Daily Comment (April 14, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Today’s uptick in the markets appears to stem in large part from chatter about COVID-19 lockdown restrictions being eased in the coming weeks. Of course, other data shows that in some countries new virus cases and deaths are still rising strongly, so it’s still too early to call the “all clear.” We review all the virus developments and other news below.

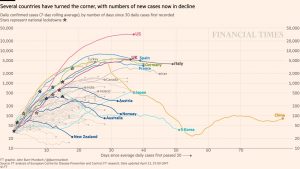

COVID-19: Official data show confirmed cases have risen to 1,934,583 worldwide, with 120,863 deaths and 464,398 recoveries. In the United States, confirmed cases rose to 582,594, with 23,649 deaths and 44,308 recoveries. Here is the chart of infections now being published by the Financial Times:

Virology

- In the week ended April 3, the 16,387 deaths registered in England and Wales were more than 50% higher than the average weekly death total over the last five years. In fact, the total was the highest since comparable records began in 2005.

- In Japan, experts from a government-appointed panel said that in 40% of confirmed COVID-19 cases they were unable to verify where or when patients had contracted the virus. That suggests the virus is spreading widely in the country.

- On a more positive note, as spring takes hold across the Northern Hemisphere, debate is intensifying over the possibility that warmer temperatures and higher humidity could slow the pandemic.

- Some scientists point to data showing a slower trajectory of new cases in warmer countries.

- Other scientists say that may just reflect the fact that many warmer countries are testing more aggressively.

Real Economy

- While even hard-hit European countries like Spain and Italy are starting to modestly relax some restrictions, other countries are announcing that their lockdowns will be extended:

- French President Macron announced a month-long extension of his country’s lockdown, prolonging measures to fight the new coronavirus into mid-May.

- Indian Prime Minister Modi said he would extend his country’s lockdown into at least early May.

- British Foreign Secretary Raab, standing in for Prime Minister Johnson as he recovers from the virus, will reportedly announce later this week that the U.K. lockdown is being extended into early May.

- On a much more positive note, two groups of states – in the Northeast and on the West Coast – have established working groups of government, public health, and business leaders to begin planning for phased reopening of the economy in their regions. Separately, President Trump today plans to announce a new working group that will focus on the economic effects of the coronavirus and analyze options for reopening parts of the country.

- As some governments begin planning for an economic reopening, one thing that could accelerate the process is growing evidence that food supply chains are under stress in various places all around the world. A key problem is finding healthy workers in Europe, for example.

- According to the Mortgage Bankers Association, 3.74% of homeowners were not making their monthly mortgage payments last week, up from 2.73% in the previous week.

- That equates to more than two million homeowners in forbearance, with the number expected to keep climbing rapidly.

- Since mortgage-servicing companies are still on the hook to pay investors in the mortgages, the burgeoning forbearance numbers are raising pressure for yet another new Fed program to support the mortgage servicers.

U.S. Policy Response

- Congressional Republicans and Democrats are reportedly having trouble agreeing on a $250 billion increase in the new Payroll Protection Program of small business loans, which is expected to run out of funds by Friday. While the White House and legislators from both parties continue to sound optimistic, the sticking point is the scope of the bill:

- Republican leaders prefer to simply top up the PPP funding.

- Democratic leaders prefer a broader bill that would increase access to the program, provide additional funds for state and local governments, and add new funding for hospitals.

- The Fed’s new, $500 billion program to buy bonds directly from states and cities is also coming under fire for being too short-term and for favoring larger localities. Given how readily programs have been expanded to date, the criticisms suggest this one could soon be extended or broadened as well.

- Citing improved money-market conditions, the New York FRB said yesterday that it will soon ease back on its emergency repo operations designed to add short-term liquidity to financial markets.

Foreign Policy Response

- The IMF said it will write off an estimated $214 million in debt relief for 25 of the world’s poorest countries by cancelling repayments owed to the Fund for the next six months, allowing them to use the money to fight COVID-19 instead. The move comes ahead of a multi-billion-dollar program of debt relief expected to be announced by the IMF and the World Bank later this week.

Markets

- In an opinion piece in the Financial Times yesterday, Allianz Chief Economic Advisor Mohamed El-Erian wrote that P/E ratios are still too high and credit spreads are still too low compared with the likely slow and choppy recovery from the crisis.

- In El-Erian’s opinion, investors should take advantage of the Fed-driven rebound in the markets to rotate into higher quality companies and issuers with stronger balance sheets, better cash flow, shorter supply chains, and less dependency on physical facilities.

- El-Erian’s focus on higher quality companies is consistent with moves that the Confluence Asset Allocation Committee has made in recent months.

Odds & Ends: Top negotiators from the EU and the U.K. will hold a call tomorrow in an effort to restart negotiations on the U.K.’s post-Brexit relationship with the EU, after talks were curtailed by the virus crisis last month . . . North Korea has carried out what appears to be its fifth short-range missile test of the year . . . Israeli President Rivlin said he would give Benny Gantz and incumbent Prime Minister Netanyahu two more days to form a government, after they informed him they were struggling to agree on a new unity government but still making progress.