Daily Comment (April 29, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

The uptick in the markets today comes as coronavirus lockdowns continue to be softened around the world and several drug groups say they could have a COVID-19 vaccine within months. The Fed ends its latest policy meeting today. Overseas, it’s still a mystery where Kim Jong Un is, while Russia has apparently sent yet another hit squad to kill an enemy overseas.

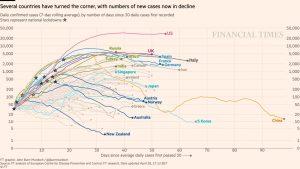

COVID-19: Official data show confirmed cases have risen to 3,132,363 worldwide, with 217,947 deaths and 938,037 recoveries. In the United States, confirmed cases rose to 1,012,583, with 58,355 deaths and 115,936 recoveries. Here is the chart of infections now being published by the Financial Times:

Virology

- Multiple U.S. and foreign pharmaceutical companies working on a COVID-19 vaccine say they have moved up their timetable for testing and could have a product available for emergency use as early as this fall. Several organizations have already started safety and efficacy tests on human subjects. The news should be a significant positive for a wide range of risk assets.

- On a less positive note, many commercial and academic laboratories in the U.S. say a lack of high-level coordination has left them processing far fewer coronavirus tests than they could. Lab executives and public health officials blame barriers including fragmented supply chains, relatively strict test guidelines, incompatible electronic systems and a lack of centralized data on where capacity exists.

Real Economy

- President Trump invoked the Defense Production Act to declare meatpacking plants as critical infrastructure that must keep operating, in spite of some local governments and unions preferring to close them to slow the spread of the virus. The move will require new measures to protect workers from infection, but it will not compel employees to return to work if they don’t want to. Nevertheless, the news should be positive for major meat company stocks.

- As much as 25% of U.S. pork production capacity is currently idle as is about 10% of beef production. Administration officials said they feared 80% of all U.S. meat production capacity could be shut down without any action.

- Large packing plants have become a target for virus shutdowns because they often represent a large, concentrated share of the total workforce in the small or rural communities where they are typically located.

- The American Petroleum Institute released data showing U.S. oil inventories expanded less than anticipated last week. The news is boosting oil prices sharply higher so far today, although it will be important to see whether the more benign picture is confirmed by the Energy Information Agency’s data later this morning.

- As European countries gradually ease their coronavirus restrictions, high-frequency alternative data on economic activity, such as electricity use and travel, are already starting to show a revival.

- Unfortunately, new analysis shows that emerging market countries trying to support their plunging currencies last month depleted their foreign exchange reserves at the fastest pace since the global financial crisis of 2008-2009. The drawdown of reserves leaves some nations vulnerable to further shocks, so the news is likely to be negative for emerging market bonds and stocks.

Financial Markets

- As a reminder that Italy’s economy has been left in tatters even as it gets control of the pandemic, Fitch has cut its rating of Italian sovereign bonds to BBB-.

- With the downgrade, Fitch joins Moody in assessing Italy’s debt at just one notch above junk. S&P last week rated it two notches above.

- In its announcement, Fitch suggested it had been prepared to cut the rating even further, but the Italian government provided additional information that allowed for the investment-grade assessment.

U.S. Policy Responses

- Treasury Secretary Mnuchin said Payment Protection Program loans of $2 million or more would face an audit before being forgiven, with spot checks for smaller loans. The audits will check whether the funds were really used to keep or rehire workers or meet other allowed expenses.

- Some observers question whether the SBA will really be able to conduct effective audits, which it normally entrusts to banks.

- All the same, the announcement reflects concern about the political ramifications if the emergency lending leads to widespread fraud.

- In another setback for the PPP, many restaurant owners are expected to forego or return the loans on concerns that they can’t meet the requirement to spend the funds within eight weeks, especially when lockdown orders are still in place and many of their employees have more income from unemployment benefits than they get from working.

- Senate Majority Leader Mitch McConnell told Republican lawmakers he doesn’t want to include infrastructure funding in the next coronavirus relief bill, but he does want a provision shielding companies from liability in pandemic-related lawsuits.

International Policy Responses

- Expectations are building that the ECB, as early as this week, could significantly expand its relatively modest €750 billion coronavirus bond-buying program toward something more similar to the Fed’s aggressive programs.

- The leftist economist Thomas Piketty, who is famous for his recent books linking capitalism to inequality, said in an interview that the EU’s need for a strong fiscal response to the coronavirus crisis was being undermined by the policy of making unanimous decisions. To solve the crisis, he called for “a small group of countries” to start making decisions on their own based on majority voting. The idea is yet another reflection of the growing potential for a breakup of the bloc.

Political Fallout

- Australian Prime Minister Morrison has called for an independent international inquiry into the origins of the COVID-19 crisis. The call has drawn a furious response from Chinese officials, who have accused Morrison of being a U.S. pawn and threatened a boycott of Australian goods.

United States: The FOMC will wrap up its latest policy meeting today. While no change is expected in the Fed’s basic policy stance, the policymakers will release updated economic forecasts and Chairman Powell could provide additional color on policy going forward during his post-meeting news conference.

North Korea: There is still no solid news on Kim Jong Un’s whereabouts, but media reports say North Korean consumers have been panic-buying staples. If even domestic residents of the Hermit Kingdom are sensing a potential crisis, it provides further evidence that an important development may be happening.

Russia-Czech Republic: A Prague district mayor says he is under police protection after authorities informed him that he and two other Prague officials, including the city’s mayor, were the targets of a Russian intelligence agent sent to the Czech capital to “liquidate” them. The officials were apparently targeted for their role in removing a statue of a Soviet war hero from a public square in Prague.

Brazil: The supreme court has authorized a police investigation into President Bolsonaro, days after Justice Minister Celso de Mello resigned and accused the president of crimes ranging from influence-peddling to obstruction of justice for trying to replace police officials investigating his family members. The threat of a massive new political scandal and potential impeachment will likely be negative for Brazilian assets.

Lebanon: As Lebanon’s government begins lifting its coronavirus lockdown, protesters demanding economic and political reforms are already back in the streets staging violent demonstrations.