Daily Comment (August 10, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

It’s Monday! Welcome back from the weekend. Equity markets are mixed. Foreign news leads off this morning as we cover the rise in unrest in Belarus, Lebanon, and Bulgaria. Policy news comes next, where we touch on the executive orders. China is third, economic and market news bats fourth, and we close with the pandemic. Here are the details.

Foreign news:

- According to the Central Election Commission, Belarus President Aleksander Lukashenko captured 80.23% (yes, that degree of precision) of the vote, with the leading opposition candidate getting 9.9%. Civil unrest emerged shortly after the polls closed with over 20 cities reporting protests; riot police were dispatched. Internet service was disrupted. Widespread voting irregularities have been reported. The outcome of the election was not a surprise; Lukashenko controls the voting apparatus and, in a fair vote, probably would have won. But, the problem for dictators is legitimacy. They crave the approval of the masses even though they won’t step down if the election results are adverse. Thus, a 55%-45% win probably would have been accepted, whereas 80%-10% is unrealistic in almost any case. What Lukashenko wanted was a nearly unanimous vote, which is only likely by ballot manipulation.

- So, what happens next? Although there were rumors that Lukashenko had fled, there is no confirmation that he has departed. Instead, it does appear various opposition leaders have left the country. Lukashenko will likely maintain power but will be damaged by this vote. His biggest threat will be within his own power structure. His second biggest threat is that President Putin tires of him and supports a replacement.

- Bulgaria is seeing rising civil unrest as protestors push back against widespread corruption. It’s not that the corruption is anything new; Transparency International ranks Bulgaria as the most corrupt nation in the EU. However, it appears the degree of corruption has reached a point where citizens are pushing back. We will be watching to see how the EU reacts to these developments.

- There were widespread protests in Lebanon in the wake of last week’s port disaster. Key ministers resigned over the weekend and the government appears adrift. It is not obvious how the situation in Lebanon will be resolved but it is becoming clear that (a) a power vacuum is developing, and (b) the country is in such a mess that there may not be any power center willing to take control.

- The U.K. and Japan are near a trade deal.

- As we warned in our WGR election series, the U.S. intelligence community confirmed that various nations are trying to sway our election.

Policy news:

- After the impasse in Congress, President Trump took unilateral action over the weekend and issued a set of executive orders to maintain stimulus. The orders themselves are controversial; after all, if presidents could legislate by executive order, why bother with a legislature? President Trump isn’t the first president to take such actions. George W. Bush was prone to issue statements after signing bills that indicated how he would execute the law, which was often in opposition to what Congress intended. President Obama aggressively used executive orders. Our primary worry about executive orders is that they bring wide vacillation on policy. The beauty of legislation is that most bills are crafted by consensus, which means the policy that emerges stays in place, allowing households and businesses to adjust. Executive orders tend to favor a certain outcome that can easily be reversed by the next president, leading to uncertainty that could impede the investment process. Here are the details of what the president signed:

- The first order creates a special unemployment benefit of $400 per week. Because the president can’t fund orders (funding is done by Congress), the benefit will be paid out of the Disaster Relief Fund. Here’s the catch—only 75% of the new benefit will be paid by the federal government. The states will need to provide the rest. Some states may simply not have the funding and thus won’t participate. In addition, the new program will require some administration by the states whose budgets are already stretched. It remains to be seen if this order will actually bring funds to the unemployed.

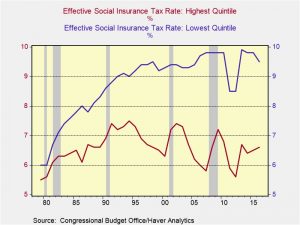

- The second order defers payroll taxes until year’s end. Under disaster declarations (which we are under due to COVID-19), the Treasury can defer taxes. This is how taxes were delayed until July this year. This action is also controversial. Although it does act as a potent tax cut to the lowest paid workers (Social Security payroll taxes are regressive; see the chart below), the deferral means that employers will be required to make up the tax when the order expires and thus they will be unlikely to do anything with the funds other than save them.

However, the most interesting item was that the president suggested he wants to do away with the payroll tax system altogether. In one sense, this would address a longstanding fiction that Social Security is a pension.[1] It’s not; it’s more like basic income for the elderly. In the absence of a payroll tax, Social Security will be funded out of general revenue. Franklin Roosevelt, in a political sleight-of-hand, created the payroll tax system to give the impression to Americans that they were paying into a pension fund. Every year, we receive lists of what we paid in and our future benefits. We will probably get the benefits, but not because we paid in. We get them by benefit of being an older American. By creating this mechanism, it made it impossible for subsequent administrations and Congress to get rid of Social Security, which was Roosevelt’s goal. If workers believed that the taxes were funding their individual pensions, it would limit the ability of future governments to change the benefit. Over the weekend, the Twittersphere went batty with comments about the end of Social Security. This isn’t going to happen. But, if there is a break in the payroll tax and the pension benefit, it will make it easier in the future to begin changing the benefit structure because the narrative of “I pay into the fund and get my money out” will be broken.

- There is limited deferral of student loan payment; private borrowing was not included.

- There is a limited eviction ban. The ban forbids evictions for federal guaranteed mortgages but not private ones.

China news:

- In retaliation for applying sanctions on leaders in Hong Kong and Xingang, Beijing has levied sanctions on 11 Americans. There were no specific actions tied to the sanctions.

- In Hong Kong, Jimmy Lai, a prominent media mogul and democracy activist, was arrested overnight under the new national security law. This is a very high-profile arrest and will certainly generate global reaction.

- Health and Human Services Secretary Azar visited Taiwan over the weekend. The fact that a cabinet secretary visited the island was not lost on Beijing, which greeted his visit by sending two military aircraft toward Taiwan.

- The “five-eyes” coalition of the U.S., U.K., Australia, New Zealand, and Canada are increasingly looking like the basis for an anti-China coalition. China appears to be recognizing that threat.

- Japan warned China about its naval activities in the South China Sea. Although rarely recognized, Japan has a potent navy and if its constitution relaxes restrictions on direct military activity, Beijing would have a problem.

- Flooding in China has affected rice growing regions and could lift food prices, always a politically dangerous issue for Chinese leaders.

Market and Economic news:

- All that empty mall space could be converted to fulfillment centers.

- Although price rallies in precious metals have been duly noted, industrial metals have been strong as well. Chinese stimulus efforts are a factor behind the rally, but dollar weakness plays a role too.

- The millennial generation is being scarred by economic turmoil. The oldest millennial, who is 39 years old, has seen a major bear market (2000-03), the Great Financial Crisis, and the pandemic. The Depression generation tended to be frugal to the point of excess; if the millennials follow that path, inflation worries are probably overstated.

COVID-19: The number of reported cases is 19,877,261 with 731,570 deaths and 12,127,638 recoveries. In the U.S., there are 5,045,564 confirmed cases with 162,938 deaths and 1,656,864 recoveries. For illustration purposes, the FT has created a nifty interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. There is evidence that infections in the U.S. are falling, which is good news. Perhaps the best way of thinking about COVID-19 in the U.S. is that we are completing the first wave. The wave began on the coasts and eventually moved inland and south, following the trend to move inside as summer temperatures rose.

- One of the most frustrating elements of COVID-19 is its novelty. It’s new and we don’t know exactly what we are dealing with. But humans, being prone to inductive thinking, tend to leap to conclusions.

- Initially, it appeared the virus spread on surfaces, so disinfecting and handwashing became the primary way to combat the spread. Now, it appears that virus aerosols are probably the primary transmission factor. Social distancing, meeting outside, and mask-wearing are thought to be the best way to slow the spread.[2]

- The data showed that children seemed to be mostly unaffected by the disease. That didn’t mean they couldn’t get it or get sick from it, but their morbidity was low compared to the elderly. However, new studies suggest that children can contract the disease and may be vectors in its spread.

- Another frustrating element of the virus is the dispersion of symptoms. Some people are deathly affected with long recoveries, while others have it and never know it. New research is focusing on the asymptomatic carriers to see if they might be a clue to counteracting the disease. One idea is that asymptomatic infections may reflect native immunity due to earlier coronavirus infections as this family of viruses includes common colds.

- Sweden has been a test case all along—it never implemented aggressive lockdowns or closed schools. It did have widespread nursing home deaths, but so did other countries. It is still unclear if Sweden has achieved herd immunity, but if it has, it would suggest another path toward living with the virus.

- There is great hope that everything gets better when a vaccine is released. However, recent polling suggests adoption may be slow.

[1] No real pension would only allow investment in one asset class, guarantee a payment level, and offer inflation protection. That’s not a pension, that’s basic income.

[2] As an aside, as we watch the Cardinals leadership struggle to manage the outbreak on the team, we note that European football has managed the disease rather well without a bubble, the preferred method of the NHL and NBA. We note that substitutes in soccer are kept apart, unlike MLB dugouts. We wonder if MLB might be better off following soccer’s protocols on substitutes.