccine from a German company. Nations within Europe are trying to ban the export of protective gear; the EU is trying to stop that, but it is willing to prevent the export outside the EU.

- There is some good news: Vaccine trials are starting.

We will have much more to say on the virus and other issues in the next day or so; an update to our 2020 Outlook is coming soon. Suffice it to say, the odds of recession have increased dramatically in recent days and may be unavoidable.

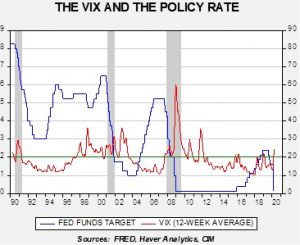

The Fed: In a surprise move, the FOMC decided to skip the formalities of Tuesday and Wednesday’s meeting and cut to the chase. It cut the policy rate of a range of 0% to 0.25% and announced QE4 by planning to purchase $700 billion of Treasury and mortgage paper. Specifically, it plans to buy $500 billion of Treasuries and $200 billion of mortgage-backed securities; this will take the balance sheet to over $5.0 trillion. In addition to these measures, the Fed reduced the discount rate to 25 bps and encouraged banks and primary dealers to use the window. Using the discount window mechanism would help support liquidity issues in the repo market. It also reduced the reserve requirement ratio to 0%. The FOMC also lowered prices on dollar swap rates with other central banks in a bid to reduce global liquidity issues. It is not clear in the statement how quickly the Fed intends to increase its balance sheet. There was one dissenter: Cleveland’s Loretta Mester opposed the rate cut but did support the other policy actions. The Fed did have “friends” as other central banks took action as well.

The Fed continues to guide policy based on financial risk. We note that the policy rate tends to be cut when the 12-week average of the VIX rises above 20.

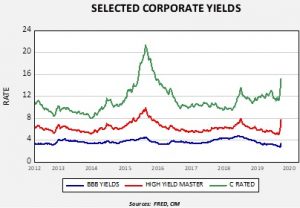

We also note that credit has been hit hard.

This chart shows rates on selected corporate yields of various credit quality. Funding strains are evident in the “hockey stick” turns in recent days; there is a clear rush for cash.

The question now is, “what’s left?” There are two other directions the Fed could take. Currently, it cannot buy assets other than Treasuries or mortgages. It could ask Congress to buy other assets, e.g., corporate bonds, and perhaps equities. Or, it could consider buying foreign bonds, which would weaken the dollar. We do note the dollar fell on the move to ZIRP and a weaker dollar should support net exports. For the time being, monetary policy is mostly exhausted.

What about fiscal policy? This is the next line of defense. We are starting to see a consensus among both conservative and liberal-leaning economists on the wisdom of direct payments to households. Sending money directly was done in Hong Kong recently and tax rebates in the U.S. were implemented by the Carter administration. The worry is that political divisions will prevent actions from being taken. We suspect that direct action will likely occur but only after conditions deteriorate further.