Daily Comment (April 6, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Happy Monday! Global equities are rising on hopes that the pandemic is stabilizing. We update the COVID-19 news. Here are the details:

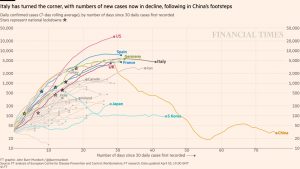

COVID-19: The official number of global cases is 1,280,046, with 69,789 fatalities and 265,462 recoveries. Here is the updated FT chart:

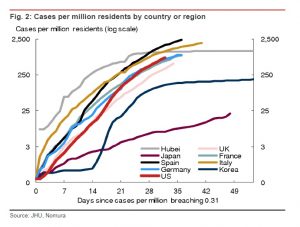

We have received requests for a chart weighted by population. We found this one yesterday.

Note that Japan’s numbers are rising at a slow pace but showing no signs of “bending.” We suspect the recent action to declare a limited state of emergency (see below) is due to worries that an exponential rise may be in the offing.

The virus news:

- PM Johnson, the first G-7 leader with a confirmed case of COVID-19, has been hospitalized. Foreign Secretary Raab is the designated successor if Johnson becomes incapacitated. The PM’s office is suggesting his hospitalization is just for observation but there are reports that his condition has worsened.

- U.S. officials are warning that this will be a difficult week.

- Some European nations are preparing to ease movement restrictions. Italy is considering serological testing to determine who can return to normal life and who must remain in lockdown. Essentially, the presence of antibodies will determine if one has been infected and is now immune.

- Ventilators have been a point of discussion with COVID-19; this report suggests that being put on the device is a grave situation that the majority don’t survive.

- Japan has declared a state of emergency for seven prefectures. The area includes Tokyo. There has been a surge of new cases in Japan.

- A tiger at the Bronx Zoo has tested positive for COVID-19, an apparent case of humans infecting other mammals.

- There have been a series of cell tower fires in the U.K. after rumors that 5G causes COVID-19 spread.

- On a lighter note, a Finnish tradition appears to be catching on in the rest of the world.

The policy news:

- Our position has been that the COVID-19 recession would be historically deep in terms of magnitude but short in duration. That belief was based on the expectation that policymakers would move quickly to support the economy and virus suppression efforts would relax by autumn. Like all our forecasts, they are always subject to re-evaluation. We have three immediate concerns:

- Although Congress moved with uncommon speed to pass a $2.0 trillion support package, passing is one thing…execution is another. On Friday, small businesses were able to apply for loans for the first time. Reports suggest the program has not gone well. First, the Treasury didn’t get rules to banks until late Thursday. Second, banks put their own restrictions on the loans. Borrowers went to banks to apply only to be turned away or faced with a myriad of rules. Compare this mess with how Switzerland executed its program. This stimulus will do little good if the process fails to deliver funding soon to small businesses. We also note that large restaurant and hotel chains can tap this program, which probably means it will run out of capacity quickly.

- While $2.0 trillion is a massive program, it probably isn’t enough. Here’s a way of thinking about it—nominal U.S. GDP is near $22.0 trillion. That means the U.S. economy generates around $418 billion per week. The stimulus will fund the U.S. economy for about five weeks. Obviously, we haven’t lost the entire economy; some level of business is still being conducted. At the same time, 80% of U.S. counties, representing 96% of GDP, are on lockdown. If the economy remains stalled beyond five or six weeks, additional help will probably be necessary. Congress needs to be working on this now, just in case.

- That being said, we do give credit to the Fed for moving rapidly and, so far, effectively. We still think that at some point the central bank will need to dip into the junk bond market and support at least down to “B,” simply because too many large companies have fallen into the category. Estimates now suggest the Fed’s balance sheet could end up at $9.0 trillion, well above its current $5.8 trillion, before things settle.

- Meanwhile, Germany continues to push back against a Eurobond, instead calling for more emergency lending. If this continues, the Eurozone will be in grave danger.

- The UN is warning that it is facing a budget crunch due to spending on COVID-19.

The economic news:

- One observation from Friday’s March employment report is that there was significant divergence between the payroll survey and the household survey with reference to employment. As most of you are aware, the employment report consists of two different surveys, one gathered from employers and the other from households. The employer survey is where the non-farm payrolls number is generated. The household report is where the unemployment rate comes from. The two numbers often diverge; the payroll report will capture those working at traditional businesses, while the household report is better at capturing sole proprietors and gig workers. In March, payrolls fell 976k; employment from the household survey plunged 2.9 million. The household survey is sobering, suggesting conditions are much worse than they look.

- Emerging market economies are reeling from COVID-19. Default risks are rising, reflected in recent dollar strength.

- Supply chains are payment chains in reverse. Goods and services flow one direction, money the other. Supply chains work due to financing. There are growing worries, again seen in recent dollar strength, that these supply chains are being threatened by funding issues.

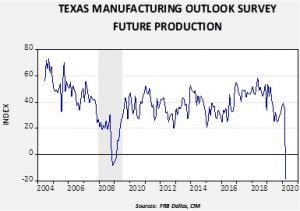

- Texas is being especially hard hit from COVID-19.

- Shipping firms are facing an employee problem. Some sailors are stuck in port due to lockdowns. This is leaving ship crews working extreme hours. Simply put, those on ships are being stretched to the limit, while others can’t get to their vessels.

- Hoarding isn’t just for households. Countries are restricting food exports.

The market news:

- Oil prices plunged overnight on news that a spat between Russia and the Kingdom of Saudi Arabia (KSA) has delayed today’s scheduled meeting on output reduction. The meeting will be held on Thursday. We have seen prices rally off the lows as the market is betting that a deal will be made at some point. However, the fact that a “you started it; no, you started it” fight between adult leaders of Russia and the KSA has led to a delay is a clear indication that managing these egos will be a challenge.

- Meanwhile, President Trump has backed away from his threat to implement tariffs on oil. Although such ideas have been circulating for some time, it is important to note that a tariff might not be all that effective in propping up prices. Assume the U.S. puts a $10 per barrel tariff on imported oil. Foreign prices will likely fall in response, but perhaps even more importantly the dollar will soar. The dollar strength will have unintended consequences for the global financial system. If the government wants to support oil producers (after all, why should any government outside of OPEC want higher oil prices), a better tactic would be to do what we do for farmers. Simply set a price for oil and pay oil companies the difference between the world price and the desired price. Although this would require a massive “spend” of political capital, we could see it as part of a stimulus bill.

- So, will we get a deal or not? We suspect that a deal will be struck and will likely collapse in short order. Both Russia and the KSA want a wide agreement with other producers to prevent the loss of market share. However, any reading of cartel behavior shows that the larger the cartel, the less likely it is that it will avoid free riders.

- One interesting piece of evidence on how much oil demand has declined: air quality around the world is showing remarkable improvement.

- One fallout from the virus is that Chinese household borrowing is slowing rapidly, and bad debt is rising.