Daily Comment (May 13, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. Our coverage begins with a few comments about yesterday’s CPI report. We take a quick look at the deteriorating situation in Israel. The Colonial pipeline has reopened. Economic and policy news follows, with China news next. The international roundup comes after that, and we close with the pandemic update.

About that inflation data: Yesterday’s CPI data was clearly a surprise. Although we expect prices to accelerate into late summer, the surprise effect will diminish over time. Usually, economists overcompensate when they miss widely, so even with rising CPI in the coming months, the market reaction should be lessened. As we have warned before, base effects from last year would tend to boost inflation this year. April data showed that and then some. However, some of the price spikes won’t last. Rising prices will eventually lift supply and will probably curtail demand.

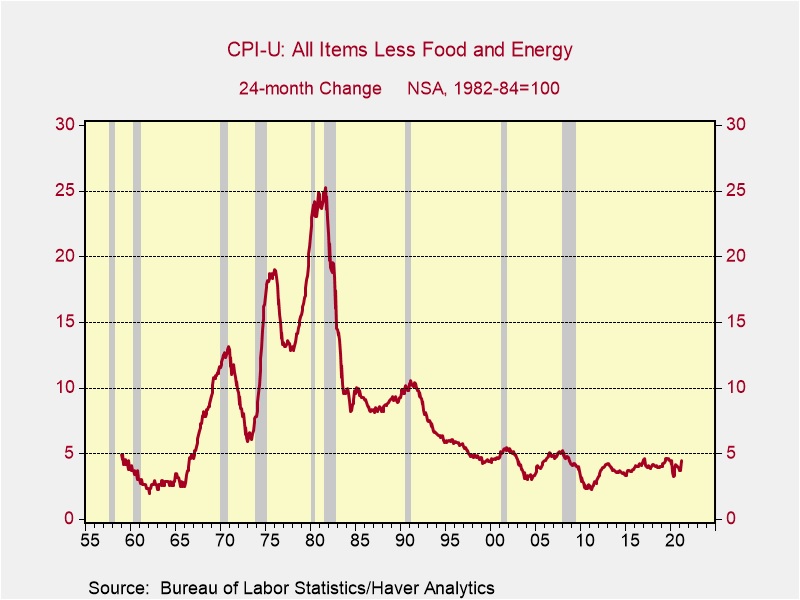

Here’s another way of looking at the data. Since an event last year affected the yearly comparisons, it might make sense to look at the price changes from two years ago. That data suggests an increase, but nothing that indicates an outlier.

The Fed’s position is that the increase we are seeing in inflation is transitory. We tend to agree with this position. Rising prices will trigger a supply response and bring down prices at some point. However, there is a risk to this position, which is that inflation expectations change. If households begin to buy now for fear of higher future prices and firms begin to treat inventory as an asset, inflation could become a much more serious problem. We don’t think that is happening yet, but we are watching closely.

Clearly markets were not happy. Outside of shorting, there really was no area of the market that hasn’t suffered over the past few days. Rising yields boosted the dollar and depressed commodities, stocks, and bond prices. In equities, the market has become richly valued, so a period of pullback isn’t the worst thing.

The FOMC is getting the first real test of its shift to a focus on labor markets and less emphasis on inflation control. There will be increasing worries about the Fed allowing inflation expectations to get out of hand. We think it is more likely that we see a few months of elevated inflation followed by a moderation. Current Fed policy will, over time, raise inflation, but there are several long-term factors that will continue to weigh on keeping inflation under wraps. These include aging demographics, the preponderance of intangible investment and capital, inequality, and the openness to trade. We do expect the latter two factors to eventually reverse, but for now, they remain factors that will dampen inflation.

The Israel problem: There is a persistent level of tension between Israel and the Palestinians. When violence flares, it can be tricky to determine whether the situation is a short-term event or something more serious. The current one is starting to worry us. The tensions are ostensibly about the eviction of a group of Palestinians from East Jerusalem to allow Israeli settlers to move in. The broader situation appears to be tied to a conflict between Hamas and Palestinian Authority. The Palestinians were expected to hold elections this year, and Hamas was projected to gain power, mostly due to divisions within Fatah. To prevent this from occurring and to remain in power, the leader of the Palestinian Authority, Mahmoud Abbas, postponed the vote. This decision has led Hamas to try to find a way to retaliate against Abbas. It appears Hamas has decided to attack Israel using the evictions as a reason. Unfortunately, the fighting is escalating rather quickly. Casualties are occurring on both sides as Hamas fires volleys of rockets into Israel from Gaza, and the IDF retaliates with airstrikes. Civil unrest in Jerusalem is leading to additional casualties. There is also increasing unrest in Arab parts of Israel and Israeli cities.

As the violence increases, outside parties are being drawn in. The U.S. is reluctantly becoming involved, with President Biden offering support for Israel. Turkey and Russia are calling for peacekeepers, something Israel will oppose. Complicating matters is the uncertainty surrounding the Israeli government. Successive U.S. presidents have been trying to reduce American involvement in the region, in part, to focus on the great power competition with China. This tragedy could undermine the Biden administration’s domestic agenda. There is one other interesting factor; the silence from the Arab states that has been improving relations with Israel is notable. The Abraham Accords have changed the diplomatic situation in the Middle East, meaning that the Palestinians can no longer rely on support from these nations during uprisings. That factor may reduce the duration of the current tensions.

Colonial pipeline: The pipeline managers announced that operations have restarted. That’s good news. The bad news is the flow in the line is between three to five miles per hour, meaning it will be several days before product begins to flow at adequate levels. Meanwhile, gas lines, reminiscent of the 1970s, have emerged. The southeast appears to be seeing the fastest price increases. We should see supply issues improve by the end of next week.

An observation: The Colonial pipeline, the inflation spike, and the tensions in Israel all have one common effect—they will tend to become a distraction for the administration’s policy progress. All new presidents enter office with plans. But, as Clausewitz noted, “No campaign plan survives the first contact with the enemy.” Although these events are not all related, they do show that governments operate under conditions that can distract and delay policy progress. Given that political capital is perishable, such events make it difficult to meet policy goals.

Economics and policy: Comments on crypto assets and credit cards.

- As crypto assets become more widely adopted, regulators are warning investors to be careful about what they are investing in. One of our concerns is that the financial system tends to deploy leverage in ways that can be difficult to monitor. If crypto assets are leveraged, they could go from a useful diversion of liquidity to an asset without ties to the rest of the economy to a factor that may affect the broader financial system. In other words, there may be more risk to a sharp drop (or for that matter, a sharp rise) in crypto asset prices if leverage is involved.

- Block.one is starting a new crypto exchange with high-profile backing.

- Tesla (TSLA, USD, 589.89) announced, due to environmental concerns, it will no longer accept bitcoin for payment.

- Facebook (FB, USD, 302.55) announced it will restart its Libra crypto project, with changes designed to address regulator concerns.

- We are seeing steady signs that the stimulus checks are being saved or used to reduce debt. Banks are worried about the decline in credit card balances, which would reduce the interest income from this lending. Interestingly enough, banks are looking to issue credit cards to those without a credit score. Although this effort is being framed as a way to help the “unbanked,” we wonder if it is more about reviving a slumping business.

- Further evidence of financial overheating is showing up in the deepest recesses of the high yield market. Some new issues allow firms to expand borrowing in the future. These clauses are being dubbed “pick your poison.”

- In the wake of Archegos, regulators are reviewing margin rules.

- In U.S. real estate, lower-cost existing homes are showing the fastest price appreciation.

- LIBOR is to be replaced, but it looks like it will take a while for a single alternative to emerge.

China: China is expanding its use of social media, and the population issue continues to dominate the news.

- According to a recent study, China is aggressively using social media to shape foreign opinion. It is also trying to affect how the regular media frames China and the PRC.

- The fallout from China’s population issues continues to resonate. One issue that undermines China’s ability to boost childbearing is that the CPC loathes to give up control, especially at the local level. The PRC created a bureaucracy designed to monitor the one-child policy and hasn’t been able to fully break it down, as the members of these monitoring groups prefer to remain employed. Thus, the policy to restrict births continues, at least partially, to remain in place. In addition, against some non-Han groups, China actively works to suppress population growth.

- Although the U.S. trade deficit continues to expand (mostly a function of U.S. growth relative to the rest of the world), imports from China have declined, mostly due to tariffs. This situation highlights a fact about trade; tariffs don’t cure an overall trade deficit, just a bilateral one.

- Loan growth in China is slowing. There is increasing evidence that China is reining in stimulus as the U.S. expands, which will likely lead to a widening trade deficit. Although it may not be a wider bilateral trade deficit with China, Beijing could see its sales rise to other nations as those countries boost their exports to the U.S.

- Chinese bond defaults continue to rise at a record pace.

- The American Chamber of Commerce in China is calling for Chinese authorities to give foreign firms in China a “fair” chance to compete for business.

- Although the U.S. is trying to restrict the use of Chinese technology, Chinese companies are having some success in the courts against these provisions.

- China’s best ally in the EU is probably Hungary. Germany has criticized Hungary for blocking EU criticism of China. The EU often requires a unanimous decision, so one nation can block an action.

- Meanwhile, at the U.N., the U.S., the U.K, and Germany were critical of China’s treatment of Uighurs. The U.S. described Xinjiang as an “open air-prison.”

- One of the goals of the Biden administration is to build a base of allies to oppose Chinese expansion. However, this goal is conflicting with trade policy. As the U.S. retreats from globalization, it is reducing the economic incentive to align with Washington.

- In an attempt to reduce the cost of childrearing in China, authorities are restricting private tutoring. Tutors are used to give students an advantage in testing, but it becomes something of an arms race.

International roundup: Russia is seeing a worker shortage and is looking at gun control. Austria’s chancellor is being investigated.

- Russia is seeing a decline in migrant workers from central Asia, leading to worker shortages in construction and agriculture.

- A school shooting in Russia is leading the government to consider new gun regulations.

- Austrian Chancellor Kurz is under investigation for perjury.

- Lord Frost, the U.K. minister for EU/U.K. trade, suggested that the Northern Ireland protocol is probably unsustainable in its current form. The U.K. wants the EU to relax its rules; the EU fears that if it does, the U.K. will use those rules to “backdoor” trade to Europe. We tend to agree with Lord Frost, but we don’t see the EU relaxing rules. If the current situation is unsustainable, it will likely be the U.K. that adjusts.

COVID-19: The number of reported cases is 160,513,476 with 3,333,245 fatalities. In the U.S., there are 32,815,408 confirmed cases with 583,690 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 337,089,765 doses of the vaccine have been distributed with 264,680,844 doses injected. The number receiving at least one dose is 153,986,312, while the number of second doses, which would grant the highest level of immunity, is 117,647,439. The FT has a page on global vaccine distribution. The Axios map shows a clear improvement in the U.S.

- A panel of medical professionals and political figures reviewed the WHO’s actions during the pandemic. Their report was critical of governments and the WHO, but it isn’t obvious whether the report will trigger any changes. The WHO doesn’t have the power to intervene in nations; in a sense, this is an issue for all international organizations. Without a hegemon enforcing rules, it is left to moral suasion to change behavior.

- Pandemic conditions in the U.S. are improving rapidly. We are seeing a steady reopening of public facilities, and travel is rising.

- However, conditions overseas are getting worse.

- Uruguay, which had mostly been keeping infections under control, is seeing a surge in infections. The emergence of new variants and sharing a border with Brazil are blamed for the rise.

- The world’s most vaccinated country, the Seychelles, is seeing rapid infections as well. The island nation inoculated its citizens with the Sinopharm (SHTDY, USD, 16.16) vaccine. The increase in infections raises concerns that the Chinese vaccine may be less effective in preventing infection or may not be effective against new variants.

- India continues to suffer from rising infections. There is some evidence suggesting that new variants are emerging in the country and may be undermining vaccine effectiveness. The rise in India’s cases appears to be spreading across south Asia. Singapore is reporting a cluster tied to its airport.

- The appearance of the Indian variant in the U.K. is increasing concern as the British reopen.

- A U.K. trial that mixed vaccines suggests that doing so increases the side effects.

- The CDC is recommending the Pfizer (PFE, USD, 39.69) vaccine for 12 to 15-year-old patients.

- To overcome vaccine hesitancy, Gov. DeWine (R-OH) is offering college scholarships and participation in lotteries.

- A German researcher may have isolated the reason why some vaccines trigger blood clotting. It appears to be an immune response to preservatives.

- A University of Washington study concluded that the fatality count from COVID-19 may be double the number reported. This sort of outcome isn’t a huge surprise; the death count from previous pandemics usually is undercounted.