Daily Comment (June 25, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

The 13th episode of the Confluence of Ideas podcast is available; it is our first in a series of reports on the November elections.

Good morning, all. Lots going on today. For the second consecutive day, we are starting with weaker equity markets. In fact, almost everything is red this morning except Treasuries. In equities, there are worries that institutional managers may try to capture Q2’s surge in equities with an aggressive rebalance and that would be bearish for stocks in the very short run. We update the pandemic news; it appears another surge in cases is upon us, although we are noting some differences compared to the initial rise. We update China news this morning, noting a real cold war is emerging on the India/China frontier and there is some divergence in policy direction between the White House and Congress. The economic news includes the IMF’s downgrade of global GDP. Poland is open to U.S. troops. We are noting some flooding issues and there was an earthquake yesterday in Mexico; we also follow up on the arctic heatwave. The Weekly Energy Update is available. Here are the details:

COVID-19: The number of reported cases is 9,440,535 with 483,207 deaths and 4,754,755 recoveries. In the U.S., there are 2,381,369 confirmed cases with 121,979 deaths and 656,161 recoveries. For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases across nations using similar scaling metrics. The Axios U.S. state map has been updated.

Virology:

- The WSJ details the rise in new cases; although increased testing is a factor, it does look like we are seeing increased spreading.

- One factor we are seeing is fewer deaths per the number of cases.

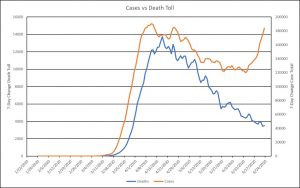

This chart looks at the rolling seven-day change in new cases and fatalities. We are seeing a clear upswing in cases, but fatalities are continuing to decline. It is possible that there is a lag between cases and fatalities. In fact, the above chart suggests there is about a 10-day lag, so some increase in fatalities wouldn’t be a surprise. But, at the same time, we are well into that 10-day window and, so far, fatalities haven’t jumped yet. We suspect two changes have occurred that may slow the rate of deaths; first, the medical system has probably gotten better at treatment. We know ventilator use has slowed as less invasive techniques have proven to be more effective. Second, it is probably the case that vulnerable populations (the elderly, chronic conditions, etc.) are being more careful in public and those contracting the disease are younger and healthier. That doesn’t mean this group can’t die from the disease, but the chances are lower.

- Therefore, we may be seeing a slow transition from avoiding the disease at all costs to learning to live with it. It is apparent that lockdowns do work in slowing the rate of infections, but the economic cost is horrific. Being more selective in who stays home, taking other measures (distancing in social situations, mask wearing) and working on mitigation therapies are all probably in our future until widespread vaccination develops.

- Disney (DIS, 112.07) may be forced to delay reopening its theme parks as workers push back against the company’s plans. Other companies and industries are facing similar concerns. Several states are reconsidering their plans to reopen as well.

- India is facing a massive problem in its medical system due to the pandemic.

- Genetic researchers in the U.K. have identified 68 genes associated with the risks surrounding COVID-19. One of the mysteries of the virus is the wide variation in symptoms. Some people who are infected exhibit no symptoms, while others are seriously affected. Their research suggests that COVID-19 is not just a respiratory illness but a cardiovascular one as well. It has also been found that Type A blood groups are at higher risk of serious complications, while Type O groups are not. If specific markers can be determined, genetic testing could indicate who is vulnerable and who is not and thus allow low-risk groups to reengage in social and economic activities (which could have much less attractive aspects as well).

China news:

- As the powers between Congress and the executive branch have evolved over time, the president generally has a greater say in foreign policy. That doesn’t mean Congress has no impact, but, in the day-to-day operation of foreign policy, the White House is in charge. Still, for better or worse, Congress reflects the broader populous and thus has exhibited swings in sentiment over various policy issues. Accordingly, in terms of foreign policy, Congress can push for sanctions and other policy measures that the president may be reluctant to implement as they might undermine other policy goals. This is a situation that has been part of American political history since Washington (our first president had to fend off congressional desires to join France against England in French Revolutionary Wars).

- Currently, Congress is pushing for numerous measures to punish China over various issues. Regarding Hong Kong, the White House is trying to prevent Congress from passing mandatory sanctions.

- Congress is pressing to ease restrictions that would allow Americans to sue China over pandemic costs.

- There are divisions within the executive branch as well. The Pentagon has published a list of 20 Chinese companies with ties to the Chinese military; it is presumed this list was created to reduce these companies’ ability to tap U.S. financial markets and perhaps sanction trade. The Senate is pushing for greater transparency for foreign firms listing on U.S. exchanges. It appears the goal of the bill is to force Chinese firms to give up their ties to the security state for access to U.S. financial markets. National Security Advisor O’Brien recently gave a speech that was sharply critical of the CPC.

- It is often the case that a president doesn’t necessarily oppose measures brought by Congress or other members of the executive branch; what presidents oppose are measures that restrict their ability to enjoy policy flexibility.

- Although direct hostilities appear to have eased in the India/China frontier, it does appear both sides are digging in for potential future conflicts. India has blocked the importation of various Chinese goods in retaliation for the recent attacks.

- There are increasing worries about military conflicts between China and the U.S.

Trade policy news:

- If you are a fan of European wines, get busy; there is a possible jump in tariffs on EU wine coming due to the ongoing dispute over EU aircraft subsidies. Other European “goodies” might be targeted as well.

- It looks like the structure of a grand bargain over Brexit is in the works. The U.K. would be allowed to make changes to its policy that may lead to an “uneven” playing field with the EU. In other words, if the U.K. relaxes its environmental laws, the EU could be at a disadvantage in trade. The EU will be given the right to selectively apply tariffs on U.K. goods to offset Britain’s advantage. The strategic ambiguity of this proposal is rather impressive; both sides can claim they got what they wanted, and a hard Brexit can be avoided. How it would actually work in practice is another matter, but this looks like a rather elegant solution.

- The U.K. is beginning to realize that a trade deal with the U.S. may require it to simply adopt U.S. regulatory policy.

Foreign news:

- Poland could receive American soldiers who are likely to be removed from Germany, assuming Poland is willing to pay for billeting U.S. troops. Poland does want the U.S. presence to remain in Europe; given Poland’s history, this is a very reasonable request.

- Russia held its May parade yesterday; the country goes to the polls today on a referendum to extend Putin’s rule.

- Mexico suffered a massive earthquake yesterday but, so far, fatalities have been remarkably light. Mexico’s unions oppose the decision by the government to nationalize lithium mines.

Economic news:

- The IMF downgraded its economic outlook, indicating the world economy will shrink 4.9% this year compared to its earlier estimate of -3.0%. The pandemic was blamed.

- One of our concerns about the economy is that state and local governments, facing falling tax revenues and pandemic costs, will be forced to curtail services and lay off workers. There are reports that New York is facing this problem.

- The Fed is conducting bank stress tests. Governor Quarles is suggesting banks test for a second downturn in the economy.

- Yelp reports that 140K businesses remain closed due to the pandemic; around 40% of those firms may not reopen.

- Congressional leaders are criticizing the Fed for relying on the three major rating agencies in their purchases of corporate debt. If the Fed widens its buying beyond this group, the central bank may be accepting more credit risk.

- We have been monitoring the financial markets for evidence of election worries. One of the issues that is evolving is that the widespread use of absentee ballots, due to COVID-19, will delay reporting results and thus it is very possible that we may not know for certain who won on the day after the election. That will include congressional races as well. We are seeing a rise in JPY call option purchases for November as traders speculate that the yen would rally if uncertainty over the election were to develop.

- On a lighter note, MLB will allow mascots to return when the baseball season resumes. Fredbird has avoided a layoff.

Weather news:

- Massive, widespread flooding is being reported in China. Although this is a period of seasonal rain, this year, rain has been much greater than normal. The Chinese party organ, the Global Times, reports that the Three Gorges Dam is ok…which, of course, begs the question: why did the CPC need to tell us that? We are also seeing flooding in Ukraine.

- Yesterday, we reported on the arctic heat wave; it appears that the higher than normal temperatures could trigger widespread fires.