Daily Comment (April 24, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning! Equity futures are pointing to a modestly higher opening; oil prices are also higher. We update the COVID-19 news. Here are the details:

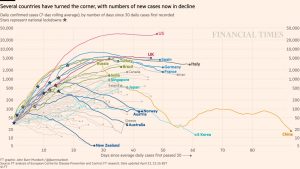

COVID-19: The number of reported cases is 2,721,354 with 191,231 deaths and 745,605 recoveries. In the U.S., there are 869,172 confirmed cases with 49,963 deaths and 80,934 recoveries. Here is the FT chart:

Here is another website to add to your COVID-19 monitor. It attempts to measure the R0 (pronounced “R-naught”) by state. That number tells you how many new cases are generated by each infection. A R0 greater than one would mean that each infection generates more than one new infection. Thus, one should be careful about relaxing social distancing standards if the reading is greater than one. Although this is an interesting site, the output is only as good as the data input. In other words, the actual count of infections is necessary to generate the R0. But, even with that caveat, watching the history of the data does show that social distancing has had a positive impact on reducing new cases.

Although we have seen some impressive data analysis on the virus, the data collection itself remains a problem. Nations have reasons to manipulate the data for political reasons; perhaps the nation with the most serious undercount is Brazil. Its leader, Jair Bolsonaro, had downplayed the impact of COVID-19; in his defense, Brazil may not have much of a choice. Its economy can’t afford to engage in social distancing, so Brazil needs to acquire herd immunity through widespread infection. It is a risky strategy, but one we may see repeated elsewhere. We note that Africa may become the next hot spot for COVID-19.

The virus news:

- There were mixed headlines on the virus over the past 24 hours. Here is the good news:

- An antibody survey in New York State showed wide exposure to COVID-19. The survey of 3,000 people showed that 14% were carrying antibodies and 21% of those from New York City were carrying antibodies. The caveats:

- The sample is small and not random. Participants volunteered at shopping centers, meaning they were healthy enough to be circulating.

- Although 14% and 22% is a start, herd immunity requires at least 70% of the population to be carrying the antibody. Achieving herd immunity through infections isn’t really possible (that’s why parents used to have “chickenpox parties” because it was better to get a child exposed early; however, the fact that these parties were held showed that the virus still circulated and herd immunity was not achieved). On the other hand, rising numbers of those who are likely immune would allow those who survived an infection to go back to regular activities.

- The bad news:

- An accidentally leaked WHO report indicated disappointing results that a study of remdesivir was ineffective in addressing COVID-19. However, Gilead Sciences (GILD, 77.60, -3.71), the company that made the drug, noted that the leaked study lacked enough participants to make statistically meaningful conclusions. The jury remains out on remdesivir, which is the subject of several ongoing studies. Equities did retreat on the news.

- One of the characteristics of COVID-19 is that it has elevated mortality for patients with hypertension. It is unclear if it is high blood pressure that is the risk factor or the drugs that treat the condition. If it is the latter, patients are left with a dilemma—continue taking the medicine and be at higher risk of dying if they contract COVID-19, or stop taking their medication and risk renal failure, heart attack or stroke.

- Lebanon has its first confirmed case of COVID-19 in a Palestinian refugee camp. Although Lebanon has managed to control the spread of the virus rather effectively due to aggressive social distancing measures, refugee camps tend to be crowded with substandard hygiene. If the virus begins to spread in the camp, it may be difficult to control.

- Highlighting the vulnerability of aging and COVID-19, in Europe, nursing homes account for about half of the fatalities from the virus.

- As the West gets to the “right-hand side” of the distribution curve, we are starting to see signs of the legal response. In Italy, it appears that lawyers are preparing to act against officials who may have made errors resulting in fatalities. We would be surprised if this trend doesn’t start to emerge elsewhere.

- And the interesting news:

- There has been a strong call for ventilators in the COVID-19 crisis. However, there is increasing nuance in deciding when to use the machines. More doctors are concluding they should be used as a last resort. In some cases, it appears the lung damage from intubation and ventilation is so great that the use of the machines may need to be curtailed.

- A study of transmission in China shows that, by far, the most dangerous place one can be for the virus is indoors. The study suggested that the most common transmission came in homes (probably from an infected family member), followed by transportation. The safest place to be was outdoors. It’s not that there were no reports of outdoor transmission but there was only one out of 7,324 that was identified as suffering from outdoor transmission. Here is the paper. If other research confirms this study, we could see parks reopen, and concerts and religious services being held outdoors.

- An antibody survey in New York State showed wide exposure to COVID-19. The survey of 3,000 people showed that 14% were carrying antibodies and 21% of those from New York City were carrying antibodies. The caveats:

The policy news:

- The House has passed the most recent support package; it goes off to the White House where President Trump is expected to sign it into law.

- The next round will be much more challenging. We see five brewing problems that will likely need federal attention and additional support. All are fraught with political risk.

- State and local governments are in deep trouble. High job losses have led to massive demand on unemployment insurance. Although the weekly claims data has soared, the antiquated systems the states use to process claims have been balky; there has been a surge in demand for COBOL programmers, an indication of the age of these systems. Funds for unemployment insurance are being drained. Medical care costs have hit state coffers as well. This need for support is running headlong into a deep political divide. Some state governments over the years have made pension promises they probably can’t keep. While the union movement has been languishing for years in the private sector, it continues to flourish in the public sector. The GOP fired a broadside yesterday, suggesting these governments should avail themselves to the bankruptcy courts, which would likely force the reduction of pension payments and abrogate union contracts. Democrats oppose this idea and want to give states aid.

- The Energy sector continues to reel. Although the drop in oil prices has caught the attention of the media (nothing like a unique event like negative prices to generate interest), the bigger story is that the industry is struggling. Treasury Secretary Mnuchin is considering a lending program for the oil industry. This is where the politics flip; oil production tends to be centered on the red states and Democrats, especially left-wing populists, are strongly opposed to fossil fuels. It is possible the administration could bypass Congress and prompt the Fed to lend directly to the industry or backstop bank loans. But, much of this debt is very risky, which would expose the Fed to losses. At the same time, a disorderly collapse of the Energy sector would be a risk to the broader economy.

- The postal service is in financial trouble again. Although it has received some assistance, the administration appears to want to prompt significant changes to its business model in return for a bailout. We would not just expect higher rates on package shipping but a renegotiation of union contracts for postal workers.

- Policymakers face a dilemma with private equity. Often, firms that are bought by private equity firms have their assets leveraged to support the debt used to buy them. As the downturn worsens, the firms purchased by private equity will likely fall into trouble; bailing them out could end up supporting the private equity firms that purposely weakened the target company’s balance sheet. Preventing bailouts means innocent workers could lose their jobs and worsen the downturn, but bailouts increase the risk of privatizing the profits and socializing the risk.

- The government has allowed homeowners forbearance with federally backed mortgages. However, the legislation apparently didn’t tell servicers how this would work. According to reports, some servicers are offering only short breaks in payment and demanding a balloon payment once forbearance ends. We have been saying for some time that mortgage servicers will need support; until they get it, their offers of forbearance will be so onerous that few borrowers will want it. At the same time, many of the mortgage servicers are the largest banks. As the smaller ones are not supported, further concentration in the industry is certain.

- From our perspective, all five issues could cause disruptions that would have an adverse impact on financial markets. For example, muni bankruptcies won’t just force public workers to be the only party to bear the cost of adjustment; bondholders will almost certainly do so as well. If bond obligations for state and local governments become a credit issue on a systemic basis, it would cause a serious jolt to the financial system in a time of great risk. Allowing broad business failures in Energy could spill over into other areas of the financial system. As 2008 showed, it is hard to know where systemic risk emerges. The same is true with private equity. And, in a period when home delivery is expanding, a postal strike would be a problem. So far, policymakers have done a good job in preventing a widespread decline in the financial markets but the longer this goes on and the more contentions the political issues become, the greater the chances are that a mistake is made.

- The Fed will begin disclosing who it is lending to in a new report.

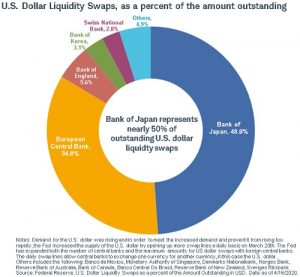

- So far, Japan has been the largest participant in the Fed’s forex swap program.

The economic news:

- As we noted yesterday, the expanding shutdowns of meat processing plants will start to lift prices and reduce supplies next month.

- There have been glitches in getting stimulus checks to households. These delays are not good news for the economy.

- There are increasing worries about a flood of business bankruptcies. One of the problems of years of low interest rates is that some companies who would not have survived under conditions of normal rate levels have struggled on over the last decade. These so-called “zombies” may finally be facing their fate but probably wouldn’t have survived a normal recession either. A bigger worry is that startups have slowed dramatically in this downturn, which will slow the recovery once it starts.

The foreign policy news:

- Chinese medical goods producers have been taking advantage of spiking demand by engaging in old fashioned price gouging. This action is occurring in the midst of rapidly deteriorating relations between the U.S. and China.

- Europe is struggling to formulate a response to the virus. Although there has been talk of a €2 trillion package, the actual level is about a quarter of that and details have not been worked out. The southern nations are worried they won’t get enough support.

- As the virus spreads in Russia, anger over the government’s response is rising. The combination of COVID-19 and collapsing oil prices is creating a problem for President Putin.