Weekly Energy Update (April 1, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After peaking in early March, prices have pulled back to pivot around $60 per barrel. Although recent builds in crude oil are bearish, expectations for stronger economic growth should be supportive for prices.

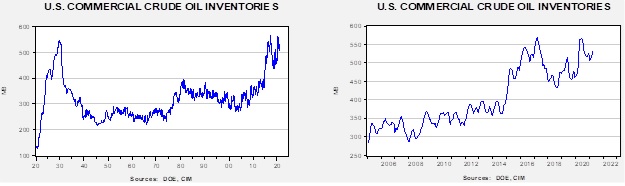

Crude oil inventories fell 0.9 mb compared to the 1.7 mb draw expected. There was no change in the SPR. Refinery operations have normalized to pre-Texas freeze levels.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.1 mbpd. Exports rose 0.7 mbpd, while imports rose 0.5 mbpd. Refining activity rose 2.3%.

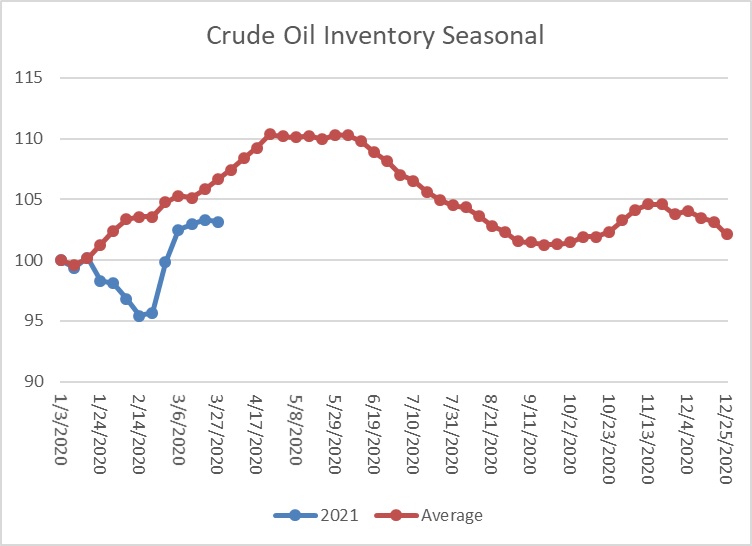

This chart shows the seasonal pattern for crude oil inventories. We are well into the winter/early spring build season. Until the Texas freeze, we were seeing a counterseasonal decline. This week, stockpiles declined modestly but usually don’t this time of year. We are currently at a seasonal deficit of 21.5 mb.

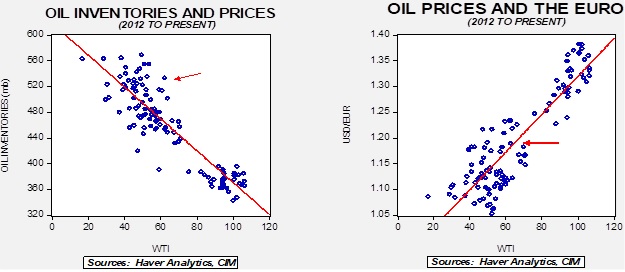

Based on our oil inventory/price model, fair value is $40.53; using the euro/price model, fair value is $64.67. The combined model, a broader analysis of the oil price, generates a fair value of $51.04. The divergence continues between the EUR and oil inventory models, although recent dollar strength has reduced the projected fair value generated from the euro/price model.

Market news:

- Abu Dhabi is unveiling a new futures contract based on its oil. If the contract becomes popular, it will put a market price on OPEC oil and could undermine efforts by the cartel to control the price of OPEC crude, especially from the Middle East.

- As vaccination efforts expand and the U.S. economy reopens, driving should rise which is bullish for corn.

Geopolitical news:

- The eventual transition to transportation electrification will dramatically reduce oil prices and revenues to oil producers. This development will likely have significant negative effects on oil-producing nations which are dependent on oil revenues. This is especially the case for less developed nations that produce oil; often, their marginal costs are high which means their oil will be the first to be priced out of the market.

- China and Iran have inked a deal for investment and security. Although we don’t expect Chinese warships and military to be engaged anytime soon, the pact will undermine U.S. efforts to force Iran to negotiate over its nuclear program and other issues.

- An Islamist insurgency is threatening a natural gas project in Mozambique.

- NGOs are calling on Chevron (CVX, USD, 105.03) to halt payments to Myanmar for projects the company has in the country. Myanmar recently had a coup and protests against the military have become increasingly violent.

- The Canadian Supreme Court has upheld the government’s carbon tax.

Alternative energy/policy news:

- The Biden administration is unveiling an infrastructure package with “green” tones to it. Proposals for greening the economy through public investment have been around for a while; it remains to be seen if this attempt will be more successful.

- As we have noted earlier, the government is considering various subsidies to farmers to compensate them for farming practices that capture and store carbon dioxide. However, to date, no concrete proposals have emerged.

- April Fool’s! Sources indicated that the U.S. division of Volkswagen (VOW, EUR, 307.20) was planning to change its name to “Voltswagen” to reflect the move to electrification. Turns out it was an April Fool’s joke a few days early.

- We continue to watch the rapid innovations in battery technology. The most recent changes are tied to lithium. It is well known that a pure lithium battery would be much more efficient, allowing for larger batteries, faster charges, and would last longer. One small problem is that lithium in its pure form is reactive and explodes when exposed to liquid. However, there are reports indicating that creating a liquid electrolyte eliminates the problem and ends the need for a solid-state battery. If this works, it would potentially revolutionize batteries and accelerate the transition.

- As we have discussed previously, hydrogen-powered fuel cells are a potential alternative to batteries. It may end up that hydrogen is more appropriate for fleets (where centralized fueling could take place) and aircraft (where batteries may weigh too much). Railroads in California are testing fuel cell locomotives.

- Wind power has been in place in the U.S. for some time, but it remains problematic. The windmills have been known to harm bird populations. Less populated areas tend to have the most persistent winds, but then require long transmission lines to deliver the “juice.” The long lines can be unpopular. The process of siting turbines can also be problematic as they are “hard to miss” once constructed. These issues have led to turbines being placed offshore, just over the horizon, to avoid these issues. In addition, winds tend to be very persistent offshore. Although such facilities are more common in Europe, the Biden administration is looking to construct them here in the U.S. as well.

- Soon after the election, the new administration suspended oil and gas leases on federal lands. It was unclear if this was a temporary measure or one destined to be permanent (or until a new government takes power). So far, the measures remain in place, but an outright ban hasn’t been announced either.

- A court in France recently declared that the government is responsible for climate mitigation. Although it is unclear how this decision will affect policy, protests against perceived government inaction have emerged recently.

- Congress has introduced new fees for methane emissions. Often, methane is released as part of the drilling process for oil and natural gas. In fact, recently, as drilling activity has accelerated, there has been a consequent increase in methane releases. Methane is a potent greenhouse gas and the fees are designed to reduce these emissions.

- Japan has been supporting coal-fired electricity plants across Asia. It has decided to end the practice, which would be a blow for coal demand.

- The American Petroleum Institute, the primary industry lobbyist, has decided to support carbon pricing. This decision suggests it sees carbon pricing as the most effective tool for carbon emissions management as opposed to cap and trade or regulatory restrictions. Now the issue will be the price applied.