Weekly Energy Update (July 23, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. The oil market has stabilized at higher levels after April’s historic collapse.

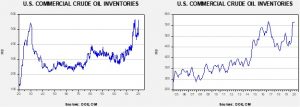

Crude oil inventories reversed part of last week’s unexpected draw, with stockpiles rising 4.9 mb compared to forecasts of a 0.8 mb draw. The SPR was unchanged this week.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.1 mbpd. Exports rose 0.5 mbpd, while imports rose 0.4 mbpd. Refining activity fell 0.2%, near expectations.

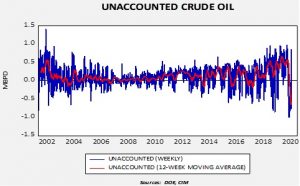

Unaccounted-for crude oil is a balancing item in the weekly energy balance sheet. To make the data balance, this line item is a plug figure, but that doesn’t mean it doesn’t matter. This week’s number is +857 kbpd. This is a large number and suggests the DOE is still struggling to figure out what is going on in the domestic crude oil market. The rise may be signaling that production is returning faster than the official figures indicate, but we will need to see more data to confirm that notion.

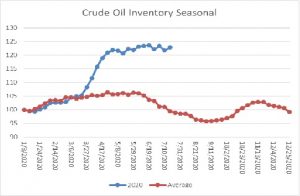

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s data showed a rise in crude oil stockpiles. We are well into the seasonal draw for crude oil. By this time of the summer, we have usually seen a 5% decline in commercial storage. The fact that inventories are mostly steady is a bearish factor.

Based on our oil inventory/price model, fair value is $28.63; using the euro/price model, fair value is $54.37. The combined model, a broader analysis of the oil price, generates a fair value of $41.68. We are starting to see a wide divergence between the EUR and oil inventory models. The weakness we are seeing in the dollar, which we believe may have “legs,” is bullish for crude oil and may overcome the bearish oil inventory overhang.

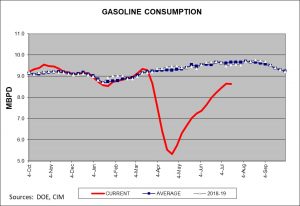

After a steady recovery since the trough in late April, gasoline consumption stalled this week. We suspect this is related to the surge in COVID-19 infections; if it continues, it is a bearish factor for crude oil prices.

In geopolitics, we are seeing growing tensions in the Eastern Mediterranean between Turkey and Greece over natural gas deposits around Cyprus. This dispute could involve multiple countries, including Egypt and Israel. Complicating matters further is the current proxy war in Libya.