Weekly Energy Update (May 27, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

(Due to staff vacation schedules, the next report will be published on June 10.)

Oil prices continue to trade in a range from $60 to $68 per barrel.

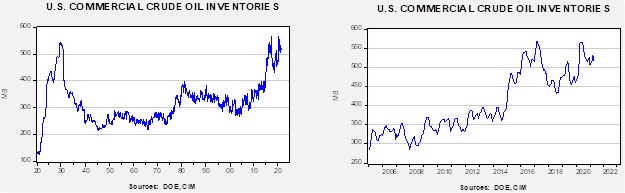

Crude oil inventories fell 1.7 mb compared to the 1.0 mb draw expected. The SPR fell 1.6 mb, meaning without the addition from the reserve, commercial inventories would have declined 2.3 mb.

In the details, U.S. crude oil production was steady at 11.0 mbpd. Exports rose 1.5 mbpd while imports rose 0.9 mb. Refining activity rose 0.2%.

(Sources: DOE, CIM)

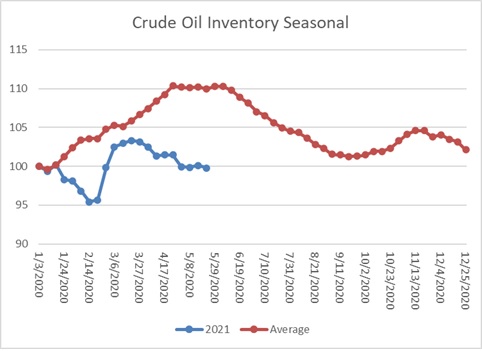

This chart shows the seasonal pattern for crude oil inventories. We are through the peak of the winter/early spring build season. In the second half of June, stockpiles usually decline. Note that stocks are already below the usual seasonal trough seen in early September. Our seasonal deficit is 51.7 mb.

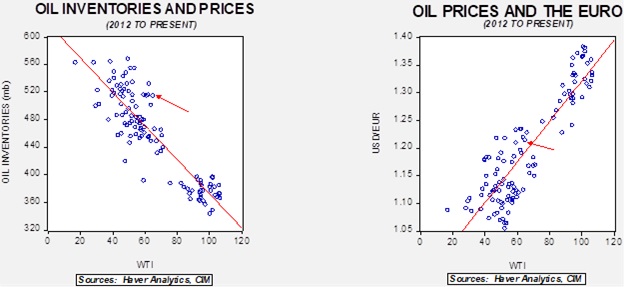

Based on our oil inventory/price model, fair value is $46.78; using the euro/price model, fair value is $69.77. The combined model, a broader analysis of the oil price, generates a fair value of $57.58. Although the slow decline in stockpiles is price supportive, the weakening dollar is much more important in lifting the model’s fair value.

Market news:

- Last week, we noted the IEA reports that outlined the path to zero emissions by 2050. It essentially argued that to reach this goal would require an immediate halt to oil and gas drilling. As the dust clears, a few new “known/unknowns” emerge.

- Is this a real plan or an outline designed to show the impossibility of reaching these targets?

- Is the IEA really becoming carbon negative? After all, it was a group designed to represent the interests of the oil-consuming nations against OPEC.

- The full ramifications of the study are that oil and gas will follow the path of coal, nuclear has to get bigger, consumer lifestyles are going to suffer, and the oil-producing nations are in serious trouble.

- Private studies tend to confirm the IEA’s position.

- We are starting to see a pushback against the IEA from member nations. If the IEA is right and continued investment means targets won’t be hit, investments in climate mitigation (seawalls, tighter building standards, rebuilding of residential housing outside of flood plains, etc.) are going to rise.

- China is adjusting its tax regime on oil and petroleum products. It will likely lead to heavier crude imports and less exports of product, raising product prices to Asia.

- NOAA is predicting an active hurricane season. Tropical activity often disrupts energy production and trade flows.

- Drought in the Western U.S. continues unabated and will affect electricity grids.

Geopolitical news:

- Last weekend, we saw Belarus force a civilian airliner to land in Minsk; a dissident was taken off the plane and arrested. Although the EU did apply some travel sanctions, in reality, the EU is dependent on oil and natural gas flows that transit Belarus. This fact weakens the ability of nations to apply sanctions.

- On June 18, Iran will hold presidential elections. The Guardian Council approves candidates for the position, and it has eliminated all the moderate or popular candidates. This ensures a hardline conservative will take power.

- Oil prices have faced downside pressure on reports the U.S. is close to returning to the nuclear deal with Iran. One factor often overlooked is that nations try to play their powers off against each other. U.S. hostility toward Iran has forced Tehran to team up with China and Russia, but that outcome isn’t always in Iran’s best interest. So, Iran wants better relations with Washington for no reason other than to reduce the influence of China and Iran.

- The KSA is continuing its policies of privatization to improve its fiscal situation. There are plans to sell off $55 billion of assets over the next four years.

- After years of civil conflict, it appears Libya has come to a peace deal. It may lead to higher production from the country and certainly more stable flows, and it has a modestly bearish influence on oil prices.

Alternative energy/policy news:

- The U.K. is about to embark on its carbon pricing market; energy firms and others are bracing for higher costs. France is also expanding its climate regulations, and in an interesting development, the populist right is supporting the measures.

- Nuclear power is also expanding, with 50 new reactors being constructed in 16 different nations.

- The Biden administration is imposing new rules through executive order to combat climate change. A number of these orders affect financial services, which would likely curtail lending to firms that provide hydrocarbons.

- China’s CO2 emissions are up 9% from pre-pandemic levels.

- As the demand for green power rises, oil majors are getting into the business of supplying this energy.

- Indonesia, a major nickel supplier, is going to build battery plants.

- At the time of this writing, Exxon (XOM, USD, 58.47) is facing an activist shareholder who opposes its business model and wants to fill four board seats. It appears at least two of the seats were won by the activist hedge fund, Engine No. 1. We view such activities as likely to increase over time and will eventually reduce oil supplies.

- Dutch courts are ordering Royal Dutch Shell (RDS.A, USD, 39.28) to take more aggressive steps to address climate change issues.