Weekly Energy Update (January 25, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

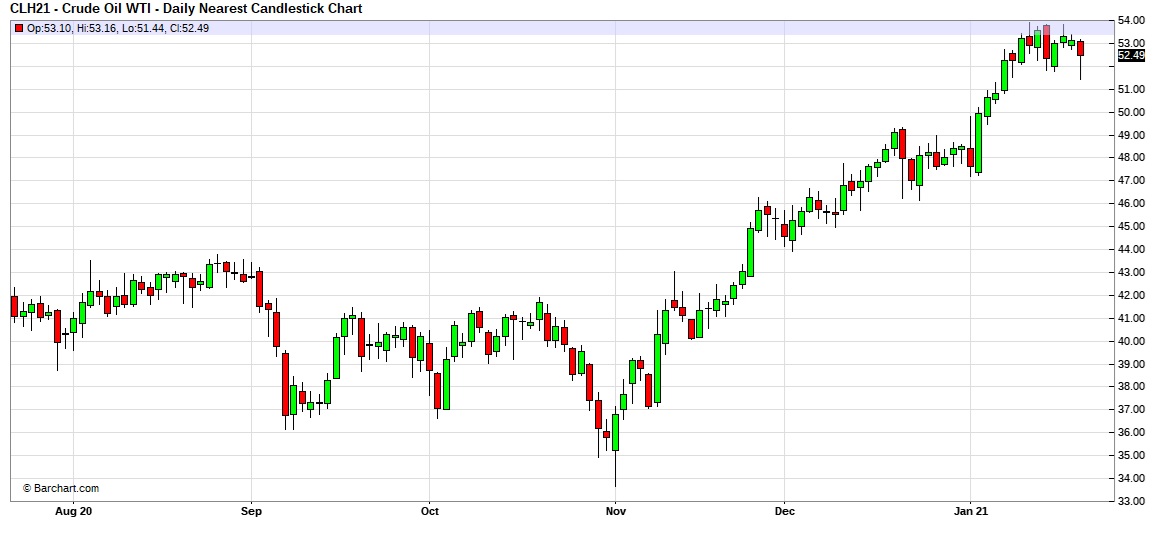

The report was delayed due to the Martin Luther King Jr. holiday. Here is an updated crude oil price chart.

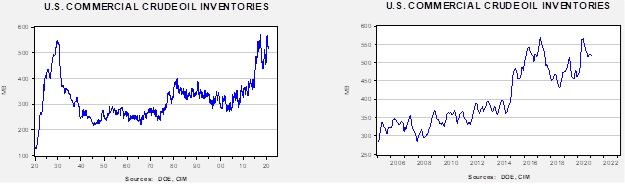

Commercial crude oil inventories unexpectedly rose 4.4 mb, when a decline of 1.3 mb was forecast.

In the details, U.S. crude oil production was unchanged at 11.0 mbpd. Exports fell 0.8 mbpd, while imports declined 0.2 mbpd. Refining activity rose 0.5%.

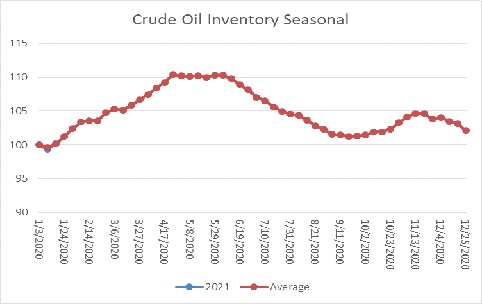

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s rise is normal (although it seemed to surprise most analysts). If we follow the seasonal pattern, inventories will rise about 10% into mid-April. That situation should be factored into the current price but the anticipated rise in stockpiles isn’t a positive for the market.

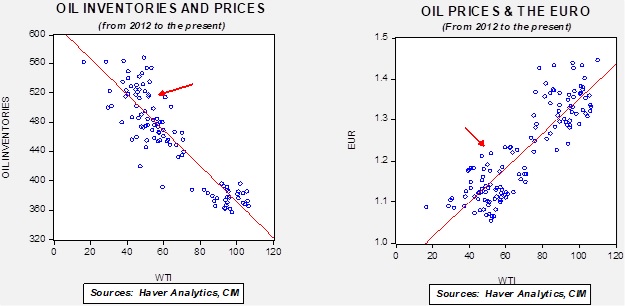

Based on our oil inventory/price model, fair value is $44.83; using the euro/price model, fair value is $70.97. The combined model, a broader analysis of the oil price, generates a fair value of $56.43. The wide divergence continues between the EUR and oil inventory models.

In geopolitics, we continue to watch with great interest the situation with Iran. The U.S. withdrawal from the JCPOA led Iran to violate its restrictions on enriching uranium. It has also moved further toward acquiring a domestic nuclear weapon. The incoming Biden administration has signaled it would like Iran to return to the constraints of the JCPOA; we have doubts Iran will accept this program, fearing that a future administration will withdraw again. We note the U.S. has shifted Israel from the European command to Central command. For years, the U.S. put Israel under the supervision of the European command to avoid upsetting the Arab states. From an operational standpoint, it makes more sense for Israel to be in Central command and now that several of its Arab neighbors have normalized relations with Israel, the emerging alliance structure in the region should benefit from the switch.

- Islamic State is returning. It claimed responsibility for two suicide bombings in Baghdad. This group has shown remarkable resilience. Although the U.S. and other allies seemingly eliminated the group a couple of years ago, if efforts are not maintained, it has the habit of re-emerging.

- Venezuelan oil is under sanction by the U.S. China is putting additives in Venezuelan oil to mask its origin and transferring cargos at sea to avoid sanctions and acquire Venezuelan crude, “laundering” the shipping documents through Swiss shipping companies. According to reports, Venezuela accounts for 50% of China’s oil imports.

On the policy front, we are seeing the following developments:

- The OCC has ruled that banks cannot exclude the Energy sector as a class without offering specific reasons why services won’t be provided. This won’t preclude a bank from refusing to lend to an oil company if the risk is considered too excessive, but it means the bank cannot refuse to make the loan just because it’s an energy company.

- Although this is the current ruling, we expect the incoming administration to provide cover for financial services to reduce lending and other services to the sector under the aegis of combating climate change.

- The French oil company Total (TOT, USD, 45.06) has ended its membership with the American Petroleum Institute, the oil lobbying group. The decision highlights the differences between U.S. and European supermajors.

- Last week, we discussed how environmentalists were focusing on constraining pipeline growth as a way to restrict the expansion of fossil fuels. This tactic looks like it will find support from the incoming Biden administration as one of his initial executive orders was to cancel the XL pipeline. The state of Michigan has ordered the closure of the Great Lakes Pipeline, a line that carries oil and natural gas liquids from Alberta to U.S. and Canadian refineries. Part of the line runs on the lakebed from the Upper Peninsula to Michigan and environmentalists argue that a rupture would create catastrophic conditions. Rising oil imports from Canada are straining the existing pipeline infrastructure and the inability to build more capacity will create bottlenecks and price distortions. We expect this trend to continue under the new administration.

- The state of New York is planning to build miles of new power lines to tap electricity from wind and solar farms that are usually situated in rural areas. This plan will pit environmentalists and landowners against each other.

- Courts have struck down a Trump era regulation that allowed for greater coal use by electric utilities. Despite this action, higher natural gas prices will likely boost coal demand this year and create a problem for the new administration. Adding to this pressure are signs that the new administration will crack down on methane emissions from natural gas wells and pipelines. We also note that Vale (VALE, USD, 17.03) is divesting itself from its coal mining operations in Mozambique.

- As countries begin to use carbon taxes to address climate change, the prospect for using carbon pricing tariffs to prevent free-riding carbon emissions will become a bigger issue. Trade officials have taken a dim view of such regulations in the past, fearing they could be used as an excuse for protectionism. Look for ideas like a “carbon border tax” to start circulating. We also note that the U.S. Chamber of Commerce appears to be supporting the idea of a carbon tax instead of regulation. And, a recent executive order recreates the Obama era working group on establishing carbon prices. The entire backbone of carbon reduction will need a workable carbon price so markets can be created to allocate carbon more efficiently.

- The Senate under Democratic Party control may allow for more climate legislation.

- The U.K. is considering a ban on new gasoline and diesel vehicles by 2030. If this plan is adopted on a more widespread basis, the oil and gas industry is in serious trouble as it will clearly show peak demand is on the horizon.

In alternative energy, we continue to see investment flows and batteries dominating the news.

- Hydropower has also been a mixed bag for environmentalists. On the positive side, the facilities create reliable electric power with no carbon emissions. On the negative side, dams change the environmental characteristics of the rivers where dams are built. Some dams were built long ago for flood control or navigation. Investors are looking at these old, smaller dams as offering the potential for hydropower, installing generators and using the existing facilities to create clean power.

- Batteries remain the key bottleneck in expanding alternative energy. Wind and solar, by their very nature, create intermittent flows of electricity. Electricity is difficult to store; conventional flow management usually relies on flexible excess capacity (peaking power) fueled by natural gas or stored water systems. This report offers some parameters on how cheap battery storage would have to be to replace conventional energy sources. To fully replace conventional, storage would need to cost $20 kWh. Current storage is around $175 kWh. However, if the target is 95%, the report suggests $150 kWh will suffice.

- Meanwhile, the race to build a better battery for EVs continues. The concept of a solid state battery that would allow for multiple recharges, longer range, and rapid recharging is the current rage.

- Of course, the mini nuclear reactor remains an interesting alternative. Researchers in the U.K. are making the case that fossil fuel use will continue without an expansion of nuclear power. (An aside: a smart lobbyist for the oil and gas industry would fund anti-nuclear groups.)

- Clean-tech firms’ equities continue to outpace oil and gas stocks.