Daily Comment (April 26, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday, the last one in April! U.S. equity futures are mostly steady this morning as investors await a plethora of earnings reports this week. Our coverage begins with the pandemic, and we are watching India’s caseloads rise. International news follows, with the U.S. decision to label the 1915 Armenian situation a genocide. An economic roundup follows (it’s all about chips), and we close with China news.

COVID-19: The number of reported cases is 147,238,543 with 3,110,511 fatalities. In the U.S., there are 32,077,477 confirmed cases with 572,200 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 290,692,005 doses of the vaccine have been distributed with 228,661,408 doses injected. The number receiving at least one dose is 139,978,480, while the number of second doses, which would grant the highest level of immunity, is 94,772,329. The FT has a page on global vaccine distribution.

Virology

- India is suffering through a strong surge of COVID-19 infections of an undetermined strain, one that is being called a “double mutation.” Anecdotal evidence from crematoriums suggests that the death count is higher than the official numbers denote. Shortages of basic medical supplies, including oxygen, are prompting airlifts to support the nation’s beleaguered medical system. The EU and member states are all promising help, and the U.S. is sending materials for vaccines.

- Japan has declared a state of emergency in Tokyo and Osaka due to a rise in cases. Japan will host the Summer Olympics in three months.

- The FDA will allow the Johnson & Johnson (JNJ, USD, 165.52) vaccine to be distributed after a one-week halt due to blood clotting concerns. There is a certain degree of vaccine hesitancy, and the J&J news was not helpful in encouraging those concerned about vaccine safety. However, as U.S. vaccine rates slow, there are growing worries that the country will fall short of herd immunity, which would leave COVID-19 in an endemic state.

- The medical sector is now starting to focus on the problem of “long COVID,” the situation where a patient has chronic maladies caused by an infection. Surprisingly, even some patients who had a mild case of the disease can exhibit long-term problems. These patients had a higher risk of mortality compared to those who were never infected.

- As the global economy emerges from the pandemic, we continue to monitor what will return to pre-pandemic life and what will change. A clue emerged; European banks announced they won’t be sending their bankers to see customers to the same degree, bad news for airlines and hotels.

International roundup: Turkey, Iran, and Ukraine lead the news.

- As expected, President Biden has declared that Turkey’s attack on the Armenians in 1915 was a genocide. This article offers background on the event. American presidents have avoided the declaration so as to not cause issues with Turkey, a NATO ally. Thus far, the response has been modest, suggesting it is being treated as mostly symbolic. Turkey has summoned the U.S. ambassador, but nothing suggesting the U.S. removing its military installations has been signaled.

- Financial market turmoil has led Turks to buy cryptocurrencies to protect against inflation and currency depreciation. Although cryptocurrencies are often lauded for their portability, an exchange in Istanbul, called Theodex, is being accused of fraud, with the government claiming that $2.0 billion may have left the country. Sixty people have been detained, and an international arrest warrant, a “red notice,” has been issued for the CEO. Although cryptocurrencies are, in theory, safe, they are often traded through exchanges that have proven to be less than secure.

- An oxygen tank at a Baghdad hospital exploded, trigging a fire that killed at least 80 people.

- Debris from the lost Indonesian submarine has been spotted, suggesting that it has been lost.

- PM Johnson is in a bit of a difficult spot, dealing with allegations he illegally used donor money to fix up his residence at 10 Downing Street. His former controversial aid, Dominic Cummings, made the allegations last week.

- After Russia ordered a pullback of troops on the Ukraine border, President Zelensky of Ukraine is calling for a revamp of the peace process to end the constant tension in eastern Ukraine. Zelensky would like to see the U.S., U.K., and Canada increase their diplomatic involvement.

- It has generally been believed that the Iran Revolutionary Guard Corps (IRGC) had a high level of political influence. After all, the IRGC controls large parts of the economy and provides the hard edge to civil control. A leaked audio tape suggests the IRGC is mostly running the country. With Ayatollah Khamenei aging, it will be interesting to see, when he dies, if the IRGC supports a replacement or dispenses with the control of the clerics.

- Across the West, the political center has been coming under pressure. It isn’t always as evident in a two-party system, but in multiparty systems, centrist parties have seen their influence shrink. In Spain, the loss of influence of Ciuadadanos, a centrist party, is a cautionary tale about how voters have deserted the party, which once looked poised to take power.

Economics and policy: Inflation and financial regulation lead this morning.

- As we have reported, the global semiconductor shortage is playing havoc with the auto industry. Now, it is spreading to the consumer appliance market. Although the shortages may not necessarily end up in the inflation statistics, there is another worry about supply constraints. The lack of goods can raise fears of shortages and prompt firms and consumers to stockpile goods when they start to become available. In other words, in the 1970s, shortages were also part of the inflation psychology.[1]

- Rents have been under pressure for most of the past year, but there are signs that the rental market is starting to firm. That news suggests that prospective tenants are starting to shop.

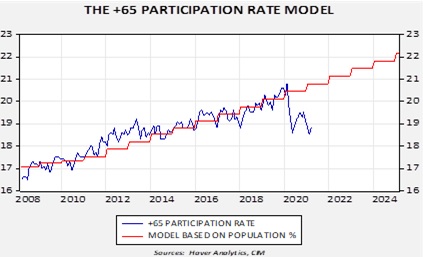

- There are widespread reports that service firms are using various perks to fill job vacancies. We suspect there are several reasons for this change. The Federal distributions are widely blamed and probably are playing a role, although research we did earlier this year suggested this was probably a minor factor. One area we are watching is the exit of older workers. Given that COVID-19 tended to have greater lethality for older people, there is evidence to suggest that many of these workers opted to take retirement rather than risk employment.[2] In comparing over 65-year-old participation to a model based on the percentage of Americans of that age, participation is running well below forecast.

We doubt these workers are coming back. If so, the pool of workers will be lower going forward, and this fact will tend to tip the balance of power toward labor. Of course, globalization and technology will still tend to offset these factors, but only to some degree. Over time, this factor will lead to (a) higher inflation or (b) lower profit margins. Most likely, it will be a bit of both.

- As we noted last week, the end of LIBOR is leading the financial industry to scramble for a replacement. Regulators are pushing SOFR, but as we noted, it is for Treasury secured repo and won’t necessarily reflect bank cost of funds. This report is a good primer on the issues involved.

- We continue to closely monitor regulatory efforts for money markets. Money markets are the primary funding source for the non-bank (shadow) banking system. Participants fear that protecting the funds from runs will either make them indistinguishable from bank deposits or reduce their liquidity to the point where depositors won’t use them anymore. At the same time, the funds were “ground zero” in both the Great Financial Crisis and the March 2020 crisis. Clearly, the current structure is unsustainable.

- The FOMC meets this week. We don’t expect any change in policy, but we will be watching the press conference for clues about future policy.

- With all the rhetoric about greening the economy and reducing carbon emissions, a factor that does get overlooked is that of energy density. The history of the industrial revolution has an element of consistently adopting power sources of increasing density; in other words, getting more power for less fuel. Crude oil and its derivative products are hard to improve upon. Batteries won’t be able to contain the same degree of power as a gallon of gasoline. The consumption side of the equation can offset some of this problem (lighter car materials can offset some of the loss of energy efficiency), but there is a notable risk that the future will have slower growth because of the lack of energy density. However, one way to overcome this problem is nuclear, the densest of all fuel sources. There has been a quiet bull market in uranium and metal miners recently and there is growing optimism that, at some point, regulators will decide to accommodate nuclear power to address climate change.

- Although there is much being written about tax increases, we do note that the current plans do include tax relief for lower-income households.

China: EU policy tries to cope with an aggressive China, Jack Ma battles the CPC over data, and industrial policy collides with environmental policy.

- President Biden is expected to visit with EU leaders next month. One of the topics of discussion will be the EU’s relationship with China. The EU issued a progress report on trade relations with China. The report suggests there has been little progress on trade issues and that these problems may be intractable. Overall, the report indicates that China’s integration into the EU economy may be reaching its limits.

- There has been a running battle between the Chinese government and Jack Ma. At its heart is data. The CPC wants the consumer data maintained by Ant Financial, and the company doesn’t want to give up this valuable asset. We suspect that the state will eventually prevail.

- As Beijing moves to achieve environmental targets, its heavy industry is struggling to support the efforts. Steel firms are being forced to close due to environmental concerns.

[1] A joke by Johnny Carson led to a run on toilet paper and a subsequent shortage.

[2] Anecdotally, we note that before the pandemic, grocery baggers at my local stores were about 50% workers over the age of 60 (at least they looked like it). Those workers have completely disappeared, replaced with younger workers.