Daily Comment (February 1, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Good morning and welcome back from the weekend. Lots going on, but first, equity futures have turned higher, and the Northeast is getting some snow. Our coverage leads off with the coup in Myanmar. Russian protests follow. The continuing saga of pros vs. flows continues this morning, with a look at potential systemic risk. Pandemic coverage is next, with a focus on the EU’s travails on vaccine distribution, followed by policy news. We close with China news. The current Asset Allocation Weekly is available.

Myanmar: Last November, Aung San Suu Kyi’s National League for Democracy won a landslide victory. Yesterday, the military decided they’d had enough of civilian rule and removed her government from power. The generals claimed fraudulent elections occurred last November for deciding to take control. The usual tactics were deployed—communications were cut off, and airports were closed. The military gave up control to civilians in 2015; it now claims it will return the government to the civilians in a year. The U.S. and EU have protested against the coup; however, China has made deep inroads into Myanmar over the years, and, so far, Beijing seems ok with proceedings. Suu Kyi has called for protests.

Myanmar is a frontier market, meaning that its impact on emerging market indices will be modest at best. However, it is an important nation in South Asia and the coup will likely improve China’s foothold in the region. China has made investments in Myanmar and could use the country for the transit of goods in the event of a naval blockade. We don’t expect an immediate market effect from this event, but it is one that merits watching.

Russia: Although we don’t expect Putin to face significant risk from Alexei Navalny, he is facing widespread unrest. Russia had another wave of protests over the weekend. A notable trend is that, unlike earlier protests that were mostly urban, this one is occurring around the country. Security forces are retaliating aggressively. Thousands have been detained, and curfews are being implemented. What is driving the continued protests in the dead of winter? Anger over corruption appears to be the underlying issue. The massive palace on the Black Sea has struck a nerve with Russians. Although Putin has denied ownership, that is generally not believed. We expect Putin to bring the civil disorder under control, but its continued existence does indicate the level of distress in Russia.

Pros vs. flows: The saga of GameStop (GME, USD, 325.00) continues. The latest controversy is over Robinhood’s decision to restrict the trading of some of the Reddit raiders’ favorite stocks. Although there is grumbling that the firm is trying to prevent traders from generating short squeezes, the reality is more pedestrian—clearing firms are lifting safety margins on volatile stocks, thus the firm is forced to restrict trading to maintain risk buffers.

Market manipulation rules require some degree of misrepresentation to impose a penalty. A group merely discussing whether to buy or sell a stock doesn’t, by itself, designate illegal activity. There are differing opinions on whether or not the activity on Reddit constitutes illegal market manipulation. The SEC is expected to investigate the recent activity. But, for now, we doubt that there will be widespread action taken by regulators.

After reflecting on this issue over the weekend, there are two items we view as important. First is the issue of the “wisdom of crowds.” The advent of decision markets has highlighted the insights of large groups of people. We use decision markets for tracking elections and generally find that they give us better signals than we get from polling. However, any reading of history will also indicate that crowds can go mad. There is no obvious trigger point where a crowd goes from insightful to unhinged, although there is an element of the Judge Potter Stewart opinion to the current situation. Second, we are closely watching to see if the “flows” lead to something systemic. Our first whiff may have occurred on Friday.

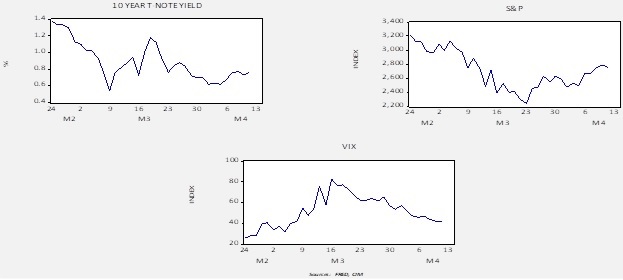

One item that caught our attention late last week was Friday’s “sell everything” trend. To be sure, it wasn’t as pronounced as the one we saw in March 2020, but it bears watching. As a reminder, this is what markets looked like last year.

Last year from late February into March, we saw the S&P tumble, the VIX rise, and Treasury yields rise, too. That is abnormal; long-dated Treasuries usually act as a hedge for financial risk, but as the pandemic raged, a separate financial crisis emerged that was leading some participants to sell “everything” to acquire liquidity. That crisis ended when the Fed essentially backstopped most of the financial system. To reiterate, this sort of pressure comes from excessive leverage, which is a side effect of ZIRP.

On Friday, we saw the VIX rise, equities decline, and long-duration Treasury yields rise. One day could simply be an anomaly, but the market action does suggest that “somebody” out in the financial system is scrambling to secure liquidity. The activity we saw on Friday wasn’t severe. However, if it continues, it may indicate rising stress, perhaps tied to the issues of the “pros vs. flows” situation. So far today, we are not seeing a repeat of Friday, but we continue to watch closely. If another March 2020 emerges, the key will be whether Congress and the Treasury quickly give the Fed the powers to backstop markets that it took away earlier this year.

Finally, silver continues to be one of the markets in focus; prices moved above $30 per ounce for a period overnight.

COVID-19: The number of reported cases is 103,036,685 with 2,229,601 fatalities. In the U.S., there are 26,188,167 confirmed cases with 441,331 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high- frequency data on various factors. The CDC reports that the total number of doses distributed is 49,933,250 and the total administered is 31,123,299, while the number of second doses, which would grant the highest level of immunity, is 5,657,142. The pace of infections, hospitalizations, and fatalities is falling as the country finally gets the post-holiday surge under control.

Virology

- The EU has had a tough time acquiring the vaccine and distributing it. The latest fiasco has to do with Ireland. Because Brexit leaves Northern Ireland within the EU’s trading bloc, the mandarins in Brussels are worried that vaccines sent to Ireland could find their way into Northern Ireland and the U.K. In response, the EU restricted vaccine flows to Ireland. As one would expect, Dublin was not pleased. After a few days of criticism, the EU backed down. Although this situation was resolved, the fact that the EU behaved this way is raising fears that Brussels is looking for ways to punish the U.K. for Brexit. The event will raise worries that relations will continue to deteriorate.

- France has ordered its borders closed to non-EU travelers.

- Civil unrest against lockdown orders has spread to Belgium.

- The EU has approved the AstraZeneca (AZN, USD, 50.60) vaccine for all adults. Earlier, it appeared that some EU states would not allow it to be injected into anyone older than 64.

- Macron praised the U.S. “Warp Speed” program.

- Two trends are converging that could mean the pandemic’s effects will linger. The first is the mutation of the virus. Coronaviruses mutate regularly. Often, they mutate to a less virulent form; after all, the goal of the virus is survival, so killing the host is not optimal. However, no plan or judgment is occurring with a piece of genetic material. The most recent variations appear to be spreading faster and could be more deadly, which could extend the return to normal. Second, vaccine nationalism is exacerbating the first trend. The natural action of politicians is to service their voters. After all, foreigners don’t get a leader elected. But, trying to get vaccines into the developed economies before distributing them to the emerging world means that new variants have a chance to develop. The convergence of these two trends probably means that the virus will be with us for longer than we expect.

- As the vaccine distribution in the U.S. ramps up, look for more participation from local pharmacies.

- One of the raging debates during the pandemic has been the best way to address it. One position held is that broad lockdowns and social distancing should be deployed to protect the population. The other position is that the virus should be allowed to circulate to bring about herd immunity. The debate has been difficult. The former position was criticized as not being realistic and too costly economically. The latter position was criticized as being immoral because it seemed to condone high fatalities. The latest data from India, which mostly followed the latter protocol due to its income status, shows a rapid decline in infection rates, suggesting that letting the virus circulate may have led to getting past it sooner. Blood tests suggest that at least 50% of the population is carrying antibodies, even though not nearly that many were symptomatic.

- Such a policy may not have been possible in the developed West. For one thing, India’s 65 years and older population is only 6.5%, compared to more than 20% in Europe. The virus is particularly lethal for older people, which would have raised the political costs in the West.

- In addition, we don’t know if the previous infections will protect against variants.

- It is also possible that the Indian population faces more infectious diseases on a regular basis, which may have offered its population some degree of natural immunity or resistance from other viruses.

- China is aggressively building quarantine centers, suggesting Beijing is worried about another increase in infections.

- Will dogs help open up public facilities? Canines are gifted with acute senses of smell and are used by security forces to find bombs and illegal drugs. The NBA is testing to see whether dogs can tell if a person has COVID-19 when they attend a basketball game. Some studies suggest dogs can determine with 95% accuracy if a person is infected.

- The CDC will now require masks on all forms of public transportation.

- Health care workers have been surprisingly reluctant to be vaccinated.

- Life insurers are starting to screen for COVID-19; it is unclear if they will use evidence of infection to deny life insurance coverage or lift premiums. It is possible they may require proof of vaccination to underwrite a policy.

- As Super Bowl Sunday looms, the NFL was able to complete its season. The league attributes its success to stricter rules on meetings and mask-wearing.

Policy and Economics: Here are some of the highlights.

- Ten GOP senators are calling for the Biden administration to open discussions to build a bipartisan stimulus bill. The opening bid is $600 billion. This will be a test of bipartisanship for the new government.

- Banks are preparing for stricter regulation under the new administration.

- Lockdowns have encouraged the purchase of higher-end liquor.

China: Hong Kong leads the news.

- The British National Overseas Passport was granted to Hong Kong citizens before the handover to China. So far, about 7,000 people have taken advantage of this passport. But with the U.K. now granting visa eligibility to some five million Hong Kong citizens, a massive expansion of those looking to flee the area is likely. We note that China will no longer recognize these passports.

- Multinationals are starting to write Hong Kong out of their legal contracts.

- PMI data suggest that recent COVID-19 outbreaks are slowing economic momentum, especially for services.

- China’s brokers are facing a surge of new investment; the industry is struggling to create investment products to deal with this high level of interest.

- As China moves to project power, it must learn the lessons of a large military. For example, the Peoples Liberation Army/Navy is discovering that operating a submarine force requires structures to protect its submariners from psychological stress. The USN began putting psychologists on submarines in the 1990s.