Weekly Energy Update (May 20, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices continue to trade in a range from $58 to $68 per barrel.

(Source: Barchart.com)

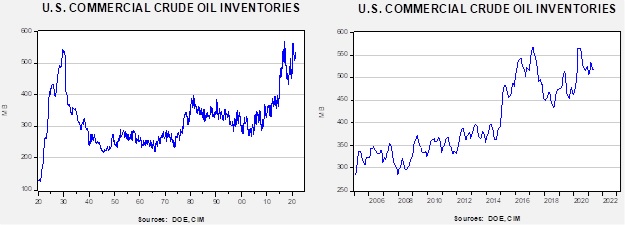

Crude oil inventories rose 1.3 mb compared to the 2.0 mb build expected. The SPR fell 1.9 mb, meaning without the addition from the reserve, commercial inventories would have declined 0.6 mb.

In the details, U.S. crude oil production was steady at 11.0 mbpd. Exports rose 1.5 mbpd while imports rose 0.9 mb. Refining activity rose 0.2%.

(Sources: DOE, CIM)

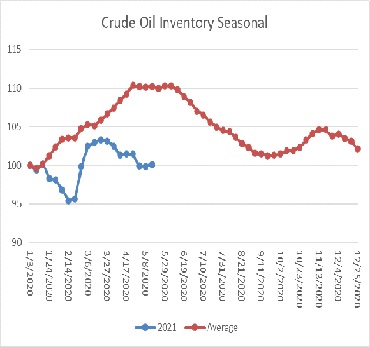

This chart shows the seasonal pattern for crude oil inventories. We are through the peak of the winter/early spring build season. In the second half of June, stockpiles usually decline. Note that stocks are already below the usual seasonal trough seen in early September. Our seasonal deficit is 53.1 mb.

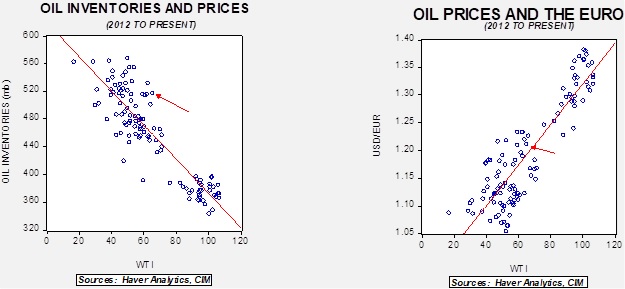

Based on our oil inventory/price model, fair value is $46.24; using the euro/price model, fair value is $69.19. The combined model, a broader analysis of the oil price, generates a fair value of $56.99. Although the slow decline in stockpiles is price supportive, the weakening dollar is much more important in lifting the model’s fair value.

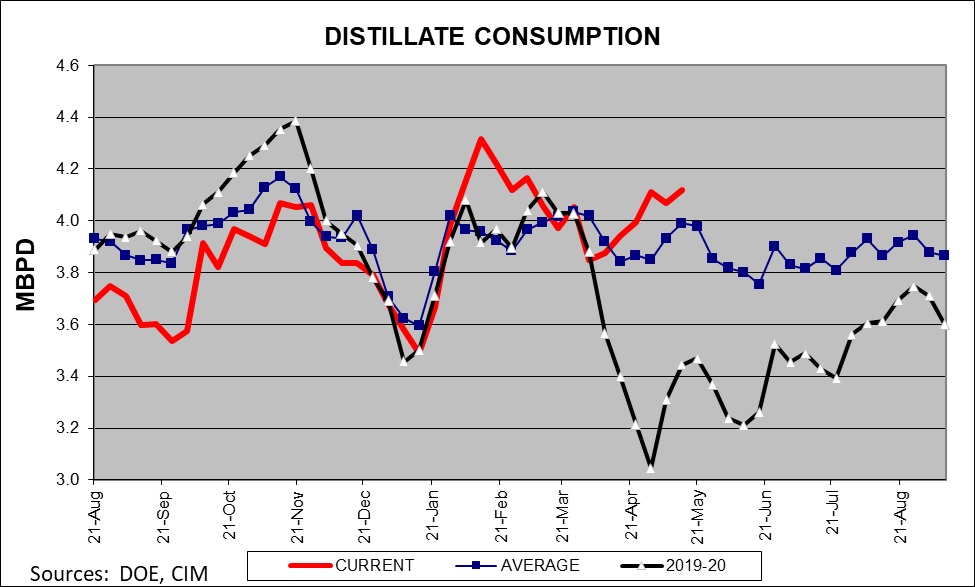

As the economy recovers, distillate demand is accelerating.

Market news:

- The IEA issued some rather draconian news this week, arguing that if the world wants to reach zero carbon emissions by mid-century, investment in oil and gas must stop immediately. We have been expecting something akin to this at some point, which is why we are more favorable to oil as a commodity compared to oil companies. Disinvestment from energy is becoming part of the ESG movement; because oil is a depleting asset, ending investment will lead to shortages before demand declines. It is quite possible that what is happening to oil is what has already happened to coal.

- Although we suspect disinvestment will lead to higher oil prices, it is also possible that oil companies unconstrained from ESG issues may conclude it is better to increase production before demand is lost. Russia is apparently considering such a strategy, and if Russia does it, we suspect the KSA will too.

Geopolitical news:

- In a surprising development, the U.S. has decided to waive sanctions on the company and CEO involved in the Nord Stream 2 project. The U.S. has been warning for months that it didn’t want to see the pipeline completed and was preparing to implement sanctions if the program wasn’t halted. The Biden administration even appointed a special envoy to the project. Instead, the administration will sanction the actual vessels involved but spare the CEO of the project, a former Stasi member who has close ties to Vladimir Putin, from direct sanctions.

- The administration’s caving on this issue is remarkable. First, it’s a major win for Russia. The pipeline will allow Russia to bypass pipelines in Ukraine, removing a chokepoint for natural gas sales. Second, although it protects Germany from Ukrainian disruptions, it makes Berlin more dependent on Russian energy. The U.S. has wanted to sell LNG to Europe so completing the pipeline will reduce demand for American gas. Third, it adds to fears in Eastern Europe that Germany is allying with Russia to their detriment. Fourth, it makes the U.S. complicit in isolating Eastern Europe.

- We suspect the administration wanted to curry favor with the Merkel government. If so, this decision appears short-sighted. Germany is holding national elections in September. The Greens, who lead in current polls, oppose Nord Stream 2. Therefore, if the administration had simply waited, it would likely have had a German government more aligned with its interests.

- It is possible the Biden administration may rethink this position. In other words, this action may be a trial balloon. However, if the U.S. maintains this decision, it appears to us to be giving a major win to Russia, who, by the way, has provided support for the hackers who recently struck the Colonial pipeline.

- Russia is facing carbon taxes on its energy exports to Europe; EU energy consumers are starting to complain.

- As the Biden administration moves to return to the Iran nuclear deal, it is important to remember that the Obama administration considered it an intermediate step to establishing Iran as the regional hegemon. It is also important to note that Iran, even in its current economic turmoil, spends an estimated $15 billion to $20 billion per year supporting its proxies in the region. If sanctions are lifted, it will support the activities of its proxies.

- The Maduro government has closed the last independent newspaper in Venezuela.

Alternative energy/policy news:

- The Supreme Court gave a victory to the oil and gas industry this week. The city of Baltimore has sued 20 major companies over climate change and wanted to try the case in Maryland’s state courts. The highest court agreed with the industry that a more appropriate venue would be Federal courts.

- To meet carbon stabilization, it is generally thought that carbon reduction will likely be necessary. This process can be as simple as planting trees or as sophisticated as factories that pull CO2 out of the air.

- One of the problems with solar and wind energy is that it is interrupted. At sundown, or if the wind doesn’t blow, power is removed. So far, the solution has been to have natural gas turbines that can be fired up when renewable energy is not available. However, there is increasing investment in batteries that will store electricity during the daytime and when there is wind and discharge it when solar energy and wind energy are lacking. If this becomes a trend, it will be a serious threat to natural gas demand.

- Another element of using less carbon is the electrifying of the economy.

- Although EVs continue to dominate the movement away from gasoline and diesel, hydrogen is still an alternative.