Weekly Energy Update (April 22, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After the recent rally in prices, the market is consolidating recent gains and establishing a larger trading range between $68 to $58 per barrel.

(Source: Barchart.com)

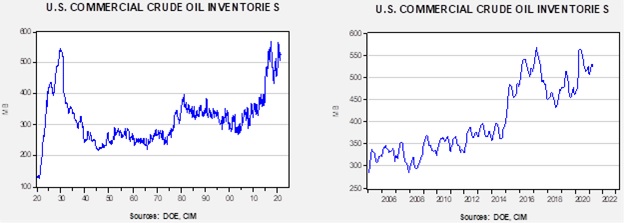

Crude oil inventories rose 0.6 mb compared to the 3.4 mb draw expected. The SPR fell 0.7 mb, meaning without the addition from the reserve, commercial inventories would have declined 0.1 mb.

In the details, U.S. crude oil production was unchanged at 11.0 mbpd. Exports were also unchanged while imports fell 0.4 mbpd. Refining activity was steady.

(Sources: DOE, CIM)

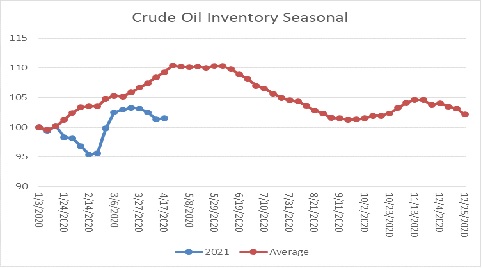

This chart shows the seasonal pattern for crude oil inventories. We are about two weeks to the end of the winter/early spring build season. Until the Texas freeze, we were seeing a counterseasonal decline. This week, stockpiles were mostly steady. We are currently at a seasonal deficit of 34.9 mb.

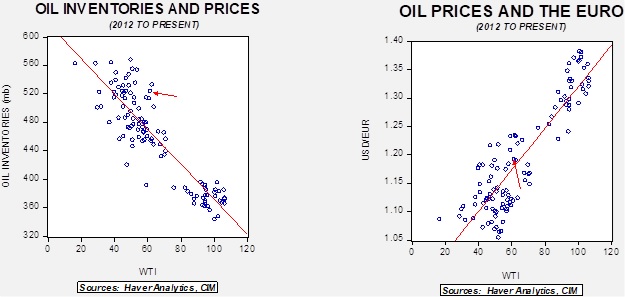

Based on our oil inventory/price model, fair value is $43.72; using the euro/price model, fair value is $65.05. The combined model, a broader analysis of the oil price, generates a fair value of $53.19.

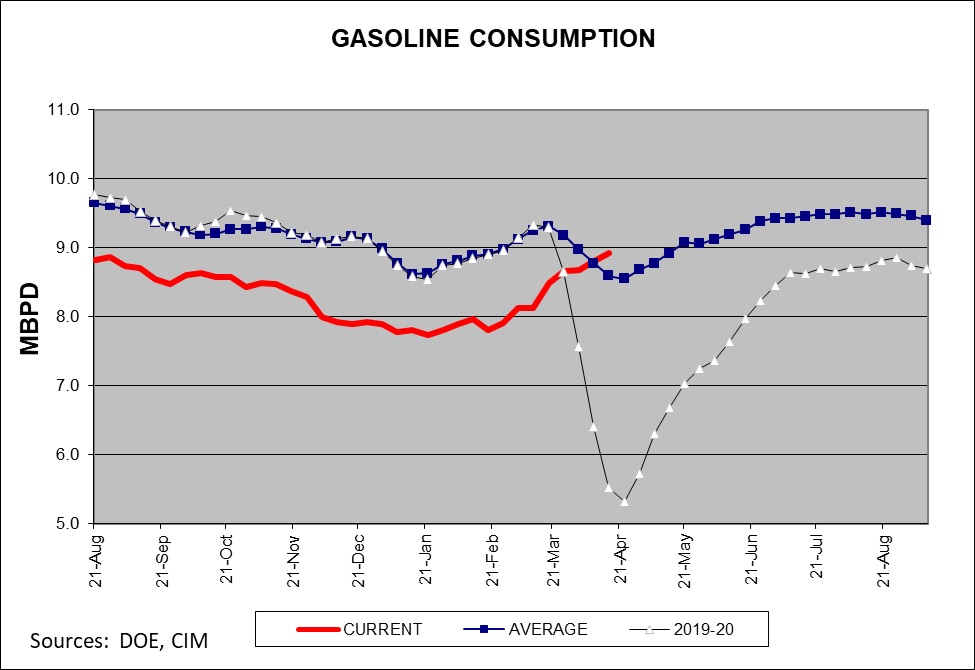

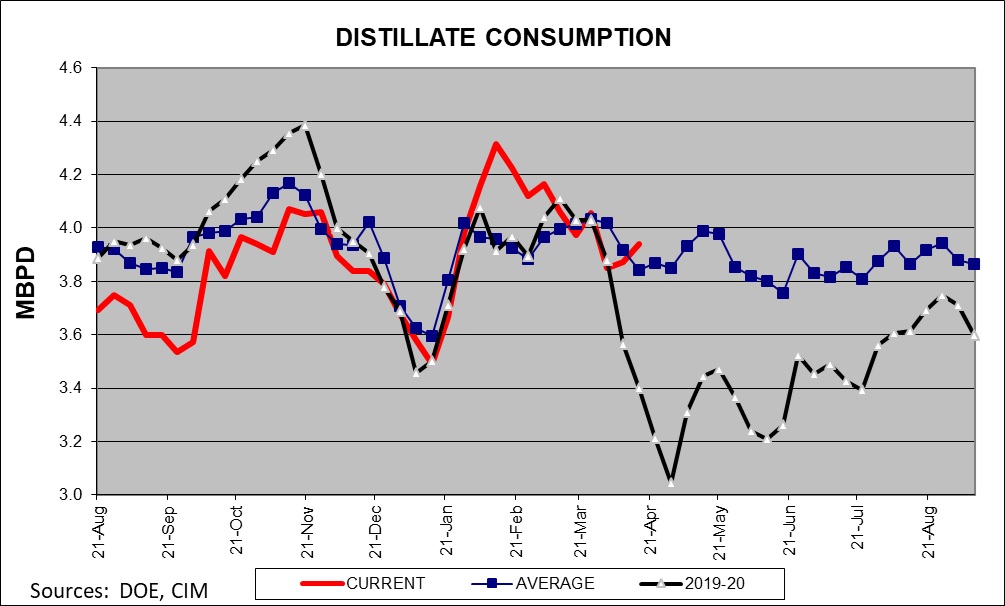

Gasoline consumption is now above the five-year average.

So is distillate demand.

It is also notable that demand is well above last year when the lockdowns were implemented.

Market news:

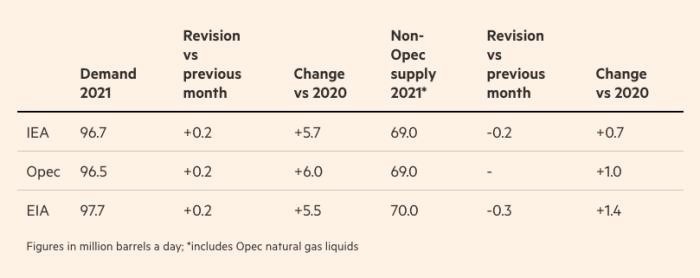

- The primary forecasters for the oil markets have updated their forecasts.

For the most part, demand is expected to rise compared to last year.

- One of the themes we have applied to our Asset Allocation has been that the oil and gas industry would be starved for capital due to ESG issues. And so, the better place to invest isn’t in the industry but in the commodity itself. Although energy stocks have done well this year, they have not done as well as the commodity overall. We have further evidence that ESG concerns are affecting capital to the industry. First, private equity, a source of funding for the industry, is drying up. Second, the industry faces the problem that changes in demand and regulation could lead to stranded assets. Therefore, a company with a development project runs the risk that by the time the fields start producing, the demand for that oil may not exist. Large firms are starting to sell off these projects; smaller firms are taking the chance that the drop in demand may not materialize as soon as expected and are buying up these projects.

Geopolitical news:

- Talks with Iran on restarting the nuclear deal have begun. Although there is optimism surrounding the talks (the fact they occurred at all is notable), Iran’s decision to enrich uranium to the 60% level presents a serious problem for negotiations.

- A complicating issue for these talks is that Iran has national elections in June, and parties within Iran are using the talks for political gain. Hardliners in Iran are expecting strong gains in the elections, as the country has navigated the U.S. crackdown and survived. Entertainment media is said to be undermining the current foreign minister who might be a candidate for president. In Iran, Mohammad Zarif is a moderate; a thinly veiled serial makes him out to be a fool.

- At the same time, the leadership is trying to deal with a series of attacks thought to be sponsored by Israel. The pace of events suggests that Israel has built a network of spies.

- An Israeli delegation is traveling to Washington to discuss the Iran nuclear deal.

- The U.S. has generally acted to maintain order in the Middle East; before WWII, the U.K. played the role of regional hegemon. As the U.S. withdrawals from the region, the fear is that without an outside power maintaining order, the region will spiral into persistent conflict. Although China and Russia have made moves to increase their influence in the region, there are doubts that either nation has enough naval power to project order into the area. However, it is also possible that regional powers could maintain order themselves. We note that Saudi and Iranian officials met in Baghdad recently to discuss relations. Although the two powers vie for regional hegemony, both have reasons to talk. The KSA would like to wind down the conflict in Yemen and needs Iran to cooperate to contain the Houthis. Iran would like to see oil export restrictions lifted and needs investment. Both nations have denied talks occurred (which we view as a good sign that the negotiations have substance). Although we have doubts that the parties can get along, at present, both need “space” to recover, and that alone might be enough for at least a temporary improvement in relations. Eventually, Iran and KSA may be able to define spheres of influence that could stabilize the region…assuming Turkey agrees.

- The KSA and Greece signed an agreement that would lead the European nation to install a Patriot missile system in the kingdom.

- China has become the dominant supplier of solar panels. This fact presents dissonant objectives to U.S. climate policy and foreign policy. On the one hand, increasing solar power capacity is part of reducing carbon emissions from electricity. On the other hand, there is evidence that some solar panel components come from Xinjiang, likely from incarcerated labor. As the Biden administration gathers world leaders for a climate summit, it is unclear how this dilemma will be resolved.

Alternative energy/policy news:

- Exxon (XOM, USD, 55.29) is proposing a $100 billion project to capture carbon among facilities in the Houston area. Overall, environmental groups tend to oppose these measures, fearing that (a) they won’t work and (b) they encourage hope that society can continue to use fossil fuels and rely on carbon capture. Despite these concerns, carbon capture technology will likely continue to be studied because it has political potency, and we may need it to control carbon that is removed from the atmosphere.

- The administration is pushing a “clean jobs initiative” as part of its infrastructure package.

- After carbon emissions fell last year due to the pandemic closures, emissions are rising rapidly as the economy reopens. Emissions are set to rise 4.8% this year, the fastest growth since 2010.

- Although lumber prices have been on a tear, trees have a competing use in absorbing and capturing carbon dioxide. Carbon markets are offering tree growers an option to cutting down their forests, and some are using the carbon markets to postpone harvesting. This situation, if it continues, could exacerbate lumber supplies.

- One of the roles in oil and gas development is the “landman,” a person who scours county records to see who owns the mineral rights to land and then pitching the owner for the right to develop the asset. Like many jobs in the commodity business, it is “boom and bust.” When development is rapid, landmen could make an impressive living. When the inevitable downturn occurred, they usually just scraped by. But, one saving grace was that oil and gas was a depleting asset; as long as there was oil and gas drilling, there was the need for their services. As the long-term outlook for oil and gas demand darkens, the landmen have moved to selling the wind and solar rights to land. The problem is that these sources of energy are renewable, meaning the rights, once sold, probably won’t be needed again. As the industry evolves, the occupations tied to it will adjust as well.

- The EU continues to delay a decision on whether natural gas is “green” or not. Although natural gas isn’t without emissions, it is much cleaner than coal or oil. The delays are hampering the industry’s ability to adapt to policy changes.