Weekly Energy Update (February 4, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

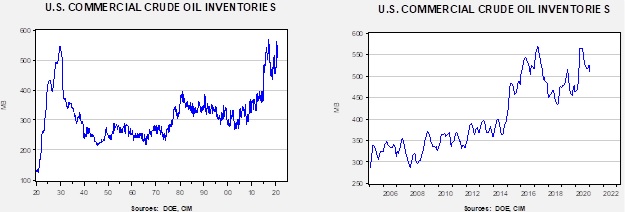

Here is an updated crude oil price chart. Prices broke out of their recent trading range and are now well above $55 per barrel.

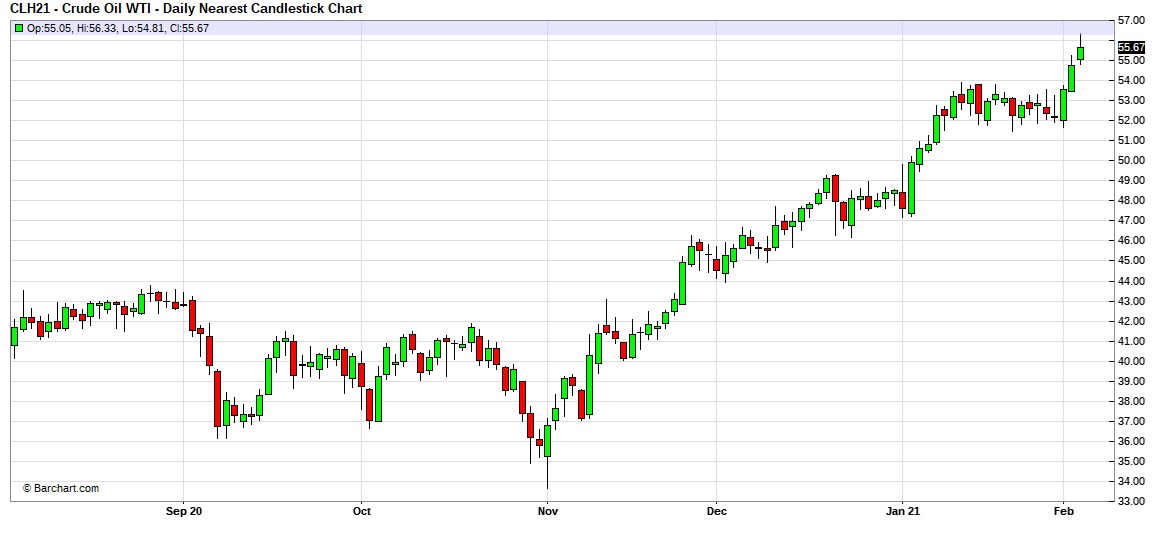

Commercial crude oil inventories unexpectedly fell 1.0 mb when a build of 3.0 mb was forecast.

In the details, U.S. crude oil production was unchanged at 10.9 mbpd. Exports rose 0.1 mbpd, while imports increased by 1.4 mbpd. Refining activity rose 0.50%.

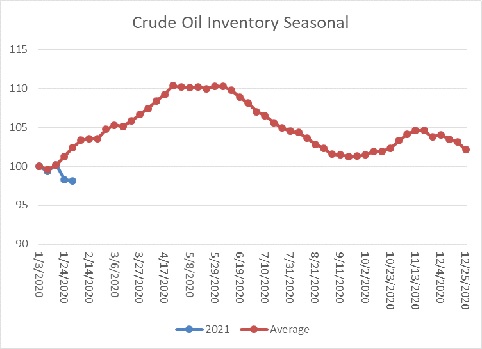

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s decline, though small, is contraseasonal. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. If we were following the normal seasonal pattern, oil inventories would be 22.4 mb higher.

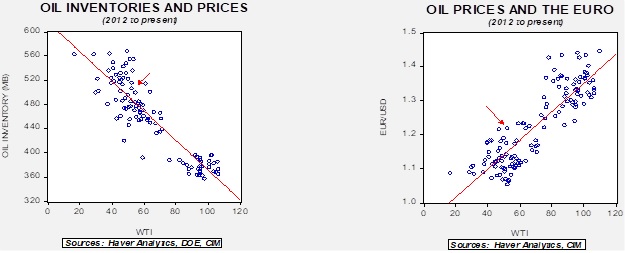

Based on our oil inventory/price model, fair value is $48.37; using the euro/price model, fair value is $70.79. The combined model, a broader analysis of the oil price, generates a fair value of $58.32. The wide divergence continues between the EUR and oil inventory models.

Geopolitical news:

- The Biden administration has reportedly offered the EU its terms for allowing the Nord Stream 2 project to be completed. First, the U.S. wants the EU (read: Germany) to renegotiate its gas transit contract with Ukraine. Second, it wants to build in a shutdown mechanism on the pipeline so that if Russia cuts off natural gas flows through Ukraine, the Nord Stream 2 flows would also be suspended. It’s hard to see why the EU would accept these terms. The whole point of the pipeline is to avoid the bottleneck through Ukraine, which holds the EU hostage to Russian/Ukrainian relations. But, Germany and the EU may want to show they want to work with the incoming Biden administration and agree.

- Israel is warning that it has new plans to attack Iran’s nuclear program. Given that relations with the Arab states have improved through the Abraham Accords, the logistics of an Israeli attack have improved. We doubt Israel will act but it is a warning to the new administration that the situation in the Middle East is fluid and may become a problem.

- Although the Biden administration says it would like to return to the Iran nuclear deal signed under the Obama administration, it is unlikely that Iran would return under the previous agreement. This situation makes returning to the deal difficult. Compounding the problem is Iran’s continued development of missile technology, which was generally excluded from the original agreement.

- At the same time, the Biden administration is suspending arms sales to the UAE and the KSA. This decision includes the sales of F-35s to the former, which was made in return for its recognition of Israel; we do expect the sale to be completed at some point.

Energy industry news:

- Although hope is rising for energy shares, it is still unclear if the industry, especially shale, can woo investors back. As we note below, the future isn’t bright. Although the world will be using oil and gas for the next couple of decades, it’s likely that consumption will decline over time.

- Adding to pressure is that pipeline projects are becoming much more difficult to complete. It may be that major projects have become impossible.

- Worries about a shrinking industry led two of the supermajors, Exxon (XOM, USD, 45.63) and Chevron (CVX, USD, 87.06), to discuss a merger in early 2020. As industry growth slows, and eventually contracts, cost-saving through mergers will likely become more common.

- The earnings for oil companies in 2020 were “brutal” as the pandemic and regulation weighed on the sector. This year will be better, but not stellar.

- It is important to note that commodities are priced based upon current supply and demand fundamentals with less regard for future market conditions. In other words, the price of oil a decade from now doesn’t have a major impact on current crude prices. But it does affect energy equities, which discount the future. Thus, the outlook for future oil demand is bearish for energy equities, but paradoxically it is actually supportive for oil prices because less investment means supplies will fall, likely faster than demand contracts.

- The only commercial carbon capture program closed, oddly, due to low oil prices. The program sold the carbon dioxide it pulled from burning coal to oil producers to enhance oil production (CO2 injection is one method to enhance oil output). When oil prices fell, it was no longer economical to operate the plant. Carbon capture has been one hope the fossil fuel industry has to maintain the industry in a low carbon world. Unfortunately, thus far, the programs have failed to deliver.

Alternative energy/policy news:

- General Motors (GM, USD, 52.48) announced it would phase out gasoline and diesel fuel vehicles by 2035, the first major automaker to create a hard timeline to offer a fully electric line of vehicles. It is not clear whether other automakers will follow, but if governments start to back this decision, the future of oil in transportation is facing a serious threat.

- Although the new administration is moving quickly to establish climate change regulation, the energy industry is responding, trying to slow the rollout.

- The oil and gas industry is trying to make common cause with the farm belt. After all, the electrification of transportation will curtail the use of ethanol and reduce the demand for corn. Unfortunately for oil and gas, the industry has undermined the use of ethanol by supporting the EPA’s exemptions for meeting the mandate for ethanol demand. It is expected that the Biden administration will not be as generous in granting exemptions. When a refiner can’t use enough ethanol to meet the mandate, it must buy Renewable Identification Numbers (RINs) to fulfill the mandate. The prices of RINs have been rising since summer. Farm groups have been upset by the wide use of exemptions which undercut the demand for corn ethanol.

- The Trump administration used the Commodity Credit Corporation (CCC) as a conduit for aid to farmers affected by the China trade conflict. This use was outside of the original mandate of the CCC, which was created during the Great Depression to support commodity prices. The Biden administration wants to continue to use this broader mandate, perhaps using the CCC funding to support a carbon bank, paying farmers for absorbing carbon by the crops they plant.

- In the waning days of the Trump administration, the OCC ruled that banks could not exclude industries from lending simply based on the industry itself. The Biden administration has reversed this ruling, which means that banks can decide not to make loans to oil and gas firms.

- The Fed is expected to support environmental lending as part of its regulatory mandate.

- Fund managers are getting into the act as well.

- Although the new administration has tried to make the point that expansion of jobs in solar and wind will offset losses in fossil fuels, the numbers don’t support the claim.

- The EU is creating a body to foster the development of batteries.

- The “hottest” area of batteries is solid state. Solid state batteries will charge faster, have greater range, and last longer than the current arrays. China claims it is making progress toward the commercialization of such a battery. Despite the hopes, it will probably take years before the technology is developed and commercialized.

- A problem for “green” energy is that much of it requires rare earths in construction. Rare earths production is mostly controlled by China, but the Pentagon is trying to support non-Chinese mining and processing by awarding contracts to firms.

- The other fuel we are watching is hydrogen. Although most of the focus is on batteries, a competitor would be fuel cell cars fueled by hydrogen. The process of extracting hydrogen from water offers the most promise but is still far too expensive to be practical. However, there is continued progress on this front.