Daily Comment (April 1, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Happy April Fool’s Day! But please don’t expect any foolishness here! As always, we soberly review the latest U.S. projections on the course of the COVID-19 pandemic, which have rattled the markets so far this morning. We also note the Fed has come out of the closet as the world’s central bank (see detailed discussion below), while Europe continues to struggle with a way to support its economy.

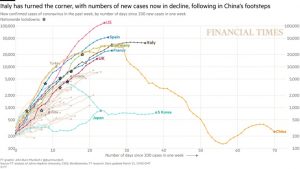

COVID-19: Official data show confirmed cases have risen to 874,081 worldwide, with 43,537 deaths and 185,194 recoveries. In the United States, confirmed cases rose to 189,633, with 4,081 deaths and 7,136 recoveries (though the recovery data is lagging). Here is the main chart of infections now being published by the Financial Times:

- Virology. In its daily news conference yesterday, the Trump administration laid out the projections that prompted the president to back down from his goal to end the nation’s lockdowns as early as April 12. If strict social distancing is maintained, the projections call for a total U.S. death toll of 100,000 to 240,000, versus as many as 2.2 million if social distancing is abandoned. The projected number of serious cases is many times greater, so the key issue will be how badly local health systems are overwhelmed. The statements appear to be a major factor in pushing U.S. equities sharply lower so far today.

-

- Highlighting the political danger from mismanaging the pressure on a health system, British Prime Minister Johnson is being criticized for insufficiently testing NHS doctors and other workers in self-quarantine. The few tests done to date indicate only some are actually infected, suggesting they’ve been pulled from the front lines for no good reason.

- Several European countries have adopted the Asian strategy of urging everyone to wear masks in public, based on growing evidence that people experiencing no symptoms can spread the disease more widely than previously thought. In the U.S., CDC Director Dr. Robert Redfield said his agency is reviewing its recommendation that healthy people who aren’t hospital workers should refrain from using masks.

- About 70 crew members on the U.S.S. Theodore Roosevelt have now tested positive for COVID-19, prompting the aircraft carrier’s commander to order the remaining 5,000 or so sailors into quarantine in vacant hotels on Guam.

- Now that China has gotten egg on its face from the faulty masks and test kits some Chinese firms have sold abroad, the government has banned firms from exporting medical supplies if they’re not licensed to sell them domestically.

- Real Economy. IHS Markit said its final March PMI for the Eurozone manufacturing sector came in at a seasonally adjusted 44.5, modestly lower than the flash estimate of 44.8 and the final February reading of 49.2 (see data tables below). In the U.K., the IHS Markit/CIPS manufacturing PMI fell to a three-month low of 47.8 in March versus 51.7 in February. As with all major PMIs, readings under 50 point to falling activity.

- Financial System. In a welcome sign that the junk bond market may be stabilizing after seizing up in early March, junk bond prices have improved a bit this week. At least two major firms have also been able to float riskier debt. Below-investment grade obligations are still trading at elevated spreads over U.S. Treasuries, but the improved market dynamics suggest that aggressive fiscal and monetary policy may have turned the tide. All the same:

-

- Reports note a massive shriveling in the market for unconventional mortgages, which aren’t backed by the government and therefore aren’t being bought by the Fed. Multiple firms have stopped offering the mortgages, denying financing for many irregular or self-employed people who find it difficult to qualify for a conventional mortgage.

- Under pressure from the Bank of England, most of the U.K.’s major banks have agreed to suspend their dividends and stock buybacks in order to preserve capital during the crisis. The regulators also expect them to refrain from paying bonuses. As might be expected, the news has driven British bank shares sharply lower so far today.

- U.S. Fiscal Policy Response. President Trump has called for $2 trillion in new spending on infrastructure to help rekindle economic growth after the coronavirus crisis passes. The new spending, which would follow the three major economic support bills already passed into law, would be paid for by borrowing at today’s super low interest rates. House Speaker Pelosi has also been calling for a “Phase 4” economic bill that includes infrastructure investment, but Senate Majority Leader McConnell hasn’t been supportive. Separately:

-

- Major private-equity funds are lobbying hard for their portfolio companies to be deemed eligible for the $350 billion in small-business rescue loans included in last month’s economic support package.

- Flight attendant unions are urging Treasury Secretary Mnuchin not to make airline rescue grants contingent on transferring an equity stake to the government, as allowed in the Phase 3 package. The flight attendants fear the stake provision amounts to a “poison pill” that would discourage airline executives from accepting the money and result in mass layoffs.

- U.S. Monetary Policy Response. Launching yet another new rescue program, the Fed said it will temporarily allow approximately 170 foreign central banks and international monetary authorities to borrow dollars by pledging the U.S. Treasuries they hold at the New York FRB. The new “FIMA Repo Facility” will supplement the currency swap facilities already in place with more than a dozen major central banks. Amid the global scramble for dollars touched off by the coronavirus crisis, the Fed said a key aim of the facility is to give foreign central banks access to the dollars they need without forcing them into disruptive sales of their Treasury holdings. The facility will likely be considered especially helpful for smaller emerging markets, though China was probably the key country under consideration. In a broader sense, the facility may be one of the most radical, risky, and controversial of the Fed’s many moves to counter the crisis as it amounts to a full, unabashed embrace of being the world’s central bank or the global lender of last resort. That role is clearly at odds with the broader U.S. trend toward deglobalization, and it is out of sync with the administration’s policy of withdrawing from the traditional U.S. role as global hegemon.

- Foreign Fiscal Policy Response. The EU continues to struggle to come up with fiscal programs that can cushion the blow from the crisis without generating pushback from the northern creditor members.

-

- European Commission President Ursula von der Leyen formally proposed the creation of a new EU unemployment reinsurance program to help national governments finance short-time wage subsidies, which are designed to discourage firms from laying off workers when orders dry up.

- To help Europe recover from the coronavirus, French Finance Minister Le Maire proposed an EU-wide facility funded by common EU debt, but the program would be limited to five or 10 years and focused strictly on economic recovery to head off German and Dutch objections to mutualizing obligations.