Daily Comment (April 30, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning as another month, that feels like a year, comes to a close. Just a reminder—tomorrow is May Day, the international celebration of Labor Day. Most European financial markets will be closed, although Denmark and the U.K. will remain open. The ECB meets today; initial market reaction to the statement was negative as the moves taken appear modest. Equity futures are mixed, and oil continues to recover; our Weekly Energy Update is available. We update the COVID-19 news. Here are the details:

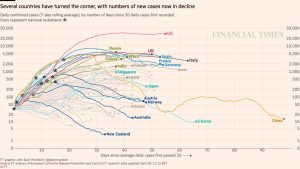

COVID-19: The number of reported cases is 3,207,248 with 227,971 deaths and 984,161 recoveries. In the U.S., there are 1,040,488 confirmed cases with 60,999 deaths and 124,023 recoveries. Here is the FT chart:

Here is another interesting graphic—it shows the spread of COVID-19 over time. What is shown is that the only parts of the world that have not reported the virus are some islands in the Pacific. According to rt.live, there are only seven states with R0 higher than one and six are in the Midwest.

The virus news:

- Equity markets rose yesterday on reports that Dr. Fauci, the head of the National Institute of Allergy and Infection Diseases, had positive comments related to Remdesivir, an anti-viral medicine produced by Gilead Sciences (GILD, 84.09). There are generally two different paths to dealing with COVID-19. The first is developing a vaccine. A vaccine, widely distributed, would establish herd immunity. A vaccine will be difficult to create; making vaccines has a host of problems, one of which is the mutation of viruses into a less virulent form, reducing the incentive to create one. A successful vaccine for any coronavirus has never been developed and research on coronaviruses suggest that natural immunity doesn’t last very long. Additionally, if the virus mutates, COVID-19 may require a new vaccine each year, similar to influenza. Despite these hurdles, the efforts to make a vaccine are impressive. There are joint projects with drug makers and academia, and the U.S. is planning a crash effort to make and distribute a vaccine. The other path is to create treatments for those who have the virus. A successful antiviral would mean that catching the bug would likely be less dangerous; this was the path taken for HIV. In addition to Remdesivir, other drugs are being investigated as well. As noted above, Dr. Fauci’s comments were very well received yesterday. However, there are conflicting studies on Remdesivir, some suggesting the drug isn’t all that successful in helping patients. As a result, having other drugs to combat the virus may be necessary. Having both types might be needed to successfully corral COVID-19, especially if the virus regularly mutates. We do note that despite mixed results for Remdesivir, the U.S. may greenlight the drug for emergency use. Our take? We suspect that Remdesivir has some value, but we may find that it is more effective for certain degrees of infection, or that timing is critical. We note that Tamiflu works best when taken early against influenza; waiting until the symptoms have become obvious tends to reduce its effectiveness. Something similar may emerge with Remdesivir.

- In our daily coverage of COVID-19, we have seen a broad spectrum of reports. At first, the virus looked like a typical respiratory malady. Although it was clearly deadly to some parts of the population (aged, with co-morbidity factors), a large number of those infected appeared to be asymptomatic, or with very mild symptoms. However, as the virus spread around the world, new symptoms emerged. There were cases of blood clotting apparently caused by the disease, and younger patients were suffering strokes after being infected. Patients who appeared mildly ill would have blood oxygen levels so low doctors tended to immediately ventilate. Renal failure was reported. Certain cancers are now a co-morbidity factor. Even dermatologists are reporting very odd symptoms from COVID-19. There is also a tendency for patients to be afflicted and appear to recover, only to become suddenly deathly ill. It sort of seems like there is a “second-week syndrome” with COVID-19. Simply put, whatever we are dealing with is affecting the human body much more broadly than it looked initially. It is unclear what we are dealing with here. However, one possibility is that the virus is mutating much more rapidly than expected. It is possible that the U.S. is being hit with different strains of the virus. This may account for the wide differences in fatalities. One possibility is that the West Coast was infected by a less virulent Asian strain, while the East Coast was infected by a stronger variant from Europe.

- The CDC now has offered six symptoms that COVID-19 tends to cause.

- Although the virus continues to surprise, there is a consensus that children are less at risk from COVID-19. It may be that they are not vectors for transmission either.

- Every government that has faced this disease has taken a number of policy steps to try to cope with the outbreak, while also reducing the impact on the economy as much as possible. Social distancing reduces the spread of the disease and saves capacity in the medical system. However, social distancing cannot exist indefinitely because of the harm done to the economy. Essentially, policymakers are being asked to manage two conflicting goals; keeping people safe and maintaining some semblance of an economy. This puts leaders in a very difficult spot, because either goal could be considered absolute and there will always be a pundit somewhere who can castigate a leader for putting a focus on either.

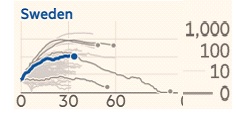

- Due to the broad spectrum of responses, there have been a number of natural experiments that we have been tracking. Sweden has been an important test case for COVID-19 social distancing policy. The country has had a “light touch,” putting fairly modest restrictions that are not aggressively enforced. Its death rates are elevated, but not widely different than other nations. A NYT study showed its fatality rates are about 18% above normal, which is low relative to other countries.

- The above chart from the FT shows Sweden’s death rate compared to other nations. Here is the entire array.

- On the other hand, the disease has been starkly more deadly for the elderly in Sweden; 86% of the 2,194 confirmed deaths have come from those over 70. Sweden’s experience seems to suggest that less restrictive measures may not be as risky for the entire population, but may be a problem for the elderly. On the other hand, it is important to draw the right lessons from an analog; Sweden’s population density is 64 people per square mile, 194 out of 235 nations. The U.S. ranks 177, with 94 people per square mile. The U.S. experience shows that highly populated areas tend to be more at risk. What this may mean for the U.S. is that restrictive measures may be appropriate for urban areas, while less restrictive measures may work in rural and more suburban settings.

- Meanwhile, India is struggling to reopen; workers are reluctant to return to work, fearing another outbreak of the virus. Meanwhile in China, manufacturing is starting to recover but the consumers of Chinese goods, both home and abroad, are slower to restart buying.

The policy news:

- The Fed met; as expected, it didn’t do anything but clearly indicated that if more was necessary, it would act. Here is a report that compares the changes in the last two statements. The statement does show that this was a continuation meeting. Nothing new was revealed, and what is in place will likely remain so for a while. Chair Powell signaled that fiscal policy should remain expansionary. On a side note, it appears the KC FRB will not be able to hold its annual monetary policy meeting in Jackson Hole this year, for the first time since 1982.

- The ECB is planning on expanding its balance sheet further, but left rates unchanged. It did ease conditions for banks to borrow, which has been characterized as “helicopter money for banks.” For the most part, financial markets were a bit disappointed in the statement. In the press conference, Chair Legarde appears to be following the Greenspan playbook, which is to answer each question with a long response resulting in fewer questions and the answers are hard to follow. The ECB simply can’t move as much in some areas, like yield curve control, compared to the Fed. That lack of power is reflected in Eurozone financial assets.

- What to do about food? President Trump has used the Defense Production Act to force meatpackers to reopen slaughterhouses, in some cases overruling state regulations. However, it isn’t clear if this action will lead to a return of meat processing. It’s one thing to open facilities, but it’s another to get workers to return to their jobs. COVID-19 have ravaged these facilities where workers process carcasses in close quarters. Unions representing these workers have criticized the executive action. It is clear that if meat processers don’t open soon, shortages will start to develop; chicken will probably be first and beef last. At the same time, these workers have more leverage than one would think. These jobs are very difficult and don’t pay all that well. If the workers don’t show up, the firms could fire them, but replacing them won’t be easy.

- One of the underlying problems for the food service industry is that there has been a huge shift in demand. Sales to restaurants have collapsed, while grocery store demand has soared. This situation has created a logistical nightmare; the packaging and distribution appropriate for commercial firms is completely wrong for households. Quantities are too large and are not in packaging that households can manage. So far, shortages in grocery stores have mostly been sporadic, but the food service industry doesn’t necessarily want to retool itself for households only to see restaurants roar back later this year. So, for now, we are limping along with reports of some food being lost.

The economic news:

- The Eurozone economy fell at its fastest pace on record in Q1; that record will almost certainly be broken in Q2.

- Chinese PMI data held up rather well in April, although exporters remain depressed.

The market news:

- Firms are increasingly turning to convertibles to raise money (not this convertible!). Nearly 60% of equity capital raised this month has come from these bonds, which can convert to equity if the stock price recovers. In 2008, we saw a similar pattern.

The foreign policy news:

- An important indicator has been announced that China is feeling more confident about having the virus under control. It has scheduled a date for its National People’s Congress for May 22. It will be held in Beijing, meaning it will be held in person.

- Because of the closure of stores, some countries are struggling to update their inflation indices.

- The battle of the virus narrative between the U.S. and China continues. China has embarked on an aggressive campaign to hold itself blameless for COVID-19. At the same time, the U.S. is engaging its intelligence agencies to determine if China, or the WHO, withheld data on the pandemic.

Brexit: Although the focus recently has been on COVID-19, Brexit negotiations have been held. The conventional wisdom is that PM Johnson will ask for an extension. However, what we have seen thus far suggests that the U.K. fully intends to leave at the end of the year and if that intention leads to a hard break with the EU, so be it. Although there hasn’t been much attention paid to Brexit recently, a hard break would likely be taken as negative for U.K. financial assets. A side note: PM Johnson is a new father.