Daily Comment (April 15, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Today’s risk-off stance in the markets comes as we’re finally getting earnings and economic data that more fully reflect the impact of the coronavirus crisis. Several figures have come in worse than anticipated (see below), tempering the recent positive vibe from government planning for an economic reopening.

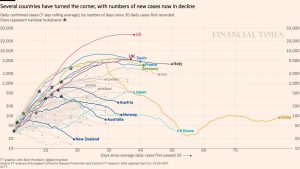

COVID-19: Official data show confirmed cases have risen to 1,997,321 worldwide, with 128,011 deaths and 500,996 recoveries. In the U.S., confirmed cases rose to 609,685, with 26,059 deaths and 49,966 recoveries. Here is the chart of infections from the Financial Times:

Virology

- New York City yesterday raised its estimated death toll from the virus to more than 10,000 from the previous estimate of about 6,600, mostly because it is now counting those who had COVID-19 listed as a probable cause of death on their death certificate even if they hadn’t tested positive for the virus. The revision highlights the continuing problem of undercounted cases and deaths, which has also been extensive in countries like the U.K., Italy, and probably China.

- New reports say many of the “imported” coronavirus cases reported by China represent travelers crossing from Russia into the northern province of Heilongjiang.

- Despite official data showing only a limited number of cases, epidemiologists suspect the outbreak is now spreading rapidly in Russia.

- In recent days, China has sealed off parts of its border with Russia and established a field hospital at the once-bustling border city of Suifenhe.

Real Economy

- In its latest World Economic Outlook, the IMF estimated the coronavirus crisis will reduce global economic output by 3.0% in 2020, followed by a rebound of 5.8% in 2021. U.S. output is projected to fall 5.9%, followed by a rebound of 4.7% next year.

- The declines this year would dwarf the global pullbacks in 2009, during the Global Financial Crisis, making this the worst global recession since the 1930s.

- As if that weren’t bad enough, analysts see the balance of risks as being weighted to the downside.

- San Francisco FRB President Daly warned that the recovery from the coronavirus crisis is unlikely to be swift, even if the threat of illness is contained quickly.

- The International Energy Agency issued an updated forecast that global demand for crude oil will fall by 29 million barrels per day in April and by 9.3 million bpd for all of 2020.

- The figures equal 29% and 9% of demand, respectively, in the same periods of 2019.

- The news is driving oil prices sharply lower so far today.

- Although the crisis has undercut prices for most commodities other than gold, it’s now proving positive for coffee prices, which are up 18% since their most recent low in late January.

- Despite the gloomy news on the economic impact of the crisis, plans for gradually reopening the economy continue to solidify, with President Trump saying yesterday that his administration will soon start working with each state to develop its own individualized program for reopening. Some would open before the administration’s voluntary social distancing guidelines lapse at the end of April.

- California Gov. Gavin Newsom laid out six indicators that he said would help determine when he begins to modify his stay-at-home order. The indicators include expanding virus testing, meeting the needs of hospitals in case of additional surges, and offering guidelines for businesses and schools to practice physical distancing.

- Oregon Democratic Gov. Kate Brown announced similar steps.

- A draft FEMA and CDC plan would prioritize reopening “community settings where children are cared for, including K-12 schools, daycares, and locally attended summer camps, to allow the workforce to return to work.”

U.S. Policy Responses

- Ten of the 12 largest U.S. airlines have reached an “agreement in principle” with the federal government to accept financial aid aimed at preventing layoffs as provided in the $2.2 trillion CARES economic support act. In return, it appears that each airline will have to eventually return 30% of the money, with interest (boosting its debt load), and also offer the government warrants for about 1% of its stock.

International Policy Responses

- Responding to IMF and World Bank requests, the G-7 group of large, advanced countries approved allowing poor countries to postpone their debt payments for up to 14 months to free up funds for their fight against the coronavirus. However, the deal is conditioned on the participation of all G-20 countries.

- In contrast with the wide support for the debt relief measures mentioned above, the U.S. and some other countries are resisting an IMF proposal to create additional reserve assets (“special drawing rights,” or SDRs) in order to help low-income emerging economies cope with the pandemic.

- The People’s Bank of China today cut its key one-year medium-term lending facility rate to a record-low of 2.95% from 3.15% previously.

- Cutting the MLF rate, which is the benchmark against which the PBOC lends to commercial banks, should reduce funding costs for Chinese banks and encourage them to lend at lower rates.

- State media have been reporting in recent days that more economic support measures could also be coming.

- Faced with shortages of ventilators and other medical equipment to fight the pandemic, the Australian government has promised to nurture local manufacturing to ensure it is less reliant on global supply chains (and China, in particular). The new policy marks another step away from the globalization trend of recent decades.

Political Fallout

- President Trump announced that U.S. funding for the WHO (amounting to approximately $450 million, or about one-quarter of the organization’s budget) will be suspended while a review is conducted to assess its role in “severely mismanaging and covering up the spread of the coronavirus.”

- He specifically called out the WHO for being too beholden to China, even though Beijing only provides about $40 million per year to the group.

- Other observers have also criticized the WHO for not pressing China to clean up its wildlife markets, for not being fully transparent about Chinese coronavirus infections, and for being late to declare a global pandemic.

Iran: Iranian naval forces seized a Hong Kong-flagged tanker and redirected the vessel into Iranian waters before releasing it, prompting a warning to ships along the Persian Gulf’s key oil export route. The ship was reportedly searched on suspicion of smuggling, but the incident is consistent with Iran’s recent shipping harassment. If this signals greater Iranian aggressiveness in the region, it could help provide a boost to global oil prices, although the market is still likely to be driven by the massive problem of oversupply.