Daily Comment (April 16, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning! Equities are rebounding this morning. We update the COVID-19 news and initial claims. The Weekly Energy Update is available. Here are the details:

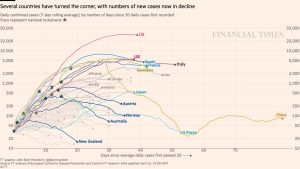

COVID-19: The number of reported cases is 2,076,015 with 138,000 deaths and 522,881 recoveries. Here is the FT chart:

There is a clear bend in the U.S. curve, which is good news.

The virus news:

- The focus for governments is moving from mitigation of the virus spread to relaxing social distancing to foster economic recovery. These actions are occurring across the developed world:

- The White House is expected to release guidelines for relaxing social distancing later today. The administration’s hastily created council for opening the country has suggested that testing needs to be stepped up for confidence to return. Given the broad geography of the U.S., urban areas in California and New York appear to be on the right side of the bell curve; however, rural America may just be starting the process.

- Germany is preparing plans to reopen; its approach appears to be quite cautious.

- In effect, we are seeing a number of nations try different tactics for returning to normal. The fact is that there are no specific guidelines and every government is feeling their way through this issue.

- Meanwhile, other nations remain on the left side of the bell curve and are coping with rising infections and fatalities.

- Britain is planning to extend its lockdown into early May.

- Sweden has rejected stringent social distancing measures, instead allowing restaurants and schools to remain open. Thus, the country has become a natural experiment of sorts for the rest of the world. Its death toll is rising, at 1,203, and is not expected to peak until early May. The country’s leadership is suggesting that stringent measures can’t be maintained (and there is growing evidence that this is the case), so a milder form of social distancing maintained for longer is better. In other words, if COVID-19 is going to become endemic, it is better to learn to live with it. One interesting trend—the average age of those dying from the disease is higher in Sweden than in other Nordic nations, suggesting the more stringent social distancing measures are most effective at sparing the elderly.

- Portugal, which would seem to be at great risk (older population, weak health care system), has done rather well due to aggressive social distancing.

- Japan, which had avoided rising cases earlier, has faced a rise in infections recently and today announced a national state of emergency.

- Russia is facing a rise in cases just as President Putin seeks approval to remain in office.

- As the U.S. and others try to figure out how to emerge from lockdown, much of the decision process is dependent on immunity. There is much we still don’t know about COVID-19. There is an assumption that once a person contracts and survives the disease, they have some degree of immunity. That is a reasonable assumption that may or may not be true. Or it may be more complicated than it seems. A recent paper in Science raises the possibility that COVID-19 may be with us in one form or another for a while; we may cycle through flare-ups and occasional lockdowns in the future. In other words, this may not be a “one and done” type disease.

- Testing woes are exacerbating the lack of knowledge.

- Blood tests in Germany suggest the levels of natural immunity remain surprisingly low.

- Even Singapore, which has been lauded for its quick response and containment policies, was forced to reimplement measures as cases increased.

- China is blocking its border with Russia in the wake of new infections thought to have come from its northern neighbor.

- Getting economies back up and running will require people to trust that they won’t get infected by others. Until a reliable vaccine is available, that will be accomplished through persistent testing, both for infections and immunity. Contact tracing is part of that, but this process is fraught with privacy concerns.

- Although there is great hope that a vaccine may be available by early next year for the general public, progress depends on the virus not mutating. There are reports that a strain in India may have mutated in such a way as to make current vaccine efforts futile.

- There are reports that the virus not only attacks the respiratory system, but that it may have lingering neurological effects as well.

- There are reports Iran is dramatically undercounting COVID-19 fatalities. Accurate data on this virus has been a problem. According to today’s report, Iran has 182,436 cases with 6,771 fatalities. If this claim of undercounting is correct, the number dead could be two times higher, or nearly 14k.

- Political tensions between the U.S. and China are elevated. For example, Chinese export controls are preventing the export of medical supplies. At the same time, doctors in both nations are continuing to cooperate. China is launching studies into immunity and asymptomatic cases, and also examining if air conditioning airflows can spread the virus.

The policy news:

- One of the challenges for the Fed from its policy of expanding the balance sheet is what assets are included. In a sense, what gets included is a political decision. For example, when the Fed decided to start buying some levels of high yield, where does the bank draw the line? In other words, who gets excluded and why?

- The Fed has expanded its purchases of muni paper but is limiting its purchases to large cities and states. Which, of course, is leading smaller government entities to complain. We suspect the Fed is expecting states to come to the aid of smaller cities.

- We also suspect the Fed’s reason for this type of support was to avoid systemic risk in the muni market. However, avoiding systemic risk may not mean that all participants are saved. Given the political nature of this decision, we would not be shocked to see the Fed expand to buy a broader swath in this market.

- There are reports that lenders can seize stimulus checks to address delinquent debt. If the practice becomes widespread, the negative public relations from such actions will be grim.

- The small business lending program either has, or nearly has, exhausted its funding. Additional funding is being held up due to partisan divisions.

- The stimulus checks are starting to hit household accounts. Early reports suggest the money is mostly going to food.

- Reports of rent relief requests, even from large tenants, are rising.

The economic news:

- Related to the muni comments above and yesterday’s retail sales data, cities and states are reeling from the loss of revenue. Many states and municipalities rely on sales taxes for the bulk of their revenue and these flows are declining as consumption falls or goes online.

- Even in the midst of a long expansion, nearly 60% of American households had little to no saving. The sudden increase in unemployment is leading to severe strain for the majority of households. There are also growing concerns that firms are about to unleash another wave of layoffs for workers who were initially spared. It appears that firms were anticipating a short downturn, but wider layoffs are emerging as evidence increases that the recovery may be slower than initially thought.

- The small business bailout program was established with great speed. However, it does have some issues. And, for some businesses, the bailout doesn’t matter; they probably wouldn’t have survived a normal recession and this downturn is deep enough that continuing to operate has become impossible.

- The best estimate we have seen for unemployment comes from Alexander Bick and Adam Blandin. Their forecast? The unemployment rate will reach 20.2% in April.

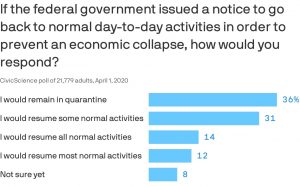

- Economic recovery is going to require more than just stimulus, bailout money and Fed support. Confidence among consumers is critical. This recent poll highlights the issue—nearly 70% of respondents would not resume pre-COVID-19 activities:

- Finally, yesterday’s retail sales data confirms the shift caused by the lockdown:

The market news:

- For the past few years, LIBOR has been scheduled to be replaced with the Secured Overnight Financing Rate, or SOFR. This rate is a representative interest rate for repo transactions using Treasuries for collateral. However, market turmoil caused by COVID-19 is apparently slowing the adoption of the new rate.

- Private equity firms are snapping up discounted public shares of companies struggling to acquire cash. Some of this new money is in the form of convertible shares.

- Pork processors are shutting down facilities due to rising virus infections. We may see depleted supplies in the coming weeks.

The foreign policy news:

- The tussle over the WHO is really all about controlling the narrative. The U.S. fears that China has excessive influence over the WHO leadership. The U.S. isn’t alone on this concern; Japan has expressed apprehension over China’s influence on the body. Petitions to remove the WHO’s leader have been conducted. This issue comes as reports indicate China didn’t warn the public for six days when a pandemic was imminent.

- The U.S. is resisting developed country efforts to boost the IMF’s funding; we suspect America fears it will be forced to provide the largest share of the new funding.

- There is great fear that COVID-19 will accelerate a growing trend toward deglobalization. We note two reports. First, Japan is paying Japanese firms to leave China and relocate elsewhere. Second, Australia is taking measures to bring manufacturing “back home” (read: out of China).

- Worries over emerging market debt have been on the rise; the IMF has been working for forbearance for some borrowers. Two other issues have emerged. First, we may not have a full picture of the level of EM debt because some of it has been issued through financial havens. Second, China, which has issued debt to EM nations through its “one belt, one road” project, is not part of any developed nation debt system, e.g., Paris Club. It is not clear how China will behave as a creditor.

- Australia is warning that the non-China rare earths supply chain could be in trouble.

Odds and ends: An Islamic State cell operating in Germany was planning attacks on U.S. bases there. Their plans were thwarted when the group was arrested. China may be testing low-power nuclear weapons in violation of nuclear testing treaties.