Weekly Energy Update (December 3, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Positive news on a vaccine for COVID-19 led to a strong rally this week, taking prices to the upper end of the current trading range.

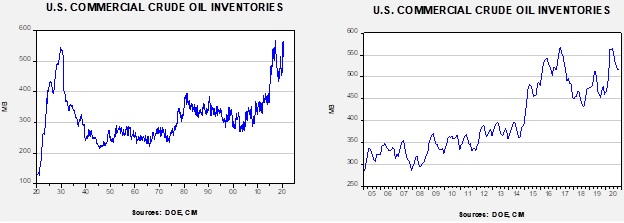

Commercial crude oil inventories fell 0.7 mb when a 1.7 mb draw was expected. The SPR was unchanged; there is still 3.2 mb of storage in excess of the 635.0 mb that existed before the pandemic.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.1 mbpd. Exports rose 0.6 mbpd, while imports rose 0.2 mbpd. Refining activity fell -0.5%.

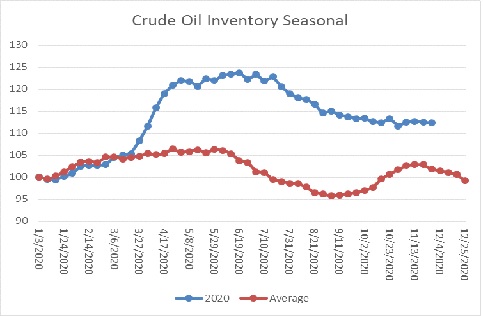

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s data showed crude oil stockpiles were steady, which is somewhat contraseasonal. Inventories are past their second seasonal peak and usually decline into year’s end.

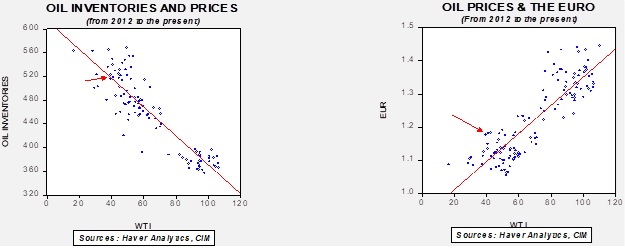

Based on our oil inventory/price model, fair value is $44.18; using the euro/price model, fair value is $63.55. The combined model, a broader analysis of the oil price, generates a fair value of $52.78. The wide divergence continues between the EUR and oil inventory models. However, current oil prices are below all three measures of fair value, suggesting that oil prices are likely undervalued. The most important support is dollar weakness.

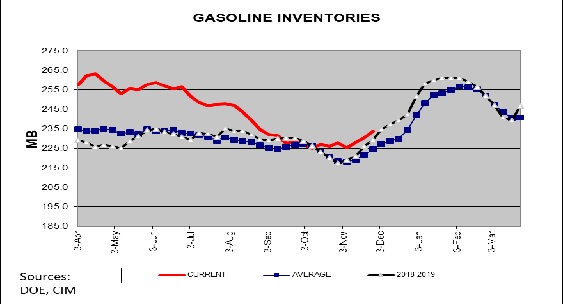

The above chart shows weekly gasoline inventories. Beginning in early November, inventories begin their seasonal increase that lasts into early February. We are clearly seeing the usual seasonal pattern develop, which means that gasoline inventories should continue to rise for the next several weeks.

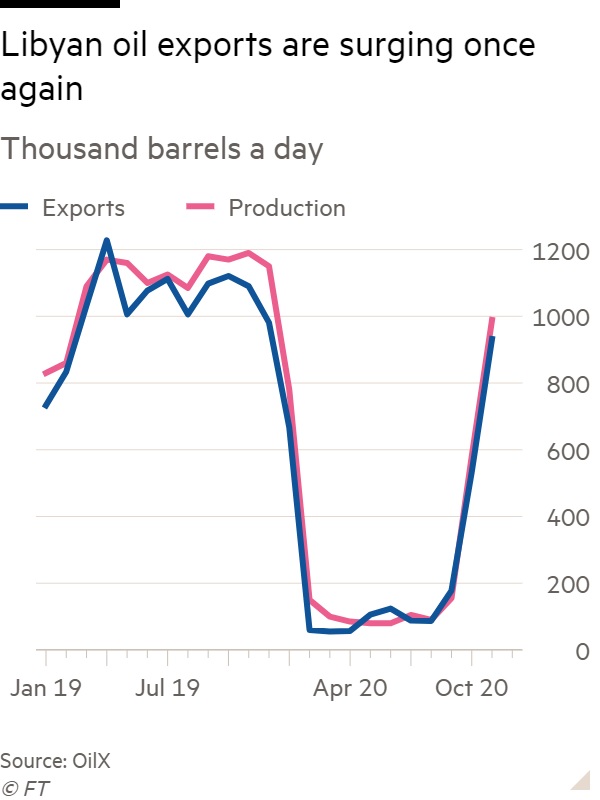

At the time of this writing, OPEC+ had not reached a decision; talks are continuing. The UAE has expanded its production capacity and would like to boost output. Iraq, which needs the revenue, would like to as well. Libyan production is recovering, adding to global supplies.

But the biggest problem facing OPEC+, and to some extent, all oil producers, is the issue of peak demand. If actions taken to manage climate change lead to less oil consumption, then oil reserve owners face the problem of stranded assets. If demand and prices are set to decline on a secular basis, then there is an incentive to produce now as the value of future oil will likely be less. It is important to remember that the reason for the collapse in oil prices in April was due, in part, to a market share war within OPEC+. Although it is difficult to parse out all the factors that played a role in the Saudis backing away from their policy of lifting market share (and, consequently, pushing down oil prices), there is a strong case to be made that President Trump’s intervention played a role. With Trump set to leave the White House next month and President-elect Biden’s policy of reducing carbon, the Saudis may be more inclined to return to their earlier policy. So far, Riyadh is holding the line on production cuts. But, if frictions rise high enough, Saudi Arabia may decide to restore discipline. We do find it interesting that, just a few short months from negative prices, the cartel is getting antsy to boost output. If OPEC+ fails to maintain production cuts, the U.S. energy industry, still struggling, will see further production declines.

In other oil and gas international news:

- Mohsen Fakhrizadeh, a leading Iranian nuclear scientist, was assassinated on Friday while traveling in a motorcade outside Tehran. Israel is thought to be behind the attack, although its policy is to never admit or deny an operation unless its personnel are caught. It appears the assassination was partially done by remote control. This isn’t the first time Iranian nuclear scientists have been targeted; at least four others were assassinated between 2010 to 2012. Iran will likely avoid escalating the situation to avoid undermining the potential for improved relations with the incoming Biden administration. In addition, Tehran will want to avoid escalation in the waning days of the Trump administration, fearing a “parting shot” from Washington. This gives Iran’s adversaries a window of opportunity to engage in attacks. At the same time, this attack, along with others, will make it difficult for Iran to change its relations with the U.S. even with a new administration in place. Iran generally doesn’t directly attack Israel, instead focusing on Israel’s overseas interests, but it will be difficult for Iran to not respond in some fashion. The trouble is that responding after the inauguration would make it nearly impossible for the Biden administration to open negotiations. The impact on markets, thus far, has been modest. Iran isn’t trading much oil so we would not anticipate any disruptions in oil supply, although there is a possibility that U.S. interests in Iraq could be targeted.

- Houthi rebels attacked the Saudi oil export facility in Jeddah earlier in the week. The missile struck a storage tank, but damage was otherwise limited.

- The administration is working to end the standoff between Qatar and Saudi Arabia. Three years ago, Riyadh established a blockade on Qatar (there were pictures of dairy cows being flown into Qatar as part of the response). According to reports, Jared Kushner is going to the region to hold talks on ending the blockade.

- Venezuela has convicted six oil executives and sentenced them to prison. They were charged with corruption.

- Europe has been restricting natural gas imports from areas where it believes methane leakages are not properly monitored and contained. Although U.S. firms have faced import restrictions from the EU, there is hope that the incoming Biden administration will be able to convince the Europeans that U.S. LNG is safe.

- Bitcoin prices have been surging recently; the “mining” of bitcoin requires massive computing power and, thus, electricity. Russians are being accused of using Abkhazia’s cheap electricity to establish server farms to mine bitcoin. In 2008, the region was invaded by Russia and is no longer under the control of Georgia. The region has claimed independence, but only a handful of nations recognize its independence. Bitcoin mining is leading to local power outages.

Hydrogen is getting a lot of press lately. Japan and Australia are working on a project where the latter supplies the former with the gas from coal. South Korea and China are also working on projects. There are reports that salt mines are being prepared to inventory to product. Even pundits are getting involved.

A massive solar project is being planned in Texas, the largest in the U.S. Of course, with solar and wind, battery storage remains an issue. Batteries are seeing new investment as well. And, there is new research in recycling oil EV batteries, which may further increase storage capacity. The commitment to EV by car companies appears to be increasing; General Motors (GM, USD, 44.68) has decided to exit the lawsuit it had joined against California over emissions standards.

Although propane fundamentals do not suggest a supply problem, a rise in outdoor dining has led to restaurants firing up portable heaters, which is leading to localized shortages.

Finally, the CFTC did not blame anyone for the oil price declining into negative territory in April. We suspect that passive investment played a major role in the decline, but government regulators were unable to make a determination. It is possible this decision could be revisited under the new administration.