Daily Comment (June 3, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Today’s Comment opens with an overview of yesterday’s “Beige Book” report from the Federal Reserve, which pointed to accelerating economic growth but continued inflation pressures. Sticking with the inflation theme, we then review the latest UN data on global food prices. Various international news items follow, and we wrap up with the latest developments on the coronavirus pandemic.

U.S. Monetary Policy: In its latest Beige Book analyzing business anecdotes on the state of the economy, the Fed said activity expanded “somewhat faster” in April and May than it did in the previous period, driven largely by increased coronavirus vaccinations, the easing of pandemic lockdowns, and rebounding consumer demand for services. The report discussed how supply disruptions and shortages across many industries are driving up costs, but it noted that rebounding demand often allows firms to pass on those costs to their customers in the form of higher prices. In summary, the report judged that “. . . expectations changed little, with contacts optimistic that economic growth will remain solid . . . Looking forward, contacts anticipate facing cost increases and charging higher prices in coming months.”

- The Beige Book focuses on current conditions as seen by local business leaders rather than the policymakers’ future expectations. It is, therefore, no surprise that yesterday’s report didn’t address head-on the key issue of whether today’s high inflation will really be transitory, as Fed officials insist. All the same, it was notable that the report offered little evidence that the supply disruptions, labor shortages, and other issues driving up prices will dissipate soon.

- For now, we remain optimistic that the current supply issues will get sorted out as the economy continues to recover from the pandemic, especially as the rebound in demand will likely be sated at some point. Moving past today’s unfortunate inflation base effects will also help bring down the measured inflation rate, while other longstanding issues such as population aging should reassert themselves and put a damper on prices. We suspect that will eventually help calm inflation concerns and put a lid on bond yields if no other inflation pressures arise.

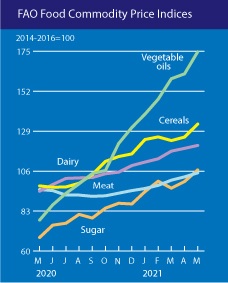

Global Food Inflation: The UN Food and Agriculture Organization said its May index of global food prices was up 39.7% from the same month one year earlier, marking its biggest annual increase since 2011. The report attributed the surge in food inflation to a range of factors, including the increased use of vegetable oil for biodiesel, China’s soaring appetite for grain and soybeans, and a severe drought in Brazil. As a result, the annual price increases were especially large for vegetable oils and cereals (see chart below).

- Not only will the data feed into current global concerns about the impact of inflation on the economy and financial markets, but it will also raise the specter of political unrest in less developed countries.

- Indeed, the FAO Food Price Index has now essentially risen back to the high levels it reached a bit more than a decade ago when soaring food prices helped touch off the Arab Spring.

Source: FAO

United States-United Kingdom, et al: U.S. Trade Representative Katherine Tai said the Biden administration would impose punitive tariffs on the U.K., Italy, Spain, Austria, India, and Turkey in response to their digital-services taxes on U.S. technology companies. However, Tai said the administration would suspend the levies for six months while it seeks to negotiate an international resolution to the issue under the auspices of the G20 and the OECD.

- The proposed tariffs, at a rate of 25%, would target imports worth nearly $2 billion from the six countries, including imports worth over $800 million from the U.K. and more than $300 million each from Italy and Spain.

- Even though the tariffs will be suspended at first, the entire issue of global taxes on digital services is yet one more dimension of the increased regulatory risk hanging over U.S. technology giants.

United States-Russia: Officials at the White House said President Biden will pressure Russian President Putin to crack down on his country’s computer hackers when the leaders meet later this month. The officials said Biden would also not rule out retaliating against the Russian criminal gangs that carried out the recent ransomware attacks on Colonial Pipeline and meat company JBS. We suspect the U.S. has greater offensive cyberwarfare capabilities than is widely known, so the administration could impose a painful punishment on the hackers if it is willing to reveal some of its weaponry. Ultimately, however, addressing the problem will probably require pressuring the Russian government to not give the hackers a safe haven for launching their attacks. That implies further U.S.-Russian tensions.

Israel: Consistent with the reports we’ve been writing about, right-wing politician Naftali Bennett, centrist Yair Lapid, and other opponents of Prime Minister Netanyahu agreed to form a coalition government that will oust him. If the government is sworn in within the next two weeks, Netanyahu would cede power to the most diverse coalition in Israel’s history, including, for the first time, an independent Arab party.

- The proposed coalition is not yet a done deal. The group would only have a razor-thin majority in the Knesset, and Netanyahu would only need to peel off a couple of its members to scuttle the plan.

- Even if the coalition successfully takes power, the slim majority and contradictory ideologies among the member parties would likely leave the government unstable. That could well paralyze policymaking and prompt yet another round of elections in the near term.

Iran: One of the largest ships in the Iranian navy caught fire and sank in the Gulf of Oman yesterday, followed hours later by a major fire at an oil refinery near Tehran. The mysterious incidents immediately raised suspicions that they could have resulted from Israeli sabotage. If those suspicions lead to fears over Persian Gulf oil supplies, they could give a further boost to the commodity markets.

Nicaragua: Police arrested President Ortega’s most prominent political opponent, Cristiana Chamorro, after searching her home for at least five hours in what her family said was the latest attempt to keep her from challenging the authoritarian Ortega in November’s presidential elections.

COVID-19: Official data show confirmed cases have risen to 171,746,400 worldwide, with 3,693,280 deaths. In the United States, confirmed cases rose to 33,307,976 with 595,839 deaths. Vaccine doses delivered in the U.S. now total 366,977,535, while the number of people who have received at least their first shot totals 168,734,435. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S infections fell to 17,247 yesterday, only slightly above the seven-day moving average of 16,270. New deaths related to the virus came in at a relatively moderate 598. The nation’s mass vaccination program continues apace, as well. Data from the CDC indicate 50.8% of U.S. residents have now received at least one dose of a vaccine, and 41.0% are fully vaccinated.

- Since it is looking ever more likely that many U.S. residents will be allowed to visit Europe this summer, this article provides a useful overview of what’s open and what’s not.

- As Japan tries to boost vaccinations, a new government decree on opening up access and providing subsidies has prompted multiple large companies to announce they will soon open vaccination sites for their employees. The central government will subsidize ¥2,070 for each vaccine dose administered by large companies with over 1,000 employees.

Economic and Financial Market Impacts

- Investors these days talk about a “Fed put” whereby asset prices are buoyed by the Fed’s near-certain intervention against any sign of market volatility. Well, now we can also talk about a “Draghi put.” Investors have noticed that ever since former ECB chief Mario Draghi became prime minister of Italy to help the country get through the pandemic and manage Italy’s share of the EU’s new pandemic relief fund, Italian bond yields have become unusually low and stable.

U.S. Policy Response

- To coax workers back into the job market amid widespread labor shortages as the economy reopens, Congressional lawmakers from both parties are considering incentives such as providing federal funding to pay for hiring bonuses and expanded tax credits for employers. A handful of states are moving to implement such programs on their own, without waiting for action from Washington.

- The Fed said it will soon start selling off the corporate bonds and bond ETFs it bought last year through an emergency facility set up to keep credit flowing during the initial stages of the pandemic. According to the Fed, the $14 billion or so in bonds and bond ETFs held in the Secondary Market Corporate Credit Facility should be sold off by the end of the year.

- The Fed promised it would attempt to conduct the sales to minimize any disruption to the corporate bond market; given the relatively small size of the holdings, it could well be successful in that effort.

- The SMCCF is separate from the Fed’s balance sheet and its trillions of dollars in Treasury and Agency securities. Yet, if investors interpret the move as a sign that the Fed is moving toward a reduction in its balance sheet, it could spark renewed volatility in the broader bond market and push yields higher again.