Weekly Energy Update (May 13, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Tightening supplies have lifted crude oil prices toward the top of the recent trading range.

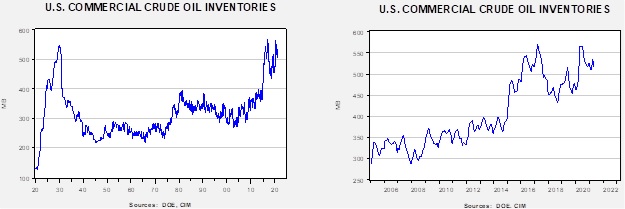

Crude oil inventories declined 0.4 mb compared to the 1.8 mb build expected. The SPR fell 1.4 mb, meaning without the addition from the reserve, commercial inventories would have declined 1.8 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.0 mbpd. Exports fell 2.3 mbpd while imports were unchanged. Refining activity declined 0.4 mbpd.

(Sources: DOE, CIM)

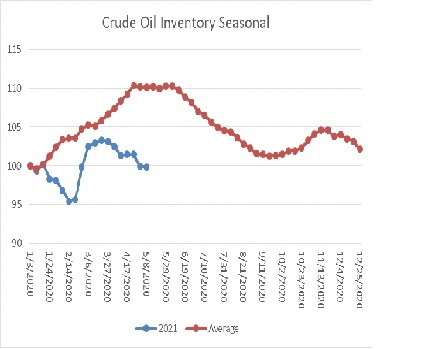

This chart shows the seasonal pattern for crude oil inventories. We are through the peak of the winter/early spring build season. In the second half of June, stockpiles usually decline. Note that stocks are already below the usual seasonal trough seen in early September. Our seasonal deficit is 52.6 mb.

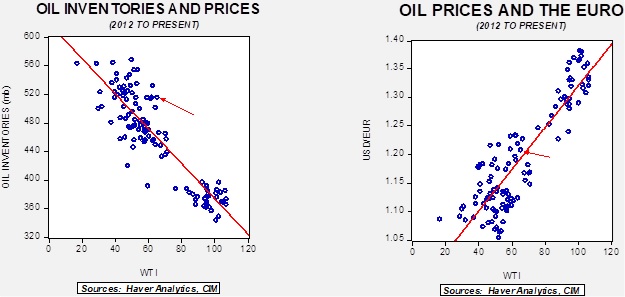

Based on our oil inventory/price model, fair value is $46.65; using the euro/price model, fair value is $68.54. The combined model, a broader analysis of the oil price, generates a fair value of $56.86. Although the slow decline in stockpiles is price supportive, the weakening dollar is much more important in lifting the model’s fair value.

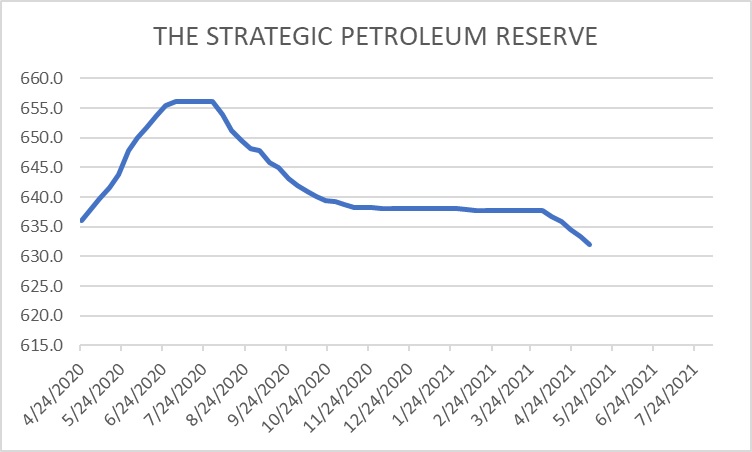

The DOE is continuing to reduce the SPR.

(Source: DOE, CIM)

This action is a bearish factor for prices, but the gradual nature of the sale has not had much of an effect thus far. We expect another 7.0 mb of sales to occur this year.

Market news:

- This week’s big news is the ransomware disruption of the Colonial pipeline. The line, which runs from Houston to New England, is a critical element of U.S. energy infrastructure. Although we expect flows to begin by the weekend, it will likely take at least a week to 10 days for conditions to normalize. Meanwhile, refineries are reducing operations because the product has nowhere to go. Restarting will also take time. As this picture shows, drivers are scrambling to find gasoline.

(Source: AP)

Local gasoline prices are rising rapidly. Meanwhile, government officials are trying other forms of transportation to move the product to markets facing shortages. This situation will affect the energy data for the rest of May.

- Michigan is threatening to close a pipeline that runs from Canada to the U.S. A portion of the pipeline passes across the Great Lakes, and there are fears a rupture could be catastrophic. At the same time, the lines have run for over 70 years without incident. The threat is raising tensions between the U.S. and Canada. Trade is conducted through the USMCA, and thus, Ottawa may have legal remedies to halt the closure. Meanwhile, Michigan Gov. Whitmer is threatening to seize profits from Enbridge (ENB, USD, 40.12), the pipeline operator, for continuing to operate the pipeline. If this situation leads to a disruption, the timing could not be worse, given the turmoil caused by the Colonial pipeline situation.

- We continue to see news on the Texas freeze-out. During the crisis, state regulators implemented a program that pays industrial users to reduce their natural gas consumption. Paradoxically, this led to the curtailment of natural gas as firms involved in the natural gas infrastructure were taken offline.

Geopolitical news:

- Crosscurrents in Iranian/U.S. relations continue. Negotiators from the Biden administration are in discussions with Iran, and there are optimistic reports that the two sides may come to an agreement on restoring the 2015 Nuclear Agreement in a matter of weeks. However, it is also evident that there is a high degree of ambiguity in what both sides want; in reality, it is unlikely that a full return to the original deal is possible. Meanwhile, low-level skirmishes between the U.S. Navy and the Iranian Revolutionary Guard Corps continue in the Persian Gulf. The fact these continue suggests wide divisions still exist.

- Iran has confirmed that talks between Tehran and Riyadh are underway, but not much else is known. The fact that the two sides are talking does suggest the KSA expects the U.S. to withdraw from the region, thus forcing Iran and the KSA to make some sort of agreement.

Alternative energy/policy news:

- The EU carbon price is rising rapidly, hitting a new record of €50 per tonne.

- There are increasing worries that rapidly rising base metals prices will slow the conversion to electric transportation. There is also a growing realization that the mining required to acquire these metals is far from green.

- The IEA reports that wind and solar power rose last year. The U.S. has approved the first offshore wind farm.