Daily Comment (March 30, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning and happy Monday! Before we begin, we want to note a correction from our Friday comment; we erroneously reported the NHL had cancelled its season.[1] That wasn’t true, and we apologize for any confusion. Global equities are lower and oil prices are testing $20 per barrel. However, U.S. equity futures are ticking higher. We update all the COVID-19 news, including some charts on what is happening in the economy. Here are the details:

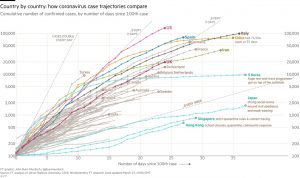

COVID-19: The official number of global cases is 735,560 with 34,830 fatalities and 156,380 recoveries. There is growing skepticism over China’s numbers; this is especially pertinent given media reports that the U.S. now has more cases than China. Here is the usual FT chart:

There is a recognizable “bend” developing in the U.S. infection rate. That is potentially good news.

The virus news:

- President Trump has extended social distancing guidelines until the end of April. There had been rumblings of ending social distancing by mid-April, but the continued surge of cases has led the government to continue the current policy.

- There is growing speculation that China may have drastically undercounted fatalities from COVID-19. There are reports that the level of cremations is far exceeding the reported 2,500 deaths from the virus in Wuhan. Although it may be possible that people died of something else, it is also possible that officials only reported those who were tested and died and did not perform autopsies on the others.

- Meanwhile, the world is watching China’s slow return to work to see how an economy recovers from lockdown.

- It appears that hospital workers in the Netherlands may have been asymptomatic carriers of the virus. If so, they may have been inadvertent vectors of the disease.

- Although China has tried to gain goodwill by sending medical devices to nations affected by COVID-19, it turns out much of what was sent was defective, blunting the soft-power effort. It seems that the crisis policy of retooling other factories for medical device production had flaws.

- One of the world’s largest producers of ventilators, Drägerwerk (DRWKR, $104.50), is warning of a global supply shortage even though it is rapidly increasing production. The FDA has approved the emergency use of hydroxychloroquine and chloroquine for treating COVID-19. Virus transmission in Seattle appears to be slowing, giving hope that social distancing is working; however, without aggressive testing and serological following for immunity, we still don’t really know for sure.

The policy news:

- Congress and the White House are already preparing for “Phase 4” of the stimulus program. The general consensus is that the preceding measures will merely offer support to those affected by COVID-19 and act as a stopgap. Restarting growth will be another matter.

- Congress is “rearming” the Fed, boosting its ability to begin lending directly to businesses and local governments. These new powers are significant; one of the problems that hampered the response in 2008 was that the Fed pushed liquidity into the banking system, where it sat idle. That led to calls among left-wing politicians for direct central bank support; in Britain, Jeremy Corbyn called for “QE for people.” These new powers are a step in that direction—the Fed would be simply bypassing the financial system and putting money directly into the economy, à la MMT. This development comes in the face of a severe testing of the U.S. social safety net.

- The U.S. plans to suspend tariff collection for three months.

- The next battle brewing could be in insurance. The industry is claiming that policies it has written specifically exclude pandemics; governments beg to differ.

- Across the pond, there are a couple items of note. First, Italy’s widespread “off the books” labor market means that millions of workers will be excluded from government support measures. And, there is a deep battle brewing in the Eurozone; a growing roster of nations, mostly in the south, are pressing for a Eurobond, a bond backed by the full faith and credit of the entire (read: Germany) Eurozone. Needless to say, Germany and the Netherlands are opposed to such measures. As we are reporting over the next two weeks in the WGR, the fracturing of the EU is becoming a geopolitical concern.

The economic news:

- Although the employment news is bad, we are seeing aggressive hiring in logistics, medical and large retail. This is a massive shift in the labor market.

The market news:

- Banks and other lenders are tightening lending standards as borrowing demand rises. Historically, lenders are pro-cyclical; they tend to increase lending in good times and withdraw it in bad times. Unfortunately, this sort of behavior makes the recession worse. Hence the entry of the Fed into direct lending.

- There are three charts we want to note this morning. First, there has been a flight-to-government money market funds (IMMK) and away from prime funds. During the 2008 Financial Crisis there was similar activity. The second chart updates the retail MMK and S&P 500, while the third chart shows how foreign central banks are drawing the Fed’s swap lines.

In 2016, SEC regulations changed and allowed the NAV on MMK to deviate from $1.00 per share. This change prompted a flight into government funds. However, we did see a modest recovery in prime MMK until recently. As financial stress has increased, so has the exodus from prime MMK.

Second, readers will be familiar with our retail MMK/S&P 500 chart, which is updated below.

When the trade war expanded in early 2018, retail investors began building cash positions. This positioning accelerated despite the rally in stocks from Q2 2018 into February of this year. But, as stocks have declined, MMK has risen sharply.

Third, the Fed’s forex swap lines are being drawn aggressively.

These swap lines are used by foreign central banks to provide dollars to their borrowers who have dollar-denominated debt. As financial stress has increased, we have seen the dollar rally. In 2008, the dollar weakened only after the draw on foreign currency swaps declined.

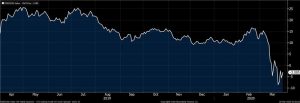

- Oil prices continue to spiral lower. A couple news items of note. First, the recently passed stimulus bill failed to include funding to purchase oil for the SPR. Second, gasoline crack spreads, which is a rough measure of refining margins, have dipped under zero recently. The chart below shows that a barrel of gasoline is trading below the cost of a barrel of oil. If this continues much longer, we will likely see refining activity decline which will put additional pressure on prices.

- Compounding problems for oil is that the calendar spread, the spread between spot and deferred futures, remains wide. This allows firms to buy oil in the spot and sell it in the future, pocketing the gain. This activity will continue until storage reaches capacity; it is at that point that oil prices will collapse. We are seeing shipping rates for oil tankers rise as firms are starting to use tankers for storage.

- The last time the U.S. shale industry was threatened, in 2016, once prices recovered production returned even stronger. That outcome is less certain this time around—the price decline will be deeper and longer and financing may be slower to return. We expect the price weakness to last longer because Russia is better positioned than the usual OPEC nation to take on the KSA. There are breaking reports that President Trump will be calling President Putin to talk about oil today; we will see how that goes but would not expect much help from Moscow.

- One area we are watching with increasing interest is real estate. We know that as households and businesses lose income their ability to service mortgages or maintain rent is coming into question. One factor we are investigating are rules that limit the liability of a commercial lessee for breaking a lease. Section 502(b)(6) is the part of the commercial code that deals with unpaid leases in bankruptcy. The bottom line is that the landlords of commercial firms may find their remedies in bankruptcy are rather constrained and this may explain part of the recent weakness we are seeing in REITs.

- There are rising concerns about widespread EM defaults; the rise in the dollar is probably a symptom of this worry. At the beginning of the year, four EM nations’ dollar debt was at distressed levels; that number is up to 18. Another complication is that China has become a larger lender into the EM space. It isn’t clear how China will deal with bad loans, but we would expect behavior more akin to the 18th

- LIBOR’s replacement, SOFR, is failing miserably as a new rate tool in the crisis. We wonder if one of the outcomes of COVID-19 will be the resurrection of LIBOR.

- Just when we need them most, there is an apparent shortage of jigsaw puzzles.

Foreign policy news:

- Russia and China are using the crisis to sow dissention through social media by releasing disinformation and spreading unfounded conspiracy theories. And, as has been the pattern, the social media firms are failing to police these actions.

- U.S. sanctions have exacerbated the impact of COVID-19 on Iran. The U.S. is pulling troops out of the K1 base in northern Iraq, the third pullout this month.

[1] One of the dangers of working from home is overhearing members of the household making unsubstantiated claims. Going forward, we will rely on Ronald Reagan’s dictum of “trust but verify.”