Daily Comment (April 9, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

It’s Holy Thursday in the time of COVID-19. With financial markets closed tomorrow for Good Friday, our next report will be published on Monday, April 13. From all of us at Confluence Investment Management, we wish you a Happy Easter and Passover. Equity markets are taking a breather today after the recent rally (although the breaking announcement by the Fed to boost lending has reversed the downtrend—see below), while oil is up on hopes of an output reduction agreement. Our Weekly Energy Update is available. Claims remain historically elevated. We update the COVID-19 news. Here are the details:

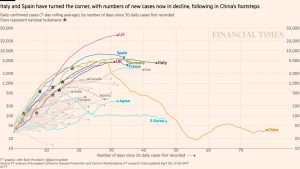

COVID-19: The official number of global cases is 1,496,055 with 89,435 fatalities and 336,780 recoveries. Here is the FT chart:

Clearly, Spain and Italy are bending the curve. The U.S. is accelerating at a slower pace.

The virus news:

- One of the persistent questions we are getting is, “when is this done?” A recent NYT report offers four benchmarks that need to be met for the current measures to be reduced:

- Hospitals need to be able to safely treat all patients without resorting to crisis standards of care. This wouldn’t mean COVID-19 cases would not continue but that treating them would become routine.

- The government at all levels must be able to treat everyone with symptoms.

- The government at all levels must have the ability to monitor confirmed cases and perform contact tracing. This may require some relaxation of privacy rules.

- A state or region must have a sustained reduction in cases for 14 days.

- In addition to these four conditions, we will need to see serological testing to see who has immunity.

- And, it isn’t really under control until there is a vaccine.

Once the four benchmarks are reached, we should see gradual relaxation of social distancing measures. Still, until herd immunity develops, we will likely see some continued modified social distancing measures, e.g., fewer restaurant tables, masks for those over 60 or with compromised immune systems, temperature testing at airports, etc.

- Although there is increasing optimism that the U.S. is “bending the curve” for new infections, this news needs to be tempered with the fact that the virus is starting to affect rural America. Sadly, the medical system outside of urban areas is less robust and thus the spread into less populated areas could bring an uptick in fatalities. Meanwhile, in the cities, medical systems are reaching the point of triage, meaning that scarce medical resources are starting to be rationed.

- There are reports that the Defense Intelligence Agency warned the U.S. government about a unique coronavirus developing in China as early as November. There does appear to be some open source confirmation that this report is true.

- We continue to see what we know about COVID-19 evolve. For instance, in China, it looked like it was a scourge for the elderly, but not a big deal for younger people. In the West, it has been surprisingly lethal to younger citizens. One thought? China may have underreported young fatalities. Genome analysis is suggesting that most of the virus cases in New York came from Europe. Thus, the China travel ban probably helped the West Coast but may not have done much for the East Coast. The research also suggests it was circulating in New York as early as mid-February. German researchers are finding that a large pool of cases are going undetected. This is both good and bad news. The good news is that a large number of cases could mean that herd immunity may be closer than we think. The bad news is that there are asymptomatic carriers among us, meaning that easing social distancing measures may be fraught with risk. AEI has a study trying to frame the actual infection rates in China; think 2.9 million. Additional studies suggest the virus may spread 2x faster than earlier thought. Finally, all this information suggests that (a) we don’t know all that much about COVID-19, and (b) it remains a mystery as to why there is such a wide variation in symptoms. For many, COVID-19 is a mild cold; for others, it’s deadly. It is hard to imagine a more effective virus.

- PM Johnson is reportedly “feeling much better.”

- As the curve bends in Europe, some countries are taking tentative steps to reopen their economies. These nations could offer guidance to U.S. officials as Washington prepares to ease social distancing measures in the coming weeks. Reopening is tricky; open too fast and risk a return of infections. But, open too slow and the economy suffers further.

- The U.S. National Stockpile of personal protective equipment (PPE) is nearly exhausted. The states are considering a consortium to buy medical equipment. This development bears watching; if states band together for this issue it is not inconceivable that this could be done for other things…think health insurance. As the Federal government steps back in certain areas, the potential for the vacuum to be filled by multiple states raises concerns about the regionalization of governance.

- Germany is sourcing PPE from China directly. The U.S. is restricting the export of PPE.

The policy news:

- BREAKING: The Fed announced it will purchase $2.3 trillion in new debt purchases which includes the government’s small business loans, municipals, mortgages, and, maybe, non-investment grade (yes, junk) bonds. Details are still sketchy, but the initial look is that this is yet another dramatic expansion of funding. Apparently, the Fed is not planning on buying junk directly but the ETFs; this is a bit of a distinction without a difference. We will be watching this going forward BUT THIS IS A BIG DEAL. The Fed is getting deeper into the “weeds” of credit, increasing the odds that the bank will eventually take credit losses. We have been watching the Fed’s balance sheet expansion with great interest; it is looking increasingly like it is trying to resolve the large private debt overhang (defined as household and non-financial corporate debt) by taking it on the public balance sheet. The last time we witnessed this sort of public/private debt swap was WWII. The alternative to dealing with this overhang is debt/deflation, which has become politically impossible. The last 12 years of very low rates allowed the overhang to persist without triggering a downturn but also led to weak growth. This debt swap may be the only way out, but there will be strings attached.

- The Fed minutes held no real surprises, but did clearly show a high level of concern.

- Europe continues to struggle to develop a response to the economic problems caused by the virus. It appears that the European Stability Mechanism (ESM), a body created during the 2010-11 Eurocrisis, will be the lending arm; Eurobonds look like a dead letter. Apparently, northern European nations are open to lending out of the ESM but want “memorandums of understanding” that would put restrictions on borrowers. This demand is toxic for southern Europe, a holdover of what Greece was required to accept during the Eurocrisis. Thus, not much has been accomplished.

- Congressional bickering over additional fiscal support is making headlines; the GOP wants a quick add to small business lending, while the Democrats want to add more money and other funding. Although much ink (or electrons) is spilt over this wrangling, this is rather normal. We expect something to be passed in the next week or so.

- The firehose of policy stimulus has a couple of caveats. First, using the banking system as a conduit has proven to be rather clunky. Second, there is a surprising lack of oversight on both fiscal and monetary policy. The lack of oversight at this stage opens up the potential for retroactive supervision years from now; you could see borrowers being questioned before Congress at some point.

- A warning: the CFTC is reporting a surge in new scams involving complex derivatives. The common feature is high fees.

The economic news:

- There are increasing reports that tenants are not paying their rent due to rising joblessness. As these payment flows stop, it is reasonable to expect that some sort of backstop will be necessary. Meanwhile, similar concerns are developing for the mortgage market as well. The leadership of the FHFA is indicating that aid to mortgage servicers isn’t likely, which probably means the Fed will need to eventually backstop that industry, too.

- State and local governments are increasingly vulnerable to rising demand for social services and falling revenue. It’s looking increasingly likely that the Fed will need to expand its support for this level of government borrowing. Unlike the Federal government, state and local governments lack monetary sovereignty and thus can’t issue debt without tax revenue.

- All eyes remain on China as it emerges from lockdown. What is being seen is that restarting an economy on lockdown is difficult. We are also seeing scattered reports of bank runs in China.

- Retailers are being severely hurt by the shutdown; it appears a wave of bankruptcies is coming.

The market news:

- We have been noting that globalization is retreating during the COVID-19 crisis. Food hoarding by countries is starting to become a problem. If this accelerates, it could create instability in nations that are net food importers.

- Sanders (I-VT) has suspended his campaign.

The foreign policy news:

- China is coming nowhere close to its Phase 1 requirements. It remains to be seen how the U.S. will respond.

- Stimulus in China has been steady, but slow, especially in contrast to the aggressive actions of the Fed.