Daily Comment (March 25, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

For the first time in ages, it actually feels right to say, “Happy Wednesday,” given the historic surge in U.S. stocks yesterday (the Dow’s rise of more than 11% was its best daily gain since 1933). Just as important, Republicans and Democrats in the Senate early this morning reached a deal on a $2 trillion economic support package aimed at mollifying the effects of the COVID-19 pandemic (see below). As always, we review all major news related to the pandemic below.

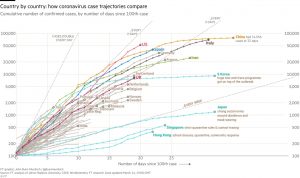

COVID-19: Official data show confirmed cases have risen to 436,159 worldwide, with 19,648 deaths and 111,847 recoveries. In the United States, confirmed cases rose to 55,238, with 802 deaths and 354 recoveries (though the recovery data is lagging badly). Here is the latest chart of infections from the Financial Times:

The rate of infections continues to grow exponentially as does the economic disruption from containment measures. Spain has now become a key center of infections, with hundreds dying daily. In the U.K., Prince Charles has tested positive for the virus; officials refused to say whether Queen Elizabeth has been tested since she last visited with the prince on March 12. There are increasing signs that Russia is systematically underreporting its cases. Fortunately, however, there are welcome signs of fiscal and monetary support being put into place.

- Real Economy. As we’ve noted, a key risk is that infections spreading widely throughout the general population will lead to legions of sick elderly and other compromised individuals, overwhelming the nation’s hospitals and ICU wards. That sets up a potential conflict between President Trump, who wants to end most lockdowns in the next couple of weeks, and state and local public health officials who want to control demands on their health systems at all costs.

-

- Trump administration officials on Tuesday urged anyone leaving the New York metro area to self-isolate for 14 days to avoid spreading the virus to other parts of the country.

- The U.S. Navy said several sailors on the U.S.S. Theodore Roosevelt tested positive for COVID-19 after the aircraft carrier’s recent port visit in Vietnam. Those sailors have been airlifted from the ship, while others are quarantined on board. The incident highlights the risk that widespread infections could potentially compromise military readiness.

- The global airline industry group IATA said total industry revenues this year will fall by $250 billion, or 40%, because of the pandemic.

- In India, the government has ordered a lockdown of the entire country for the next 21 days, but the move may be backfiring as migrant workers who are potentially infected rush to return to their rural villages.

- More positive news continues to come out of China, where a poll of 119 firms conducted in mid-March by the American Chamber of Commerce in China showed 22% of respondents said they have already resumed normal business operations. Another 13% expect a return to normal business by the end of this month, and 23% more by the end of April. However, canceled orders from the Western retailers threaten to derail the ramp up in operations.

- Financial System. With millions of Americans losing their jobs and suddenly finding it difficult to pay their mortgages, mortgage REITs continue to buckle under the strain. At least four significant mortgage REITs have now said they can’t make margin calls as the value of their assets declines. Since the Fed has only moved to buy obligations guaranteed by Fannie Mae and Freddie Mac, firms specializing in buying non-agency backed paper have been especially hurt.

- U.S. Fiscal Policy Response. Key provisions of the Senate’s draft economic support package, which Majority Leader McConnell aims to pass later on Wednesday, remain under wraps at this writing but reportedly include:

-

- A $500 billion fund to provide low-interest loans to large businesses and state and local governments, some of which will backstop Fed loans; the fund will be overseen by an inspector general and five-member congressional panel

- Some $50 billion will be channeled specifically to the passenger airline industry

- Airlines are banned from buying back stock or paying CEO bonuses while receiving funds and for one year after

- Some $367 billion in low-interest loans to small businesses

- Some $150 billion in additional resources for healthcare providers

- Increased unemployment benefits of $600 per week for workers who lose their job, along with four extra months of benefits beyond the normal 26 weeks; jobless benefits would be extended to nontraditional employees like gig workers and freelancers

- Checks in the amounts of $1,200 per adult and $500 per child paid directly to many U.S. citizens, with reduced amounts for those with higher incomes

- Bans on any funds being used to support businesses owned by President Trump, Vice President Pence, members of Congress or other high government officials

- A $500 billion fund to provide low-interest loans to large businesses and state and local governments, some of which will backstop Fed loans; the fund will be overseen by an inspector general and five-member congressional panel

- Foreign Fiscal Policy Response. After a meeting of Eurozone finance ministers yesterday, Eurogroup President Centeno said there was broad support for using the bloc’s €500 billion sovereign bailout fund to combat the economic effects of the pandemic.

- Monetary Policy Response. Moving fast to implement its new support programs for commercial loans, the Fed directed top money manager BlackRock (BLK, 371.70) to buy agency commercial mortgage-backed securities secured by multi-family home mortgages on behalf of the New York Federal Reserve. The Fed also tapped BlackRock to manage the new Fed-backed facilities buying new and seasoned investment-grade bonds from U.S. companies. Separately, the People’s Bank of China is consulting with Chinese banks on a possible cut in deposit rates, with the aim of boosting institutions’ profitability again after previously ordering them to cut lending rates and ease credit standards.

Odds and ends: Some Russian oil firms are reportedly pushing back against President Putin‘s effort to boost production in his market share war with Saudi Arabia.