Weekly Energy Update (March 26, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

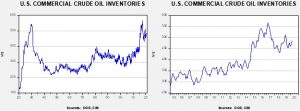

Crude oil inventories rose 1.6 mb compared to the forecast rise of 3.0 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 13.0 mbpd. Exports fell 0.5 mbpd, while imports declined 0.4 mbpd. The inventory build was less than forecast due to a modest rise in refinery operations.

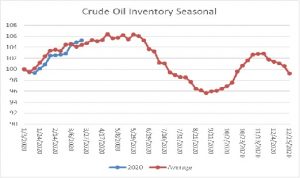

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s report maintained the recent pattern of putting accumulations modestly above seasonal norms. Inventories will be expected to rise steady into late May. We will be watching this chart closely in the coming weeks for signs that inventories are rising abnormally due to the market share war described below.

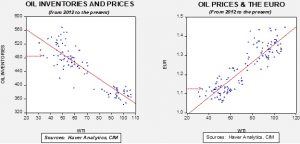

Based on our oil inventory/price model, fair value is $55.20; using the euro/price model, fair value is $50.09. The combined model, a broader analysis of the oil price, generates a fair value of $50.96. As we noted last week, the model output is less relevant unless Russia and the Kingdom of Saudi Arabia (KSA) come to an agreement on supply.

In the coming weeks, there are two key factors we will be monitoring. The first is the recession’s impact on product demand. So far, there is little evidence that demand is being affected. We do expect that we will start to see consumption decline markedly in the near future. Second, U.S. commercial crude oil storage is around 550 mb. If commercial inventories rise to that level, price declines could become catastrophic because there will be nowhere for that oil to go. We approached that level in 2017 but OPEC took action to prevent further declines in prices. The government’s decision to add to the Strategic Petroleum Reserve will help in this area but we still worry that the lack of storage capacity could have a profoundly bearish effect on oil prices.

On the international front, the U.S. is pressing the KSA to end its price war. We doubt Riyadh will change course, but we will monitor this development.