Weekly Energy Update (May 6, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Tightening supplies have lifted crude oil prices toward the top of the recent trading range.

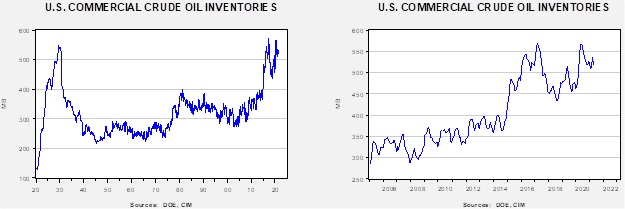

Crude oil inventories declined 8.0 mb compared to the 2.0 mb draw expected. The SPR fell 1.0 mb, meaning without the addition from the reserve, commercial inventories would have declined 9.0 mb.

In the details, U.S. crude oil production was steady at 10.9 mbpd. Exports rose 1.5 mbpd while imports fell 1.2 mbpd. Refining activity rose 1.1 mbpd.

(Sources: DOE, CIM)

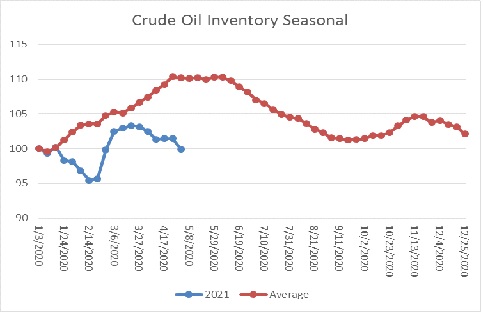

This chart shows the seasonal pattern for crude oil inventories. We are through the peak of the winter/early spring build season. In the second half of June, stockpiles usually decline. Note that stocks are already below the usual seasonal trough seen in early September. Our seasonal deficit is 53.0 mb.

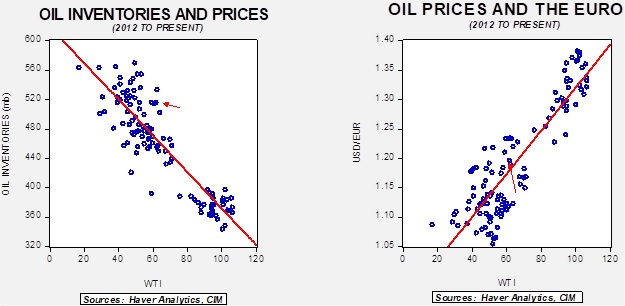

Based on our oil inventory/price model, fair value is $46.25; using the euro/price model, fair value is $66.02. The combined model, a broader analysis of the oil price, generates a fair value of $55.09.

Market news:

- Exxon (XOM, USD, 60.99) is facing increasing investor pressure to change its direction from a fossil fuel company to something else. This is a theme we think has legs; essentially, regarding the previous point, transportation is shifting from drilling to mining. The company isn’t the only energy firm coming under scrutiny.

- Michigan is threatening to close a pipeline that runs from Canada to the U.S. A portion of the pipeline passes across the Great Lakes, and there are fears a rupture could be catastrophic. At the same time, the lines have run for over 70 years without incident. The threat is raising tensions between the U.S. and Canada. Trade is conducted through the USMCA, and thus, Ottawa may have legal remedies to halt the closure.

Geopolitical news:

- The situation between the U.S. and Iran continues to be fluid. There are rumors circulating that the U.S. was willing to release some frozen funds to Iran in return for Iran releasing prisoners. This rumor was denied, but the comments may either signal that something is going on, or it was offered as a trial balloon. At the same time, American and Iranian vessels are engaging in close encounters in the Persian Gulf. Such close calls raise the possibility of an accident that would raise tensions.

- Saudi Aramco (2222, SAR, 35.65) and India’s Reliance Industries (RELIANCE, INR, 1921.50) are in talks; the former is considering a minority stake in the Indian company. In a first, Saudi Aramco is discussing using stock to fund the purchase.

- The EU is facing pressure from the industry to implement a carbon equalization tax. This tax would raise tariffs on imported goods that don’t apply the same low carbon standards as Europe employs.

Alternative energy/policy news:

- The Senate has voted to restore methane control rules for the oil and gas industry. They were suspended by the previous administration, and there are expectations that even tougher rules may be in the offing. To some extent, this swing in policy is a growing problem; political polarization is leading to conditions where policy swings violently between governments, hampering long-term planning.

- China is rapidly becoming the dominant producer of electric vehicles. Interestingly enough, a sizeable portion of the new capacity is coming from startups. The U.S. is planning to keep pace, but China’s large domestic market and its ability to streamline approval will tend to give them an advantage.

- Cobalt prices are up 40% this year. It is a key component of batteries, with most of the metal coming from the Congo. Acquiring important metals is a significant issue surrounding the shift to electric vehicles.

- One of the overlooked issues surrounding the transition from fossil fuels is the amount of land required to “green” the economy. In the end, there is a strong case for nuclear and carbon-captured natural gas, simply because it will be hard to expand the footprint for wind and solar to meet the nation’s demand for electricity.

- We have been watching the solid-state battery industry development for some time. Here is a new entrant. Solid-state batteries hold great promise because they would hold more energy and recharge much faster.

- Data from NOAA show that temperatures have turned warmer.

- Despite promises, it doesn’t appear that the change from fossil fuels to green energy will lead to no loss of blue-collar jobs. Instead, there is a higher likelihood of job losses which will make selling the policy difficult politically.