Daily Comment (February 19, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

We have several recent multimedia offerings. First, we have a new chart book recapping the recent changes we made to our Asset Allocation portfolios. As we noted last week, we’ve also posted a new Confluence of Ideas podcast. Being Friday, we have a new Asset Allocation Weekly, chart book, and podcast. The new Weekly Energy Update is now available; it was delayed a day due to the holiday earlier this week. You can find all this research and more on our website.

U.S. equity futures are higher this morning as markets grapple with the steady rise in interest rates. We begin the discussion with our view of rising debt levels. From there, we cover policy and economics, with special focus on the minimum wage developments. A roundup of international news follows, and we close with a pandemic update.

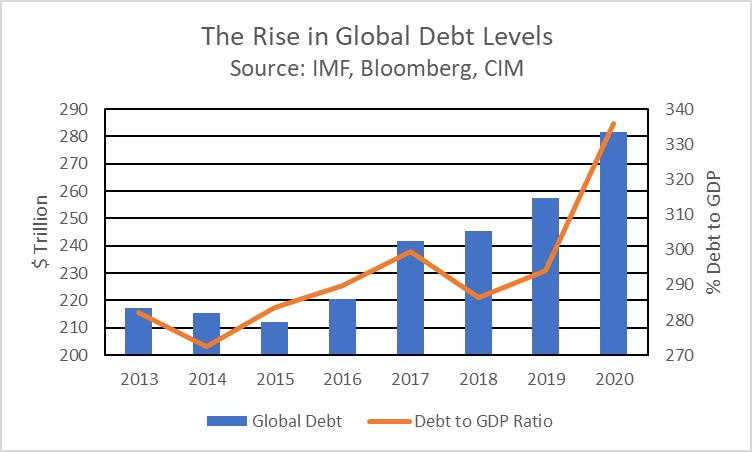

Following last year’s debt binge that saw households, companies, and governments raise over $24 trillion to offset the pandemic’s impact, worldwide debt levels have soared to unprecedented levels. This surge in global debt has sparked concerns of a possible financial crisis in the offing. Here are our thoughts about it:

This time may be different: The four deadliest words in economics are “this time is different,” as almost every time an economist has uttered the phrase, he was proven wrong. Therefore, we hedge the statement with the word may. That being said, we are optimistic that the debt binge will not lead to an imminent financial crisis for the following reasons:

- Creditors are being proactive. Unlike the months leading up to the Asian Financial Crisis and Global Financial Crisis, global creditors this time around appear to be more flexible regarding working with debtors to restructure loans. The IMF, World Bank, and some private institutions have provided struggling countries and companies with much-needed debt relief and debt forgiveness in order to prevent future defaults.

- Households are deleveraging and throughout the developed world have used stimulus money to improve their balance sheets. As a result, the Euro area, U.K., Japan, and the U.S. have all seen declines in household debt as a percentage of GDP. The reduction of debt suggests that households are better positioned to withstand a recession. In general, households have less power in the creditor/debtor relationship, so the decision by households to reduce debt reduces the risk that we will see a repeat of the Great Financial Crisis. At the same time, using stimulus to reduce debt does weaken the overall impact of fiscal spending.

- Financial institutions are more capitalized. In December, the Fed released the results of its 2020 stress test. It concluded that the banking sector was sufficiently capitalized to lend to households and businesses in the event of a crisis. Given the role of the U.S. in providing global liquidity, strong banks here likely bode well for the global financial system.

- There is low rollover risk. Increases in the federal funds rate have frequently led to weakness in the financial system as companies and governments often finance debt with short-term loans. Thus, a rise in those rates generally results in increased servicing costs. Although there is growing concerns that the Federal Reserve could raise rates in order to contain inflation, Fed Chair Powell has signaled that he is more focused on full employment rather than inflation.

If we are wrong: The biggest risks to our prediction are:

- There is a possibility that creditors may become less patient over time. As the recovery solidifies, debt moratoria will be lifted, and we could still see debt deflation develop.

- Higher interest rates pose a risk. As we have seen the yield curve steepen, there is a risk that rising rates will increase financial system stress. Thus, we are paying close attention to the FOMC and the idea of yield curve control.

- Although the banking system is well-capitalized, the non-bank financial system is probably less so. Because this part of the financial system is “in the shadows,” it is more difficult to determine its health. Usually, rising interest rates trigger problems in this sector.

- Rising asset prices, over time, present a risk. This is what Hyman Minsky noted when he said, “stability breeds instability.” Rising asset prices can encourage excessive risk taking, leading to problems. The important factor to note from this “Minsky risk” is that excessive behavior is endemic to financial markets; the key is whether or not the excessive action occurs within a critical sector. The activities we have seen discussed this week on Capitol Hill are probably not.

Policy and economics:

- When President Biden met with a group of mayors and governors last week, he bluntly told them to get ready for a legislative defeat; his proposed minimum wage hike is unlikely to happen, at least in the near term.

- The State Department said on Thursday that the Biden administration is open to reopening discussions with European countries and Iran to begin rejoining the 2015 Iran nuclear agreement, also known as the Joint Comprehensive Plan of Action (JCPOA).

- In response, Iran said the U.S. must first return to the 2015 nuclear deal and lift sanctions if it wants to start talks, appearing to snub the Biden administration’s efforts to begin direct discussions before officially rejoining the accord.

- The Senate Energy and Natural Resources Committee is planning to hold a hearing on electric grid reliability and resilience after millions were left without power in Texas and elsewhere due to a winter storm.

- The value of U.S. farm exports to China will touch $31.5 billion in the federal fiscal year ending September 30, the highest ever, according to the U.S. Agriculture Department.

- Vice President Kamala Harris said on Thursday that the 2.5 million women who have left the workforce since the beginning of the pandemic constitute a “national emergency,” one that could be addressed with the Biden administration’s $1.9 trillion coronavirus relief plan.

- Democrats filed President Biden’s immigration bill on Thursday; it is unlikely to make its way through Congress.

- Biden is expected to speak with Saudi Arabia’s King Salman and signal a downgrade in relations with the kingdom’s day-to-day ruler, Crown Prince Mohammed bin Salman.

- President Biden will deliver a robust defense of America’s own democracy and the broader power of democracies to face autocratic threats from China and Russia during a virtual address on Friday to the Munich Security Conference.

International news:

- In a surprise retaliatory move Thursday, Facebook blocked Australians from sharing news stories, escalating a fight with the government over whether powerful tech companies should have to pay news organizations for content.

- Taiwan’s presidential office named the former head of the National Security Bureau, Chiu Kuo-cheng, as its new defense minister in a major reshuffle of the island’s key national security posts. The move comes amid China’s increasingly aggressive posture toward democratic Taiwan.

- Italian Prime Minister Mario Draghi said the European Union’s recovery package would help make the country’s debt sustainable.

- Spain is hoping to entice people to prepare for retirement with a voluntary savings plan as it tries to wean them off relying solely on state pensions. The aim is to set up a fund by the end of the year that would be run by private investment companies, offering Spaniards an affordable alternative to supplement their public pensions.

- Sterling climbed to $1.40 for the first time in almost three years as investors looked past gloomy data and focused on hopes that the U.K.’s rapid coronavirus vaccine rollout will boost economic prospects.

- On Thursday, Canada’s main opposition party called for the House of Commons to formally declare that China is committing genocide against more than one million Uighurs in the western Xinjiang region.

China news:

- China may ban the export of rare earth refining technology to countries or companies it deems a threat to state security concerns, according to a person familiar with the matter.

- This is likely in retaliation to increased scrutiny Chinese firms have been getting from the West. In 2019, we discussed the threats of a potential export ban on rare earths in a Weekly Geopolitical Report.

- United States agencies in charge of food safety have taken aim at a controversial theory backed by Chinese health officials with a new statement saying there is no evidence that COVID-19 can spread via food and food packaging.

- China has for the first time revealed that four of its soldiers were killed, and one seriously wounded, in last year’s Himalayan border clash with India.

- It’s time for the United States to be “crystal clear” that it will not allow China to invade Taiwan and will end its longstanding “strategic ambiguity” about whether it would come to the island’s defense, said Senator Tom Cotton, a senior Republican on the Senate Armed Services Committee.

COVID-19: The number of reported cases is 110,146,931 with 2,435,733 fatalities. In the U.S., there are 27,854,389 confirmed cases with 491,411 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 73,377,450 doses of the vaccine have been distributed with 57,737,767 doses injected. The number receiving a first dose is 41,021,049, while the number of second doses, which would grant the highest level of immunity, is 16,162,358. The Axios map shows marked declines in infection rates.

Virology

- President Biden makes his first appearance at a meeting of the G-7 today as the economic heavyweights gather virtually to discuss the global coronavirus pandemic and come up with a plan to distribute vaccines equitably.

- The first study of a coronavirus vaccine in pregnant women launched on Thursday. This is part of an ongoing effort to assess the safety and effectiveness of the shots in groups of people that were excluded from the original trials.

- French President Emmanuel Macron has said Europe and the U.S. should urgently allocate up to 5% of their current vaccine supplies to developing countries where COVID-19 vaccination campaigns have scarcely begun and China and Russia are offering to fill the gap

- Israel has raced ahead with the fastest COVID-19 vaccination campaign in the world, inoculating nearly half its population with at least one dose.

- The two coronavirus vaccines developed by Pfizer-BioNTech SE (PFE, USD 34.47; BNTX, USD 113.86) and Moderna (MRNA, USD 173.00) appear to be highly effective against the more transmissible variant of the virus first detected in Britain, according to newly published studies in the New England Journal of Medicine, in a potential boost to vaccination efforts around the globe.

- The African Union has secured 300 million doses of Russia’s Sputnik V vaccine as it seeks to ramp up inoculation in a region that has largely been left out of the global rollout of COVID-19 jabs.

- New evidence from China is affirming what epidemiologists have long suspected: the coronavirus likely began spreading unnoticed around the Wuhan area in November 2019 before it exploded in multiple different locations throughout the city in December.

- The COVID-19 vaccine developed by Pfizer Inc. and BioNTech generates robust immunity after one dose and can be stored in ordinary freezers instead of at ultracold temperatures, according to new research and data released by the companies.