Daily Comment (September 3, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Perhaps the biggest news this morning is that equity markets are set to open lower. Equities have continued to rally in an orderly fashion, with the major indices setting new record highs. Stocks have been lifted by improving earnings, low interest rates, moderate inflation and expectations of accommodative policy. We lead off with specific comments about the EUR and other reports about the economy and markets. Policy news is next; we cover the Beige Book and ongoing negotiations (or lack thereof) over new stimulus. Foreign news is next, focusing on the fallout from the Navalny poisoning. China news follows, and we close with the pandemic update. Being Thursday, a new Weekly Energy Update is available. Here are the details:

The Eurozone strikes back: In a recent WGR (and podcast) on the prospects for a Eurobond, we argued that the issuance of such a bond, which would be backed by the full faith and credit of the member states of the EU, could be a catalyst for a new bear market for the dollar. Given that the dollar is overvalued in terms of purchasing power, the greenback has been ripe for a few years of depreciation, something that should be welcomed by U.S. policymakers. The EUR has seen a “summer of appreciation”; in May, the EUR was trading around $1.08. A couple days ago, it touched $1.20. The move has caught the attention of ECB officials, who worry that the stronger currency will reduce already depressed inflation. But, it often takes a retired official to really say what is worrying governments—in a Bloomberg interview, Jean-Claude Trichet accused the Trump administration of “beggar thy neighbor” currency policies and suggested that the EUR should be at its levels seen earlier in the summer. Trichet’s comments are self-serving; the EUR is still well below our fair value estimate of $1.29 and locking in the EUR below that level gives Europe a competitive advantage over U.S. exporters. Current officials cannot be so candid, but we suspect Trichet is saying what the EU believes. It wants to remain an export promoter, and a stronger EUR will force Europe to change.

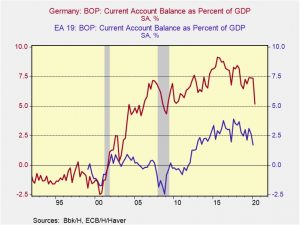

This chart shows the current account relative to GDP for Germany and the Eurozone. Since the Eurozone crises of the last decade, Germany has used the Eurozone to increase its current account surplus and has turned the entire Eurozone into a “Germany at large.” A stronger EUR is a threat to this situation. Will these comments change the trend? We doubt it. The EUR is undervalued, and the Eurobond reduces America’s ability to apply economic sanctions. We view yesterday’s commens as an attempt to slow the appreciation, but not enough to reverse it.

- The bounce in the dollar hit precious metals prices yesterday. In general, a stronger dollar is bearish for gold. But, if the U.S. is determined to weaken the dollar and the EU resists, we could create a “race to the bottom” in terms of trying to pull domestic demand from each trading bloc, which should be quite favorable for gold. In other words, if no one wants a strong currency, a non-liability backed one, like gold, should benefit.

Other economic and market news:

- Debt issuance is in (as it should be given current interest rates). The U.S. fiscal debt is projected to reach 100% of GDP next year, and corporate issuance is rising very fast.

- For the first time in three decades, Australia is officially in a recession.

- In the labor markets, there are increasing reports that furloughed workers are facing permanent layoffs. There is a growing possibility of a “K”-shaped recovery, where some sectors are recovering well and others continue to suffer. This isn’t the first time such divisions have occurred; in the 1980s expansion, we saw what was described at the time to be “rolling recessions.” For example, the oil patch was hit hard by the sharp drop in oil prices in 1986. Texas, Oklahoma and Louisiana slumped, but the rest of the country benefited from lower energy prices. This time around, we are seeing less geography and more sector divisions.

The Beige Book: The Beige Book is an overview of the economy compiled by the regional Fed districts. It offers a disaggregated view of the economy and can offer some geographic insights about the state of the economy. In general, the report suggests the recovery continues from the troughs seen in Q2, but the pace does appear to be slowing in most districts. The labor market conditions described above, where some workers are getting back to work while others are facing layoffs, is shown in this report as well.

- Congressional leaders remain divided over additional stimulus. Both sides continue to blame the other for the lack of progress.

Navalny and other foreign news: Germany has confirmed that traces of Novichok, a nerve agent produced by Russia, has been found in Alexei Navalny, the Russian opposition leader. German doctors have determined that it was a military-grade agent, suggesting that elements of the Russian security apparatus are probably behind the poisoning. The key question now is, “What does the West do about it?” One possibility is that Germany could cancel the Nord Stream 2 project; that outcome would delight Washington and be a blow to Moscow. Such a move would certainly harm relations between Germany and Russia, but it would send a signal to Putin that his actions do carry consequences. We could see U.S. natural gas benefit from the cancellation as it would likely increase demand for American LNG.

- Unrest continues in Belarus. The U.S. is backing an EU proposal for new elections. One potential problem for Lukashenko is that the tech sector, which has been an area of growth for the country, is considering relocation. If the companies move, their skilled workers will probably follow.

- Bulgaria is also facing civil unrest as protestors have been out in force for the past two months opposing the government of Boyko Borissov. The protests are all about high levels of corruption in this Eastern European nation.

- The Brexit negotiations are at loggerheads; the GBP has eased on concerns. The EU is accusing British negotiators of bad faith, but the EU wants to put Britain in a position where it faces all the restrictions of a member without voting rights. A hard Brexit is an increasing possibility; the issue for markets is whether a hard Brexit would matter all that much. There is no doubt the U.K. economy would suffer from a break with the EU. It would see its trade with Europe plummet and the adjustment would be difficult. However, in the long run, the kingdom could develop a new policy course. That would look like the great unknown. But, for the time being, the odds of a hard break are rising.

China news:

- The State Department has issued new restrictions on Chinese diplomats, who are now required to seek U.S. approval to visit U.S. college campuses. The U.S. is framing this as “reciprocal,” which is generally true; China places restrictions on the freedom of movement of diplomats. The move will weaken relations with China but is consistent with other actions seen this year.

- Although no new skirmishes on the China/India frontier were reported overnight, tensions remain high. India has banned more Chinese technology and is building up its forces in the region. Defense ministers of both nations are going to be at the Shanghai Cooperation Organization meetings being held in Russia. The participation could offer a chance to talk, or simply make for an awkward gathering for the rest of the group.

- China’s foreign minister, Wang Yi, has been on a charm offensive in Europe. By all accounts, the Europeans are resisting.

- Negotiations continue over the fate of TikTok. The sticking point is the algorithms that drive the app. If that software isn’t part of the sale, the value of the company to a non-Chinese owner is lower than otherwise.

- Although the EU is clearly unhappy about the EUR’s appreciation, Chinese officials, so far, have been quiet about the CNY’s rally.

- Since the 1970s, the U.S. has engaged in a form of strategic ambiguity over Taiwan. Either it hasn’t confirmed that it would defend the island or hasn’t delineated on what terms it would intervene militarily. This position has served the U.S. well, but, according to Richard Haase, the policy has probably outlived its usefulness. Given the rising strength of China’s military, Haase argues the U.S. should make clear its intentions.

COVID-19: The number of reported cases is 26,062,946 with 863,741 deaths and 17,316,206 recoveries. In the U.S., there are 6,115,184 confirmed cases with 185,752 deaths and 2,231,757 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. Axios has updated its state map; the reopening of colleges has led to a rise of infections in several states.

Virology:

- Although vaccines continue to dominate the news, we have paid close attention to treatment options. It is possible we will never get a vaccine that works, or if we do, it may only offer limited immunity, similar to influenza. However, treatments that reduce the lethality of the disease would reduce the risk of infection and perhaps the costs of natural herd immunity. It appears that common steroids improve the outcomes for people with severe cases of the disease.

- Meanwhile, the vaccine debate continues. The CDC has asked states to prepare for distribution of a vaccine by November, and the FDA appears ready to grant emergency use before year’s end. The political overtones are hard to miss, but our concern is twofold. First, it will take a while before we know the longer-term effects of any vaccine. If it turns out the early candidates have flaws (e.g., require multiple doses, cause unexpected side effects), it could dampen the acceptance of future, perhaps more effective, vaccines. Second, it’s possible that demand overwhelms supply, leading to concerns about distribution, or that the rush makes adoption slow (we are leaning toward the second outcome). The third item to remember is that vaccines have complicated supply chains. Getting a vaccine and getting production to scale are two different things. In other words, the announcement effect may not last once the hurdles of distribution are revealed.

- Silvio Berlusconi, the former PM of Italy, has an asymptomatic case of COVID-19.