Daily Comment (May 6, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. U.S. equity futures are mostly steady this morning. Our coverage starts with Facebook. Next is coverage of the U.K. local elections along with other international news followed by our pandemic coverage, including a look at the Biden administration’s decision to temporarily suspend patent protection for COVID-19 vaccines. Economic and policy news comes next. We close with comments on China.

Facebook: Facebook’s (FB, USD, 316.32) oversight board declined to reinstate President Trump to its platform but did say it would review the case again in six months. The fact that the media treated the news as if it were a key economic release or a Supreme Court decision is notable. As expected, GOP leaders were displeased, but the bigger issue is why. As a society, we grant such power to a private company with little regulatory oversight. We do expect this situation to be addressed at some point. It is unclear if it will be good or bad for the company or other social media companies. After all, regulation often solidifies a company’s market position by increasing the cost of entry.

The creation of the oversight board was, in a way, an attempt to shift the burden of decision away from Facebook. The oversight board has the veneer of independence; the 20-member committee is comprised of political leaders, human rights activists, and journalists and is based in London. Although nominally independent, the company funds the operation to the tune of $130 million. Thus, it is hard to say the company has no influence on its decisions.

President Trump isn’t the only political leader who has been a problem for the company. It has blocked the Myanmar military. Venezuela’s President Maduro has had his page frozen. Brazil’s President Bolsonaro has also had posts removed. Poland and Mexico have called for curbs on the company’s power.

In the end, the plan to create an oversight board to avoid scrutiny has failed. The board pushed the decision back to the company, suggesting that in six months, it should make a call. As social media firms have become conduits of speech, they have also become deeply mired in politics everywhere. In the older media environment, political systems relied on the lack of concentration to allow for a fair dispersion of information. There were numerous newspapers and rules against concentrating ownership. In broadcast media, where there were only three networks, the fairness doctrine regulated the way political news was managed. Social media grew up in a deregulated environment and was not really considered media for a long time. It looks like avoiding regulation in this arena will be impossible, although there is another alternative…the firms could be broken up, and the creation of a larger number of social media companies, with none dominant, could allow for a freewheeling media. However, the monopoly profits that the current firms enjoy would be the cost.

U.K. elections: The U.K. is holding local elections. Under normal circumstances, this wouldn’t be big news. But in the post-Brexit world, these elections have become proxies for independence movements. There will be a close study of the outcomes to see if independence movements in Scotland and Wales gain support. It will also tell us, to some degree, Boris Johnson’s popularity. Although we remain favorable on U.K. assets, seeing them as undervalued in the wake of Brexit, the independence issue is a risk that, if it expands, could be a bearish factor for the U.K.

International roundup: Fish fights, Russian troops, and worries about Peru are in the news.

- One of the more contentious concerns about Brexit was fishing rights. The British Channel was part of the EU’s fisheries area; post-Brexit, it is not. It is complicated. Although the U.K. could deny continental fishermen access to British waters, U.K. fishermen needed EU markets for the fish they caught. For the most part, the deal wasn’t really resolved. It has now become something of a farce. The U.K. is restricting French fishermen’s vessels in the area around Jersey, one of the British Channel Islands. The U.K. has sent two Royal Navy vessels to patrol the area. Unfortunately, Jersey gets its electricity from France, and the French are threatening to cut off the island. We doubt this will become a war, but it does highlight the difficulties involved with leaving the EU.

- Russia is keeping a rather high level of troops on the Ukraine frontier during NATO military exercises.

- Peru will hold elections on June 6. The candidates, Pedro Castillo and Keiko Fujimori, are polar opposites. The former is a leftist in the mold of Evo Morales and Hugo Chavez, and the latter is a rightest similar to her father. As the election draws near, there are reports of increasing capital flight as wealthy Peruvians become increasingly worried.

- Tax reform efforts in Colombia are leading to increasing unrest.

COVID-19: The number of reported cases is 155,297,849 with 3,244,849 fatalities. In the U.S., there are 32,588,066 confirmed cases with 579,280 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 321,549,335 doses of the vaccine have been distributed, with 249,566,820 doses injected. The number receiving at least one dose is 148,562,891, while the number of second doses, which would grant the highest level of immunity, is 107,346,533. The FT has a page on global vaccine distribution. India’s cases continue to rise. Although overall U.S. cases are falling, the Axios state map does show a mixed picture of rising and falling cases.

- The Biden administration shocked the pharmaceutical world by supporting a temporary suspension of vaccine patents. Lifting the patents would allow developing world manufactures to expand production rapidly. But, the drug companies fear this step will undermine the patent system and weaken protections on their intellectual property. Shares fell both in the U.S. and abroad. Although it is clear there are concerns, it should be noted that this move may be more public relations than substantive. Getting patent relief will entail negotiations, and it isn’t obvious whether developing nations have the technology to make the vaccines, even if they have the formulas.

- The CureVac (CVAC, USD, 101.20) vaccine has completed its clinical trials and is set to announce results. If it works, it will offer an mRNA vaccine that doesn’t require the freezing that earlier, similar vaccines required. That characteristic would be a major support for the developing world.

- Preliminary results from Moderna (MRNA, USD, 162.84) indicate that its booster shots created an immune response to variants of COVID-19.

- Polls suggest that the U.S. may be reaching the point of vaccine saturation. A recent experiment shows that one way to overcome vaccine hesitancy is to pay people $100 to get vaccinated.

- Two members of the Indian delegation to the G-7 meeting tested positive for COVID-19.

- Although lockdowns likely reduced deaths and infections from the virus, it has had an adverse impact on other issues, such as opioid addiction.

Economics and policy: Inflation, inventories, and taxes are in the headlines.

- We often are asked questions about inflation. Most of the time, the focus is on policy. Although worrying about monetary or fiscal policy is understandable, our many years of looking at inflation have made it clear to us that the topic is deeply complicated. At its heart, inflation is a balance sheet decision. When a household or firm decides it would rather hold real assets instead of financial ones, it is a key element to rising price levels.

- Although just-in-time inventory management methods appear to have started in Japan in the 1970s, they didn’t really catch on in the U.S. until the 1980s. In the 1970s, in a period of negative real interest rates, the cost of carrying inventory was theoretically negative as well. Most firms saw the value of their inventory rise, so holding inventory was a benefit.

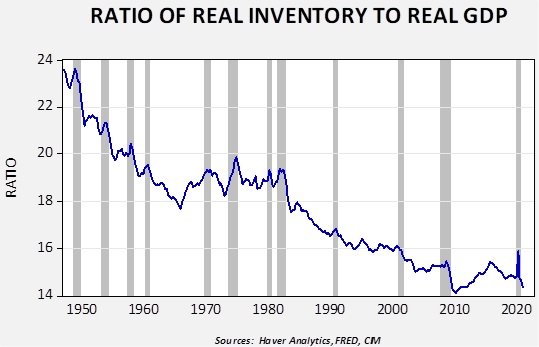

- This chart shows the ratio of real inventories to real GDP. It falls over time, in part, because of the economy’s steadily increasing dominance of services, which by their nature, have less inventory. Some of this decline is also due to inventory management. After the war into the mid-1960, a period of steadily falling inflation volatility, there was a steady decline in inventories relative to GDP. However, as inflation began to rise in the mid-1960s, this downtrend stopped, and there was a tendency to hold inventories relative to GDP. After inflation fell in the early 1980s, the downtrend resumed and is currently at historic lows.

- Automakers are apparently rethinking their inventory management. Insecurity of supply is the basic reason behind the change. Yet, if firms begin to believe that holding more “stuff” is better than holding financial assets, it will tend to lift goods prices and support inflation.

- The basis of just-in-time inventory methods is the idea that inventory is a negative factor, and it is preferable to have as little as possible. That position appears to be deteriorating, at least regarding cars, and if it starts to spread to other industries, it will tend to lift prices.

- The Biden administration is attempting to move numerous tax proposals through a narrowly divided Congress. That means that individual senators and representatives can have sizeable influence. Simply put, it is a better use of time to wait and see what happens with taxes rather than plan changes based on proposals.

- Another issue with taxes is the incidence of corporate tax.[1] Economic theory suggests that shareholders pay, but if a firm has market power. They may be able to pass the taxes on to consumers via higher prices or to labor through lower wages. The debate remains unresolved, but there are worries that a hike in corporate taxes may not have the impact policymakers expect.

- The broadest version of the corporate tax will likely require the OECD to agree to a global minimum tax. The U.K. has indicated it might agree.

- A U.S. judge tossed out the CDC’s eviction moratorium, suggesting the CDC didn’t have the legal authority to impose it. It was scheduled to end on June 30. The administration is scrambling to move aid to renters to avoid massive evictions. The DOJ says it will appeal the ruling. Clearly, the current situation cannot continue. Renters cannot continue to live in housing without paying rent, and landlords cannot be expected to forgo rental income indefinitely. It would create a chain of defaults that would adversely affect the economy. We suspect the final solution will be some sort of socialization of the arrears. A mass eviction event could not only harm renters and strain social welfare systems but could also lead to falling rents.

- After several years of negative interest rates, Germans are beginning to react to the rates of return on cash by increasing their risk. Given the conservative leanings of Germans, this is a remarkable development.

- In the U.S., banks are encouraging corporations to move their cash out of deposits to avoid falling afoul of capital rules.

- The Biden administration is reversing an earlier rule on gig workers, making it more difficult for companies to claim contractor status.

- Companies are re-examining job requirement rules, suggesting that many jobs that currently require a bachelor’s degree may not need that status. Such a move could boost employment over time.

- One factor that may be affecting hiring is that the tech center cities are seeing slower hiring than the rest of the country. This might reflect the work from home changes, which would lead to less demand for services in these cities.

- At long last, the CME is closing the last of the open trading pits. The trading floors have been lightly populated for over a decade, but the end has finally come.

- We recently issued a series of reports on central bank digital currencies. A comment from the FT suggests that the central banks are not likely to protect privacy. We also note that cryptocurrency volumes are rising rapidly.

- Hedge funds are positioning for a slow depreciation of the dollar.

- Be aware—the debt ceiling issue will return this summer.

China: The Uighur issue continues to resonate, and Chinese equity listings remain an issue.

- There is growing reluctance among America’s allies to declare China’s treatment of the Uighurs as genocide. This is mostly due to worries about losing trade with China. It is also true among companies.

- However, this reluctance isn’t true for Australia. The country revoked a 99-year lease in Darwin to the Landbridge Group, a Chinese company, on national security grounds. Beijing isn’t happy.

- Short sellers argue that a sizeable number of Chinese listed firms in the U.S. are beyond regulation and should be delisted.

- As Ant Financial moves toward its IPO, it is trying to figure out how to bring its health alliance mutual aid network into regulatory compliance.

- China is opening Hong Kong’s bond market to the mainland, with the goal of slowly opening China’s capital account.

- China is apparently gathering data from televisions to see what households are up to. The government decided not to mention that to its citizens.

[1] In other words, who pays?