Daily Comment (May 28, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! U.S. equities are expected to open higher this morning as President Biden’s new budget proposal caused a boost in investor optimism. Today’s report starts off with a brief summary of the $6 trillion proposal. International news follows, with an update on EU relations with Belarus following the recent plane incident and a crackdown on Big Tech by French authorities. Economics and policy news are up next, including reports of an automaker resuming production and the U.S. withdrawal from Afghanistan. China news follows, and we close with our pandemic coverage.

Biden’s budget proposal: The Biden administration is expected to unveil a budget proposal of $6 trillion over the next decade. The proposal will likely include investments in infrastructure, childcare, and cybersecurity, and Biden plans to pay for this additional spending through taxes on corporations and high earners. This budget is expected to meet stiff opposition from Republican lawmakers who fear that the increase in fiscal spending could lead to a return to the 1970s era of stagflation. On the other hand, the administration believes the increase in spending will boost the economy’s long-run health and predicts that the deficit will begin to narrow going into 2030.

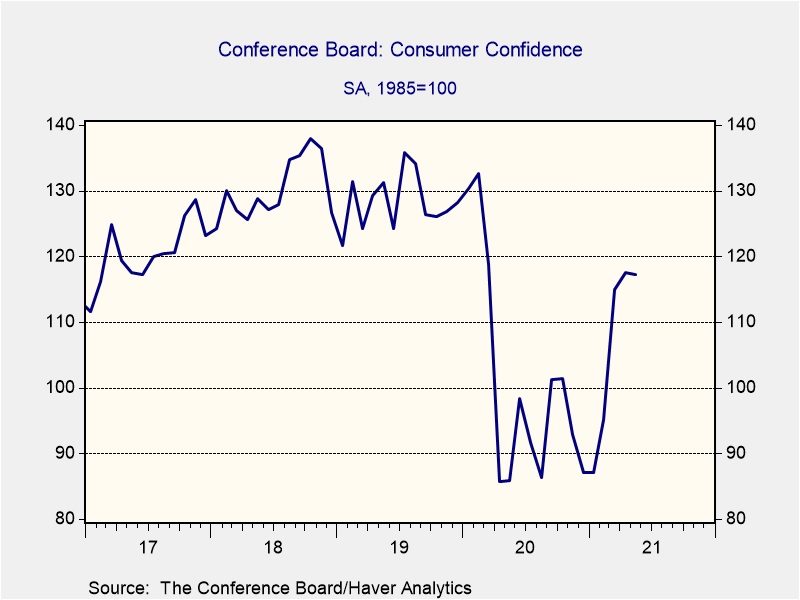

The additional spending over the next decade should be supportive for equities. However, there are still concerns as to whether the increase in spending will translate into sustained economic growth. President Franklin D. Roosevelt, who President Biden is often compared to, was unable to avoid a downturn in 1938 despite the fiscal expansion. In our view, it is never wise to assume that all spending is good, and vice versa. That being said, we are optimistic that additional spending will likely provide a boost in consumer confidence after an unexpected decrease in the Conference Board Consumer Confidence Index in May.

International news: EU airlines forced to cancel flights to Moscow, French regulators agree to a settlement, and the BOJ to consider climate change.

- A few European airlines had to cancel their flights heading to Moscow after Russian aviation authorities failed to approve new routes that avoided Belarus’s airspace. In response to a decision by Belarusian authorities to divert a Ryanair (RYAAY, $150.42) flight, the EU had advised airlines to avoid the country’s airspace.

- Alphabet Inc.’s (GOOG, $2401.52) Google is nearing a settlement with French regulators over accusations of anti-competitive behavior. The suit alleges that Google used its platform to advantage itself in auctioning ad space over its competitors. As part of the settlement, Google will pay a fine, admit no wrongdoing, and agree to change its platform to make it easier for other ad auctioneers to compete.

- Syrian President Bashar Assad won a fourth term in office in an election widely criticized by the West of not being free or fair. President Assad received over 95% of the vote.

- Canada is expected to cut back its bond-buying program in July. This would be the second time this year the country dials back the program, the first time being in April. It also signaled that it may be willing to raise rates in July.

- Microsoft (MSFT, $249.31) stated that the Russian hackers behind the SolarWinds (SWI, $16.68) attack have escalated their efforts to gather data from U.S. federal agencies, think tanks, and non-governmental organizations.

- Bank of Japan Governor Haruhiko Kuroda announced that the central bank will consider climate change in discussions about monetary policy.

Economics and policy: Republicans willing to add to the deficit, SOS Blinken warns of renewed conflict in Gaza, and the U.S. withdrawal ahead of schedule.

- Some Senate Republicans are willing to add to the national debt if the infrastructure plan is scaled back from $1.7 trillion to $1 trillion. President Biden is expected to make a decision by Memorial Day as to whether he will continue negotiating with Republicans or go it alone with Democrats.

- Secretary of State Tony Blinken warned that further evictions of Palestinians from East Jerusalem could potentially “spark another round of violence.”

- The China-focused global competition bill advanced through the Senate on Thursday. The bill has garnered bipartisan support, suggesting there is a good chance of it becoming law. If passed, the bill will provide $52 billion to support domestic semiconductor manufacturing, $16.9 billion to the Energy Department, and $10 billion to NASA.

- The United States informed Russia that it will not rejoin the Open Skies arms control pact.

- General Motors (GM, $59.77) has reopened two of its plants and added a second shift in a third plant. The moves indicate that the automaker may have found a way to source materials in spite of the semiconductor shortage.

- In his opening statement to the House Appropriations subcommittee, Defense Secretary Lloyd Austin stated that the U.S. withdrawal from Afghanistan is slightly ahead of schedule. The process is believed to be between 16% and 25% complete.

China:

- Angered at renewed speculation that the coronavirus may have originated in a lab in Wuhan, China has resurfaced its claim that the virus may have come from the U.S. military. In October 2019, Wuhan hosted the World Military Games which the U.S. participated in. China is suggesting that this event may have been the true source of the virus.

- China plans to develop 12 of its top universities to rival MIT and Stanford University in science and technology. The program will focus on teaching students artificial intelligence and data science.

COVID-19: The number of reported cases is 168,520,476 with 3,501,002 fatalities. In the U.S., there are 33,192,974 confirmed cases with 592,432 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 359,849,035 doses of the vaccine have been distributed with 289,212,304 doses injected. The number receiving at least one dose is 165,074,907 while the number of second doses, which would grant the highest level of immunity, is 131,850,089. The FT has a page on global vaccine distribution.

- Chile has announced that it will need to borrow $10.8 billion to help fund its response to the ongoing coronavirus outbreak. It plans to use money from copper prices to repay the debt.

- Germany is expected to open up vaccinations to children 12 years and older once the Pfizer (PFE, $38.65)/BioNtech (BNTX, $197.70) vaccine is approved by the European Medicines Agency.

- On Friday, the Food and Drug Administration is expected to announce that the contamination problem in a COVID-19 vaccine plant has been resolved. The plant is expected to resume production of vaccines for Johnson & Johnson (JNJ, $168.81) and will now be cleared for use in both the U.S. and overseas. Prior to the agreement, vaccinations made in the Baltimore plant were slated to be shipped primarily to Europe.

- U.S. scientists will begin running clinical trials that will test whether or not fully vaccinated people will be able to switch brands when getting the COVID-19 booster shot. At this time, there is no timetable as to when people will need to receive their third/second dose (depending on brand) of the vaccine as scientists aren’t sure when the antibodies will wear off.

- COVID-19 cases have dropped dramatically on college campuses.

- According to a new study published by JAMAS Cardiology, some of the athletes from the Big Ten who recovered from COVID-19 were later diagnosed with myocarditis, or inflammation of the heart. Exercising with the disease can increase the risk of cardiac arrest and sudden death.