Daily Comment (December 14, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! U.S. equity futures are higher this morning as vaccine distribution begins. The Electoral College votes today. There are two big items today—Brexit and the vaccine, so we lead off with those two categories. There was a major hack announced over the weekend. The Fed meets this week. We update economics and policy and close with a roundup of foreign news. A note to readers—the Daily Comment will go on holiday hiatus starting December 23 and return on January 4. And, watch for our 2021 Outlooks; we will publish both the 2021 Outlook and the 2021 Geopolitical Outlook later today. Here are the details:

Brexit: That “whoosh” you heard over the weekend was the passing of another deadline! Last week, after PM Johnson and EC President von der Leyen met, Sunday was said to be the end of talks. However, as we have seen throughout this whole process, the real deadline is that last possible day, which in this case, will be December 31, 2020. The leadership indicated it would continue talking, even though the tone was decidedly pessimistic. The GBP rallied on the news. Here are the details of what we know so far:

- The “level playing field” issue has been a key sticking point. According to reports, although the two sides are not in agreement, there was a hint of progress on this issue, which is probably why talks were extended.

- The EU is clearly worried that if talks fail, individual EU states will try to make their own deals with the British. This action would undermine the EU and Brussels is warning them to continue to work in concert.

- The Royal Navy is preparing four patrol ships to guard British fishing areas if a hard Brexit occurs.

- The U.K. appears woefully unprepared for a hard Brexit. There are warnings that food shortages are possible; such warnings will only trigger hoarding, which will exacerbate the problem. There are said to be two thousand vacancies in Britain’s civil service related to trade and other issues if a hard Brexit occurs. Perhaps the lack of planning for a hard break has led EU negotiators to postulate that the Johnson government isn’t really serious about a sudden exit. We suspect that if true, this is probably a miscalculation on the part of the EU.

- An interesting development is occurring in Norway. That nation has a trade arrangement with the EU even though it is not a member. In the arrangement, Norway pays to be in the EU, but it has no say in its governance. It has been offered as a model to the U.K., although it looks unattractive. This arrangement has apparently become unpopular in Norway. Next year, elections will be held, and Euroskeptic parties are making gains by promising to renegotiate the current arrangement.

- Overall, we still expect some sort of deal to be struck but not until the last possible moment. That is usually how EU negotiations work.

COVID-19: The number of reported cases is 72,336,167 with 1,314,159 fatalities. In the U.S., there are 16,257,899 confirmed cases with 299,191 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors.

Virology

- And so it begins—vaccine distribution of the Pfizer (PFE, USD, 41.12)/BioNTech (BNTX, USD, 127.30) is now underway. It is a logistical challenge; the mRNA-based vaccine must be kept at -94o until it reaches its final destination. The first doses left Gerald R. Ford International Airport in Grand Rapids, MI from Pfizer’s Portage, MI facility over the weekend. Injections at nursing homes are expected to begin today. We also expect a massive public relations blitz to begin to encourage Americans to take the vaccine.

- Meanwhile, around the world, the news on the pandemic is grim:

- South Korea, which has generally managed to keep the virus under control, is facing a new wave of infections as winter sets in. There is reluctance to implement restrictions due to the negative effect on the economy. Japan is also seeing a rise in cases.

- Germany is implementing new restrictions as cases and fatalities rise.

- Sweden, which had famously opted for light restrictions and allowing for the virus spread to bring herd immunity, is facing serious ICU capacity constraints as infections rise. Its Nordic neighbors are offering help.

- Russia is facing a wave of anti-vaccine online content which is apparently slowing the acceptance of Russia’s vaccine.

- Peru has suspended its trials of China’s Sinopharm (SHTDY, USD, 12.28) vaccine due to a “serious adverse event.”

- Sanofi (SNY, USD, 47.83) has suffered a serious setback in its vaccine as inadequate controls led to some participants getting too small a dose. The problem will delay its Phase 3 trials to H2 2021.

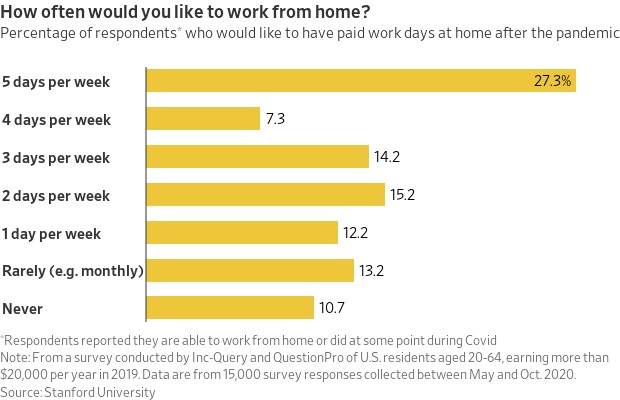

- Work from home has become part of the response to the pandemic. Google (GOOGL, USD, 1774.80) announced it won’t allow workers to return to the office until September 2021, and when they do, it will only be for 3 days a week. It is looking increasingly like work from home will become a permanent part of the landscape going forward.

This chart shows nearly 50% of respondents to this survey would prefer to work more than three days per week from home.

The hack: Over the weekend, several government departments, including Treasury and Commerce, admitted they had been hacked by what appears to be a foreign government, very likely Russia. The hack came to light after the cybersecurity firm FireEye (FEYE, USD, 13.83) announced its systems had been penetrated through a software distribution management firm called SolarWinds (SWI, USD, 23.55). The government has ordered all its departments to disconnect from the software. According to reports, the hackers have been placing malware in U.S. computer systems since early spring, meaning they have had nine months to capture data. It is still too early to tell what has been lost or what the hackers were after. Apparently, it was a massive breach.

- Although it may not be related, Google has indicated it is facing a widespread outage.

The Fed: The FOMC meets this week and is trying to manage an upcoming problem. It is clear that the economy is going to face a serious slump in Q4 and Q1, but there could be a notable rebound as the vaccine is distributed. Thus, should it add stimulus now to help the economy in the short run and run the risk of inflation or dealing with the signaling challenge of tapering stimulus later in 2021? The good news about the vaccine is that it probably avoids the worst-case scenarios. Nonetheless, the chances of a bad outcome are not zero; fiscal stimulus could disappoint, and the current vaccine is a new technology that hasn’t been used beyond clinical trials. Thus, we expect the FOMC to extend its QE program.

Economics and policy: Fiscal stimulus talks continue and are tied to vaccine distribution.

- The political standoff on a large fiscal support package has not been resolved, so Congress is preparing a smaller bill with what it hopes can pass. Although we suspect the current bill is inadequate to support the economy, something is better than nothing and would help. We do note that some of the vaccine distribution is expected to be funded by state governments which may not have the revenue for this leg of the vaccine journey.

- It looks like a wave of evictions may be coming as Federal protections expire at the end of the year. We would not be surprised to see fewer evictions than expected, as landlords have little likelihood of getting back lost rent and finding solvent tenants might be difficult. Thus, coming to some sort of terms might make more sense.

- Independent delivery drivers are putting burner phones in trees around distribution centers to get the first crack at delivery orders.

- We have seen a surge in industrial metals prices. Steel firms are reporting stronger demand and are restarting mills. Prices are rising as well.

Foreign news: A roundup.

- The BOJ’s Tankan survey of manufactures showed a stronger than expected rise in Q4.

- One of the challenges of moving production out of China is that Beijing has tended to keep a lid on worker unrest. Indian production workers attacked an iPhone factory owned by Winstron (3231, NTD, 31.05) over wages and working conditions.

- China announced it is prosecuting a rating agency manager who apparently took bribes to give companies favorable ratings.

- It is looking increasingly like the Belt and Road initiative is going to end up being China’s first overseas debt crisis.

- Iran’s execution of Ruhollah Zam, a journalist, was condemned by the EU. Iran has summoned the ambassadors of France and Germany to protest the interference in Iran’s internal affairs. Iran’s decision to execute Zam will not help their goal of easing sanctions.

- Stagflation in Pakistan led to widespread protests yesterday.

- The Mexican legislature is fast-tracking a law that would reduce cooperation with the U.S. on drug trafficking. According to reports, the U.S. was caught off guard by the new law, which was proposed by AMLO. The action stems from the U.S. decision to arrest former defense minister Gen. Salvador Cienfuegos earlier in the year on drug trafficking charges; the charges were later dropped.

- Iraq has struggled to maintain order this year. An area that had been relatively calm, the Kurdish north, faced protestors angry about delayed payments of government salaries and pensions. The Kurdish leadership and Baghdad have been at loggerheads for some time, and the latter has retaliated by not sending funds to the Kurds.

- For years, Cuba’s official exchange rate of pesos to the USD has been parity. The market rate has been nowhere close to that level, but the parallel exchange rates have likely benefited insiders in the government. In a surprise move, the government announced a massive devaluation, taking the official rate from 1:1 to 24:1. We reported last week that there were protests by artists; the leadership wants to make sure that this devaluation won’t trigger civil unrest. Although dollars circulate in Cuba, this devaluation will almost certainly trigger inflation and further impoverish those who don’t have access to dollars.

- The ECB will allow banks to resume paying dividends with some limits.