Daily Comment (March 31, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

As March draws to a close today, we’re reminded of the old adage about the month: in like a lion, out like a lamb. After what we’ve all gone through during the last month, we certainly hope for a day that’s as quiet and gentle as a lamb! As always, we review all the key news on the coronavirus epidemic and related, market-relevant items.

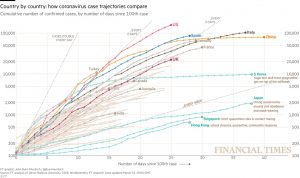

COVID-19: Official data show confirmed cases have risen to 801,400 worldwide, with 38,743 deaths and 172,657 recoveries. In the United States, confirmed cases rose to 164,610, with 3,170 deaths and 5,945 recoveries (though the recovery data is lagging). Here is the latest chart of infections from the Financial Times:

- Virology. Two research groups affiliated with the Chinese insurance giant Ping An (2318.HK, 76.70) yesterday projected that new infections will peak no later than this weekend in key countries including the United States. The projections seem rosy to us, especially since they show U.S. infections topping out at just 300,000. Besides, a respected model from the University of Washington still projects the U.S. peak hospital usage will come later, on April 15. All the same, we think the Ping An researchers’ model sensibly incorporates factors such as how late the countries started to enforce social distancing, their population density, the share of their population aged 60+, the number of intensive-care hospital beds they have available, and the level of public support for their officials’ lockdown orders. Those markers are probably worth watching to gauge the future course of the pandemic.

-

- As serious COVID-19 cases start to overwhelm the medical resources available in New York City, one of the nation’s top academic medical centers there told emergency room doctors that they have “sole discretion” to decide whether to place patients on ventilators or to “withhold futile intubations.” In other words, rationing.

- China for the first time admitted that its official tally of cases excluded people who were infected but not showing symptoms. Officials said they will begin counting asymptomatic cases on Wednesday.

- U.S. spy agencies have been tapped to try to figure out the true incidence and impact of the virus on China, Russia, North Korea, and Iran.

- In a reminder that human folly, carelessness, or malintent could all be at play here, reports say U.S. customs officials in recent years have often intercepted Chinese scientists trying to transport undocumented and undeclared biological substances – including SARS and MERS samples – into the U.S.

- While the crisis is opening up new opportunities for healthcare firms (especially in telemedicine), there are also new threats. The heads of the WHO and Unitaid, a UN-backed group funding global health innovation, are supporting a proposal that would force companies to pool their intellectual property related to coronavirus treatment, vaccines, and diagnostics and make them available at low cost to world governments.

- Real Economy. As consumers continue to stock up on grocery staples, and as production and logistics systems continue to snarl, global grain prices have jumped 15% or more in recent weeks, in contrast with the steep price declines for many commodities facing reduced demand because of the pandemic. However, grain stockpiles are actually relatively high, suggesting prices could quickly drop again as the crisis passes.

-

- The All-England Lawn Tennis & Croquet Club meets on Wednesday to determine whether to hold this year’s Wimbledon Tennis Tournament. Observers expect the June 29 tournament to be canceled for the first time since World War II.

- As China continues to restart its economy, its official purchasing managers’ index for manufacturing rebounded to 52.0 in March from its record low of 35.7 in February. That was a welcome surprise as the index had been expected to remain significantly below the 50 level that indicates expanding activity. However, even the statistical agency warned not to interpret the rebound as a sign that China has had a “V-shaped” recovery and is now back to full health.

- As if to underline that recovery from the pandemic will be a stop-and-go affair, some recent moves by Chinese local governments to reopen movie theatres, tourist attractions, and other venues have been reversed on fears of a rebound in infections.

- Financial System. New reporting suggests U.S. and European banks are struggling with about 100 “warehouse” credit lines to collateralized loan obligation marketers. The credit lines provide temporary funding to CLO managers as they build portfolios of lower-quality loans that are later marketed to investors. Those assets have now plummeted in value, leaving the banks with an undisclosed amount of potentially problematic loans.

- U.S. Fiscal Policy Response. The Treasury Department said the government will begin sending out stimulus payments to households in the next three weeks, with no action required for most people. For people who don’t regularly file tax returns, the government will create a web portal for people to upload their direct-deposit information to the IRS. Separately, Secretary of Labor Eugene Scalia said the federal government will release the recently approved funds to boost jobless benefits this week, but how quickly those payments reach laid-off workers depends on overburdened state unemployment systems.

- Foreign Fiscal Policy Response. Just three weeks after the U.K. released a budget calling for £156 billion in bond sales in fiscal 2020-2021, the government issued a revised plan calling for a total of £46 billion in April alone. Separately:

-

- Klaus Regling, the managing director of the EU’s European Stability Mechanism, poured cold water on the idea of issuing EU-wide “coronabonds” to finance the bloc’s response to the pandemic. According to Regling, it would take between one and three years to set up a new European institution to issue such debt. However, in an apparent olive branch to hard-hit Italy and Spain, he did suggest aid in the short term could be funded via existing bodies and instruments.

- Similarly, Eurogroup President Centeno said in a letter to EU finance ministers that coronavirus aid could be raised using existing institutions and mechanisms, though “alternatives” could be considered. He also called a meeting of all 27 EU finance ministers to discuss aid next Tuesday.

- As a reminder, our latest Weekly Geopolitical Report, published yesterday, examines how the disputes over coronavirus funding have the potential to cause a breakup of the EU.

- Political Implications. Russia has sent military medical units to Italy in order to help it deal with the crisis, echoing China’s effort to burnish its image by sending aid abroad. Separately, Hungary’s parliament gave Prime Minister Viktor Orbán the right to rule by decree until his government decides the coronavirus crisis has ended.

Global Oil Market: Two major shale producers in the Permian Basin have asked Texas regulators to consider curtailing crude output in the state as the industry grapples with collapsing demand and plunging prices. Meanwhile, poorer oil producers such as Iraq and Venezuela are being forced to consider steep budget cuts as low oil prices cut deeply into their revenues.