Daily Comment (May 6, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Today’s positive market action comes as state governments and countries around the globe continue to ease their coronavirus restrictions. Besides that, it’s also VE Day, and the beginning of National Nurses Week! We review all the virus news below, along with a discussion of new developments in U.S.-U.K. trade, Brazilian politics, and last week’s attack on Venezuela.

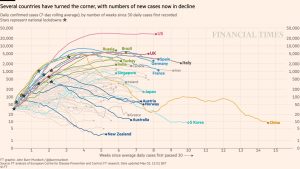

COVID-19: Official data show confirmed cases have risen to 3,685,129 worldwide, with 258,051 deaths and 1,208,139 recoveries. In the United States, confirmed cases rose to 1,204,175, with 71,078 deaths and 189,791 recoveries. Here is the chart of infections from the Financial Times:

Virology

- Gilead Sciences (GILD, 79.14) said it will provide licenses to other drug firms to manufacture and sell its COVID-19 treatment, remdesivir, outside of the U.S., farming out production to ensure supply meets global demand.

- Highlighting how vulnerable the aged are to the disease, New York State said it has recorded at least 4,968 confirmed and presumed deaths at nursing homes and adult care facilities. New Jersey said it has had 4,151 deaths at such facilities, as it and Pennsylvania have now become prime U.S. hotspots for COVID-19 fatalities.

- Russia reported its fourth straight day of at least 10,000 new coronavirus cases, making it an important hotspot for infections along with countries like Brazil, Mexico, and India.

Real Economy

- President Trump and Vice President Pence said Tuesday afternoon that the administration is considering disbanding its coronavirus task force, shifting its responsibilities to individual departments like FEMA, and perhaps setting up a new group focused on “safety and opening.” A firm date for the transition hasn’t been decided, but Pence said it could be in late May or early June.

- Just as various states here are easing lockdowns in uncoordinated fashion, several of Germany’s federal states have started to move at their own pace, drawing complaints from Chancellor Merkel and the federal government.

- In a positive sign that travel and tourism could rebound well when virus lockdowns are eased, the CEO of short-term rental company Airbnb said domestic bookings in Denmark and the Netherlands are already at 80% to 90% of their levels at the same time last year. However, he wasn’t sure how long the rebound would last, prompting the firm to lay off one-quarter of its employees.

- A travel rebound can’t come fast enough for hotel owners. A new JP Morgan analysis shows 23.7% of hotel properties in CMBS deals were behind on their mortgage payments in April, up from 4.2% in March.

- More broadly, one lasting impact of the crisis could be that fixed, long-term rental agreements in commercial real estate will be replaced with shorter, more flexible payment plans.

Political Fallout

- The U.S. and Australian governments continue to push for an international inquiry into the origins of the new coronavirus and how China handled the initial outbreak, including putting pressure on the EU to support such an investigation.

- However, top EU officials are pushing back in favor of a multilateral study of the epidemiology of the virus that wouldn’t place blame on any particular country.

- Blaming China for poorly handling the initial stages of the outbreak is also complicated by increasing evidence that the virus may have been spreading to the U.S. and Europe, including France, as early as December, well before it was recognized as a major problem in much of China.

- With Russian virus cases surging and the government response widely panned as inconsistent and miserly, Russian President Putin’s approval ratings fell to just 59% in April, marking his lowest polling since taking office in January 2000.

United States-United Kingdom: To accelerate a comprehensive U.S.-U.K. trade deal, U.S. Trade Representative Lighthizer and British International Trade Secretary Truss announced that almost 30 bilateral working groups will hold virtual discussions on key trade issues over the next two weeks. It’s positive that the administration is now able to shift its attention to other issues beyond the coronavirus, but, as we’ve said before, it will be difficult to quickly reach a deal, and when push comes to shove, the Brits may not find U.S. demands to be very palatable.

Brazil: Testimony made public yesterday indicates President Bolsonaro is being investigated for trying to control Rio de Janeiro police who are investigating his sons there for corruption. The testimony from former Justice Minister Moro suggests the scandal could “have legs.” If so, it would likely be an ongoing drag on Brazilian stocks.

Venezuela: New details have emerged about last week’s mysterious paramilitary attack in Venezuela. Reports say a group of about two dozen soldiers, consisting of Venezuelan military defectors and foreign mercenaries (including two U.S. veterans), planned a sea attack to arrest the country’s authoritarian government and free political prisoners. However, the group was apparently infiltrated by Cuban or Venezuelan operatives, and the attackers were intercepted by Venezuelan forces before they could land. Reports say eight attackers were killed and 13 were captured. Both President Trump and Venezuelan opposition leader Guaidó claim they had no knowledge of the operation. Nevertheless, the Bay of Pigs-like fiasco probably gives President Maduro a bit of help as he continues to resist efforts to topple him.