Daily Comment (April 1, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

We have published our latest Weekly Geopolitical Report, which constitutes Part III of our series on the Geopolitics of Central Bank Digital Currencies (CBDC). We also have several other recent multimedia offerings. There is a new chart book recapping the recent changes we made to our Asset Allocation portfolios. Here is our latest Confluence of Ideas podcast. Our most recent Asset Allocation Weekly, chart book, and podcast are also available. Note: Due to the upcoming Good Friday and Easter holidays, we will not publish an AAW this week; it will resume on April 9. Being Thursday, there is a new Weekly Energy Update. You can find all this research and more on our website. As a reminder, due to the Good Friday market closures, there will be no Daily Comment tomorrow; we will be back on Monday and recap the employment report on that day.

Good morning. It’s Opening Day! Major League Baseball kicks off its season to mostly restricted crowds. On the first day of Q2, U.S. equity futures are ticking higher. Our coverage begins with economics and policy the day after the infrastructure package was revealed. An update on the Archegos event comes next. China and international news follow. Technology is next, and we close with a pandemic update.

Economics and policy: The infrastructure package dominates this sector’s news.

- Yesterday, we discussed the proposed infrastructure package, which was formally released yesterday. Although a spending package of this size and breadth will always be controversial, the fact that it includes tax increases means that opposition will likely escalate. The opposition is already preparing to oppose tax hikes. We note that the wealth tax didn’t make the cut; such taxes are devilishly difficult to enforce (wealth can slip across borders, as can wealth holders). The experience in other nations suggests wealth taxes are not all that effective.

- The underlying thesis of what the White House is doing is that government spending is necessary to boost economic growth. This idea was uncontroversial from the Great Depression into the 1970s, but the inflation that occurred in that decade was partly blamed on the disincentives to private sector investment. This cycling of ideas is part of our thesis that societies move through equality and efficiency cycles. We have been in an efficiency cycle since 1978 but have been slowly trending toward an equality cycle over the last decade. This presidency is accelerating that trend.

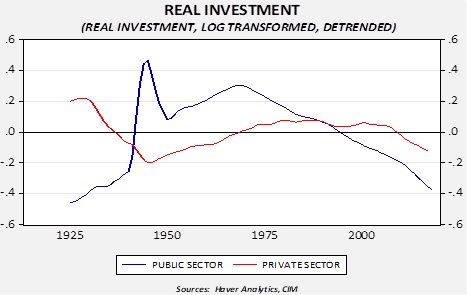

- Although there are concerns about “crowding out” a situation where rising public investment displaces private investment, we are currently in a situation where both public and private investment are below trend.

This chart shows real public and private investment against the trend. There was clear displacement during the Great Depression and the war years, although the cause of the drop in private investment probably had more to do with weak demand and excessive investment as the industrial revolution came to a close. But, in the 1950s, both rose against trend. What we have been experiencing this century is unusual; public sector investment has been falling against trend since the early 1970s, but since the Great Financial Crisis, both are below trend. Thus, we are probably in a position where (a) we probably have too little public investment, and (b) there is probably room for both rising public and private investment. In fact, one could argue that in the 1950- the 60s, we were able to increase both.

- There is another item of note. We have been accumulating research on the semiconductor industry. It is a highly efficient industry that is becoming a notable geopolitical risk. Not only are parts of the industry strung out around the world, but Taiwan is absolutely essential, and China has a large segment as well. The package attempts to reduce this geopolitical risk by proposing to spend $50 billion on building capacity in the U.S.

- All that being said, it is critically important to remember two points. First, although the need for investment is reasonably clear, getting it right is really hard. Investment is one of the hardest things society does because it requires some projection into the future. If one gets it right, he or she is blessed with stronger growth and lower inflation. Getting it wrong means resources are squandered.[1] So, if the investment allocation is done well, this investment will effectively pay for itself. If it isn’t, we will expand debt for little purpose. In reality, what has been proposed will probably fall somewhere in between. It should also be remembered that private sector investment carries the same risks. What tends to make private sector investment preferred is that the threat of ruin makes investors careful. Public sector investment lacks a profit motive, and thus, it is even more difficult to get right. Second, this package, paradoxically, could end up acting as a drag on growth. It should be noted the spending is spread over eight years, but the tax increases hit immediately. It will take years for the benefits of the spending to be felt, but paying for it will occur new. We can debate if this makes sense (actually, it doesn’t), but this is the structure of the current bill.

- So, will it pass? We have our doubts. The GOP would probably be on board for parts of the package and might even go along with a smaller increase in the corporate tax rate. We don’t see any member of the opposition voting for the package as currently constructed. However, within the majority, there are deep divisions. The populist left has figured out the second point above and wants even more spending. Centrist Democrats are already balking at the tax hikes.

- Although we are poised for really strong GDP growth, this growth is coming from a place of weakness for many parts and sectors of the U.S. Thus, the ability of the economy to absorb fiscal spending may be unusually high. That isn’t to say this situation is permanent, but at present, we are not all that concerned about overheating the economy.

- The administration has suspended collections on defaulted student loans of over 1.0 million borrowers as part of pandemic relief.

- The EU and U.K. are locked in a fight over swaps clearing, a business that has been dominated by London for some time. We look for New York to offer to appease both sides.

- South Korea is reporting a surge in ship orders, suggesting that international trade will likely rebound.

- Fortunately, the shipping snag in the Suez has been resolved; unfortunately, those in Long Beach and Los Angeles remain. Pandemic-related capacity reduction and an increase in goods demand contributed to the backup.

- Supply constraints are also showing up in other industries. Autos continue to be hampered by the lack of semiconductors. Consumer staples prices are poised to rise on increasing input costs. Even cardboard boxes are becoming scarce.

- Housing regulators are moving to reduce the availability of mortgages for vacation and second homes. This area of residential real estate has been active but may be under threat due to these changes.

Archegos: So far, the good news is that the collapse of Archegos Capital has not been systemic. Although a number of investment banks have suffered losses (some more than others), it doesn’t appear that anyone is in enough trouble to require a bailout. Still, the event highlighted the problems within the non-bank financial system (“shadow banking”), namely, leverage is widespread. Servicing banks don’t seem to have a good idea about the security of their collateral. It also showed how the financial services industry is extremely adept at creating products that (a) allow for high levels of leverage to occur and (b) seem structured to avoid regulatory scrutiny. The event also shows that regulators always seem to be chasing situations and making new rules that would have protected the markets from what just happened but do little to affect future events. The SEC is examining what occurred with Archegos; reports suggest that the family office space may be riskier than generally perceived.

China: China’s lending practices and messaging control dominate the headlines.

- A new report that investigates the terms and conditions of Chinese loans to emerging and frontier markets suggests that Beijing lends similar to a 19th century imperialist. Terms include confidentiality clauses and measures that exclude China’s loans from global resolution bodies, such as the Paris Club. Our position is that the belt and road project is a modern version of 19th century imperialism, a natural progression given China’s excess capacity. Essentially, China can no longer rely on the wider world to buy its exports, and thus, is creating colonies through debt and investment to force smaller, less-developed nations to be a conduit for its excess production.

- China is increasing pressure on foreign correspondents who publish reports that Beijing doesn’t like. A British and an Irish journalist have left the country, citing excessive pressure. Increasingly, Beijing is controlling the message and is intolerant to positions that stray from the CPC’s line.

- The U.S. and Taiwan have announced a cooperative agreement among their respective coast guards. Beijing isn’t pleased. Adding to the pressure, Taiwan is purchasing Patriot missile systems.

- Huawei (002502, CNY, 2.94) reported falling revenue in Q4, as U.S. sanctions weigh on the company. In a surprising development, Ericsson (ERIC, USD, 13.19), who generally benefits from sanctions on Huawei, has been lobbying against sanctions on the Chinese company. As sanctions hit Huawei, China has been threatening Ericsson’s business in China and has also expanded to other Swedish businesses that operate in China. This situation highlights the difficulty of sanctioning China; unlike the Soviet Union, China is a major international economic force and has multiple ways to not only evade sanctions, but retaliate.

- We are noting a steady number of articles quoting U.S. officials expressing concern that China is considering an invasion of Taiwan. This is a topic will we be investigating in the coming weeks.

International news: The Taliban is winning; the U.S. restricts trade with Myanmar and the EU takes aim at Poland.

- As the conflict in Afghanistan winds down, it looks like the Taliban is poised to return to power. The lesson learned in conflicts with superpowers is that the cost/benefits eventually tilt towards withdrawal, especially if the country in conflict isn’t a key security risk to the superpower. The Taliban simply waited the U.S. out. In some respects, it’s amazing the U.S. stayed as long as it did, but in the end, Afghanistan just isn’t a big enough problem to maintain the conflict.

- In light of the continued problems in Myanmar, the USTR announced that the U.S. was suspending trade engagement with the country. It isn’t clear if this action will sway the generals (given China’s deep involvement, it’s doubtful), but the U.S. action may allow other nations also to restrict trade until the situation is resolved.

- The European Commission has referred Poland to the ECJ to investigate the independence of the Polish judiciary. The right-wing populist (RWP) government in Poland has taken steps to reduce the power and independence of its judiciary. This has been a sticking point for the EU for some time. It appears that the EU is formally moving to deal with this issue. As the EU moves against the RWP in Poland, we note that Hungarian PM Orban is trying to build an EU coalition of like-minded political movements.

- Russia has seen a series of intelligence gaffes as its spies in Italy, the Netherlands, and Bulgaria have been outed gathering data on NATO and the EU. It is unclear why counterintelligence across Europe is suddenly uncovering these actions by Russia. It could be that they have become so widespread that they are hard to not find. Or, another possibility is that Russian intelligence has a mole, and that person has revealed sources. The fact that they are all now being captured may mean that the mole has moved on.

- Alexei Navalny has announced a hunger strike to protest his lack of medical treatment.

- Ireland’s PM is calling on the EU and U.K. to “reset” relations as tensions in Northern Ireland increase.

- There was an attempted coup in Niger in an apparent effort to prevent the swearing-in of Mohamed Bazoum, the president-elect, tomorrow. The outgoing president, who lost in a disputed vote, may be behind the coup attempt. Niger is the world’s sixth-largest miner of uranium.

- Canada is moving to aggressively attract immigrants. Although increasing immigration is unpopular with many Western nations, Canada remains sparsely populated[2], and immigration may be the only way to significantly boost population growth.

- It’s not easy being green; Green parties across Europe are popular but have a hard time turning environmental concerns into political power. This is a problem with single-issue parties. Other parties can easily co-opt the message.

Technology: We don’t trust or particularly like tech firms.

- Recent surveys show a drop in trust held in technology firms. Data collected by Edelman shows that trust in tech firms fell globally but plummeted in the U.S. The rising lack of trust will tend to increase the odds of higher regulation. In a related issue, taking tech money in Washington is becoming toxic.

- In cyberwar, the U.S. has tended to mostly “play offense,” focusing on attacking rather than defending. A rash of hacks has shown the weakness of that position. The government agency tasked with protecting America is underfunded and understaffed, raising fears of continued vulnerability.

COVID-19: The number of reported cases is 129,032,284 with 2,818,245 fatalities. In the U.S., there are 30,461,312 confirmed cases with 552,073 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 195,581,725 doses of the vaccine have been distributed with 150,273,725 doses injected. The number receiving at least one dose is 97,593,290, while the number of second doses, which would grant the highest level of immunity, is 54,607,041. The FT has a page on global vaccine distribution. The Axios map shows that infections are starting to increase again despite accelerating vaccinations.

Virology

- Although the focus remains on vaccines, it is highly likely that COVID-19 will remain endemic after the pandemic ends. That means it will continue to circulate and have the potential for outbreaks. Widespread vaccination will tend to reduce the impact on the medical system (we would expect that fewer hospitalizations will result), but the nature of the virus means that mutations will emerge, and vaccines won’t offer persistent sterilizing immunity. That is why antiviral treatments will continue to be important. Recently, a cocktail of various treatments was tested and showed some promise in reducing the effects of the virus.

- The next debate will likely be over vaccine “passports.” So far, the U.S. has no digital or central repository monitoring who has been vaccinated. The card one receives when vaccinated is the only record a person will have to show they have received the shot. It is not hard to imagine that industries with high levels of close contact—airlines, casinos, sports arenas, cruise ships—will want their patrons to be vaccinated to prevent outbreaks. However, this desire will run into vaccine hesitancy. Already, there are calls to outlaw vaccine passports. This situation could be complicated by the insurance industry; it would not be a stretch to see insurance companies insisting that the aforementioned industries require passports for protection against lawsuits resulting from outbreaks.

- Some vaccine “good news”—mothers who are vaccinated and become pregnant give protection to their offspring. Pfizer (PFE, USD, 36.25) is testing a freeze-dried version of the vaccine that would reduce the costs of storage and handling. The freeze-dried version would only require refrigeration and not the super-cold temperatures of the current vaccine. The company also announced its vaccine could protect for at least six months. Another study shows it to be very effective in adolescents.

- Russia claims it has developed a veterinary version of a COVID-19 vaccine.

- Some unfortunate vaccine news—Johnson & Johnson (JNJ, USD, 164.35) had 15 million doses ruined due to a manufacturing error.

- The EU announced it would not send any more vaccines to the U.K. until its quotas are met.

- France announced new lockdowns.

- In the wake of the WHO study on the origins of COVID-19, the U.S. and others are calling for a new, independent study. We doubt China will cooperate; in fact, Beijing is calling for investigations of other countries to see if the virus originated there.

- India has halted vaccine exports in a bid to build domestic supplies.

[1] Although a whole different story, this is why China’s economy is such a “high wire act.” China relies on investment to grow, and, as Michael Pettis has pointed out, it has probably reached the point where the true value of its investment is close to zero if not negative. In other words, high-speed rail to nowhere increases GDP at the time of the investment but should be written to zero upon completion to account for the waste.

[2] Canada has 10 people per mi2 compared to the U.S. at 87 per mi2.